BIS Annual Economic Report 2023

Introduction

El Informe Económico Anual de este año explora la trayectoria de la economía mundial y los retos políticos que plantea. Se trata, de hecho, de una exploración no de uno, sino de tres viajes entrelazados: el viaje que ha llevado a la economía mundial hasta la coyuntura actual; el viaje que puede quedar por delante; y, en segundo plano, el viaje que podría hacer el sistema financiero a medida que la digitalización abra nuevas perspectivas. Es mucho lo que está en juego. Los responsables políticos tendrán que trabajar de forma concertada, extrayendo las lecciones adecuadas del pasado para trazar un nuevo camino para el futuro. Por el camino, la perenne pero esquiva búsqueda de coherencia entre la política fiscal y la monetaria volverá a ocupar un lugar central. La política prudencial seguirá desempeñando un papel de apoyo esencial. Y las políticas estructurales serán fundamentales.

A continuación se analiza cada una de estas tres trayectorias.

The macroeconomic journey: looking back

¿Cómo le fue a la economía mundial en el año examinado? Y lo que es aún más importante, ¿qué fuerzas determinaron su trayectoria?

The year under review

La inflación siguió situándose muy por encima de los objetivos de los bancos centrales en gran parte del mundo. Afortunadamente, había indicios claros de que la inflación general estaba tocando techo o había empezado a descender. Pero la inflación subyacente se mostró más obstinada. El retroceso de los precios de las materias primas y la marcada desaceleración de los precios manufactureros proporcionaron un alivio bienvenido, incluso cuando los precios de los servicios, más rígidos, cobraron impulso. Estaban actuando varias fuerzas, entre ellas el alivio de los cuellos de botella en la cadena de suministro mundial, la rotación post-pandémica de la demanda mundial desde el sector manufacturero a los servicios, y los efectos de los generosos paquetes de apoyo fiscal. Los mercados laborales se mantuvieron muy tensos, con tasas de desempleo en general en mínimos históricos.

El crecimiento mundial se ralentizó, pero demostró una notable resistencia. La tan temida recesión en Europa no se materializó, gracias en parte a un invierno suave, y China repuntó con fuerza una vez que se levantaron repentinamente las restricciones de Covid. El consumo se mantuvo sorprendentemente bien en todo el mundo, ya que los hogares siguieron recurriendo a los ahorros acumulados durante la pandemia y el empleo se mantuvo boyante. A medida que avanzaba el año, los expertos revisaron al alza sus previsiones de crecimiento, aunque seguían viendo un crecimiento mundial más lento en el año siguiente.

Una vez más, las tensiones provocaron una intervención oficial a gran escala a ambos lados del Atlántico para evitar el contagio, una imagen preocupante y cada vez más familiar. Los bancos centrales activaron o ampliaron las facilidades de liquidez o las compras de activos. Cuando fue necesario, los gobiernos proporcionaron respaldo de solvencia, implícita o explícitamente, en forma de garantías y apoyo final a los sistemas ampliados de seguro de depósitos. La respuesta restableció la calma en los mercados.

En respuesta al endurecimiento y a las perspectivas económicas, las condiciones financieras reaccionaron de forma desigual. En general, los bancos endurecieron las condiciones crediticias. Pero los mercados financieros reaccionaron menos. En general, las condiciones se endurecieron en comparación con las existentes en el momento de la primera subida. Sin embargo, en la segunda mitad del año se relajaron un poco, a medida que bajaban los rendimientos de los bonos y subían los precios de los activos de riesgo. Los bancos centrales se enfrentaron a una desconexión entre su comunicación, que apuntaba a un endurecimiento más persistente, y las opiniones de los participantes en los mercados financieros, que veían una postura más relajada en el futuro.

The longer-term backdrop

Como se analiza en detalle en el Capítulo II, la combinación de inflación elevada y vulnerabilidades financieras probablemente refleje mejor la confluencia de dos factores interdependientes. En primer lugar, la forma cambiante del ciclo económico. En segundo lugar, las políticas monetaria y fiscal ponen a prueba, una vez más, los límites de lo que podría denominarse la "región de estabilidad", es decir, la región que traza las constelaciones de las dos políticas que fomentan una estabilidad macroeconómica y financiera sostenible, manteniendo controlables las inevitables tensiones entre las políticas. La forma cambiante del ciclo económico determina qué tipo de síntoma señala que se están poniendo a prueba los límites: la inflación, la inestabilidad financiera o ambas. La conducta de la política, en interacción con las fuerzas estructurales, determina la forma del propio ciclo económico.

De ahí un agudo dilema político. Una dolorosa lección que los responsables políticos habían extraído de la época de alta inflación era que las políticas que resultaban demasiado ambiciosas podían generar inestabilidad de precios. En la era de baja inflación, sin embargo, las limitaciones a las expansiones económicas habían desaparecido aparentemente. Los límites de la región de estabilidad se habían vuelto más difusos, apenas visibles de hecho. Y la fragilidad del sistema financiero, no respaldada por un esfuerzo suficientemente incisivo para reforzar la regulación prudencial, enturbiaba aún más el panorama. La economía parecía estable hasta que, de repente, dejó de serlo. La experiencia posterior a la Gran Crisis Financiera (CFG) difuminó aún más los límites de la región. La inflación rondaba obstinadamente por debajo de los objetivos de inflación: tras haber ayudado a los esfuerzos de los bancos centrales, la globalización los obstaculizaba ahora. Y se pidió a la política fiscal que se pusiera manos a la obra para garantizar que los bancos centrales dejaran de ser el "único juego en la ciudad", y así fue.

El notable repunte de la demanda mundial tras la pandemia, con las interrupciones de la oferta como telón de fondo, hizo el resto. Contra todo pronóstico, la inflación volvió con fuerza. La política monetaria tuvo que endurecerse, tensando las finanzas públicas y los balances del sector privado. El sistema financiero se vio sometido a tensiones. Aunque era comprensible cuando estalló la crisis de Covid, en retrospectiva, ahora está claro que el apoyo de la política fiscal y monetaria fue demasiado grande, demasiado amplio y demasiado duradero..

The macroeconomic journey: looking ahead

Teniendo en cuenta dónde nos encontramos, ¿cómo se presenta el camino por recorrer? A corto plazo, es posible que la economía mundial supere sin problemas los obstáculos a los que se enfrenta. Esto es lo que parecen anticipar los participantes en los mercados financieros y los analistas profesionales. Además, mirando más hacia el futuro, el viaje podría continuar sin mayores incidentes. Dicho esto, los peligros a corto y largo plazo acechan en el camino. Y las políticas serán el factor decisivo.

Near- and longer-term hazards

A corto plazo, destacan dos retos: restablecer la estabilidad de precios y gestionar los riesgos financieros que puedan materializarse.

La inflación podría resultar más persistente de lo previsto. Es cierto que ha ido disminuyendo, y la mayoría de los analistas prevén que se sitúe dentro de los intervalos objetivo en los próximos dos años. Además, las expectativas de inflación, aunque difíciles de medir con fiabilidad, no han hecho saltar las alarmas. Aun así, la última milla podría resultar más difícil de recorrer. El sorprendente repunte de la inflación ha erosionado sustancialmente el poder adquisitivo de los salarios. No sería razonable esperar que los asalariados no intentaran ponerse al día, sobre todo teniendo en cuenta que los mercados laborales siguen siendo muy estrechos. En varios países, las demandas salariales han ido en aumento, las cláusulas de indexación han ido ganando terreno y han aparecido signos de una negociación más enérgica, incluidas huelgas. Si los salarios se recuperan, la cuestión clave será si las empresas absorben los costes más elevados o los repercuten. Dado que las empresas han recuperado su poder de fijación de precios, no hay que subestimar esta segunda posibilidad. Nuestras simulaciones ilustrativas indican que, en este escenario, la inflación podría seguir siendo incómodamente alta. Como documentaba el Informe Económico Anual del año pasado, las transiciones de regímenes de baja inflación a regímenes de alta inflación tienden a autorreforzarse. Y una vez que se instala la psicología de la inflación, es difícil desprenderse de ella.

Unos tipos de interés más altos, un giro en el ciclo financiero y una desaceleración económica acabarían por elevar las pérdidas crediticias. Éstas, a su vez, podrían generar nuevas tensiones en el sistema financiero. Es bastante habitual que las tensiones bancarias aparezcan tras un endurecimiento de la política monetaria, hasta en una quinta parte de los casos en los tres años siguientes a la primera subida. La incidencia aumenta considerablemente cuando los niveles iniciales de deuda son altos, los precios inmobiliarios son elevados o el aumento de la inflación es más fuerte

Una vez que se materialice el tramo crediticio, la resistencia del sistema financiero volverá a ponerse a prueba. Simulaciones sencillas indican que, en el escenario de tipos de interés implícitos de mercado, en una muestra representativa de economías avanzadas las pérdidas de crédito estarían en línea con las medias históricas. Pero serían de una magnitud similar a las registradas durante la CFG en el escenario de tipos más altos por más tiempo.

The impact of those losses will depend, critically, on the loss-absorbing capacity of the banking system. Since the GFC, thanks in no small measure to the financial reforms, banks have bolstered their capital. That said, pockets of vulnerability remain. Recent events have shown how the failure of even comparatively small institutions can shake confidence in the overall system. Moreover, the price-to-book ratios of many banks, including large ones, have been languishing far below one. This reflects market scepticism about the underlying valuations and long-term profitability of those institutions. Admittedly, this is not new. But, in an environment of more fragile confidence, it could turn out to be a significant vulnerability.

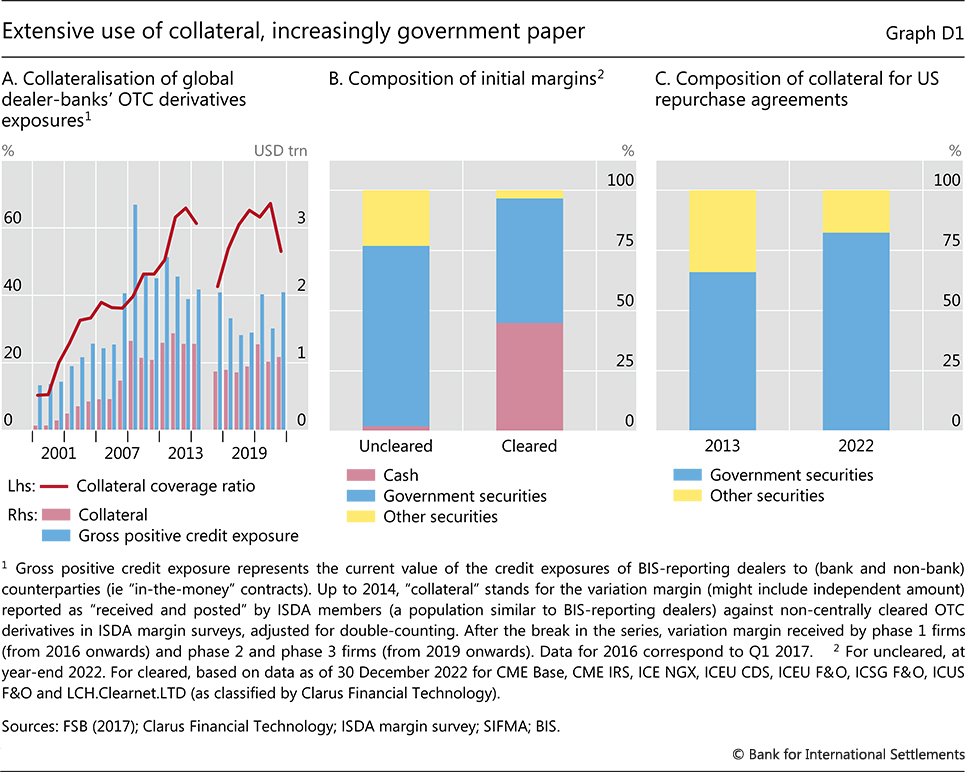

Before stress emerged among banks, all the attention was focused on the NBFI sector. And with reason. The sector has grown in leaps and bounds since the GFC, and now accounts for over half of all financial assets globally. While, on balance, less leveraged than its banking counterpart, the sector is rife with hidden leverage and liquidity mismatches, especially in the asset management industry. It has been a source of large losses for banks, such as in the Archegos case – which, incidentally, hit Credit Suisse especially hard. And it was at the heart of the March 2020 turmoil, which prompted large-scale central bank interventions. The latest tremors in the UK gilt market are a reminder that attention is still justified.

While it is hard to tell where strains might emerge next, several vulnerabilities stand out. In the corporate sector, private credit markets remain very opaque against the backdrop of a long-term deterioration in credit ratings. In the leveraged loan market, securitised products have grown rapidly. Exposures to commercial real estate are bound to see losses, as the sector is buffeted by powerful cyclical and structural headwinds – losses that could also be a source of stress for banks, as they have been throughout history. In addition, structural weaknesses linger in some government bond markets.

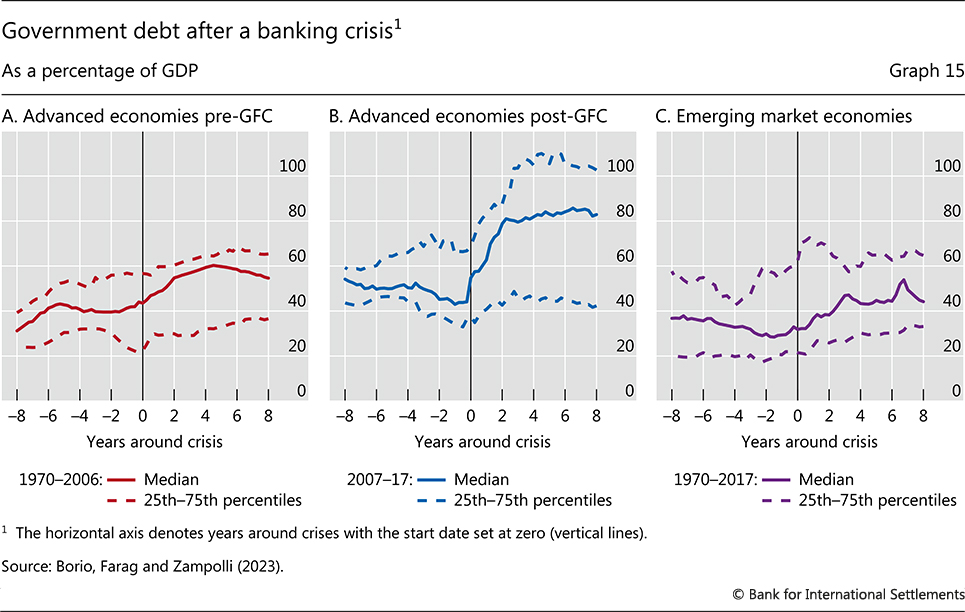

Looking further out, a key source of concern is the sustainability of public debt – an issue analysed in depth in Chapter II. A vulnerable sovereign means a vulnerable financial system. This is because the sovereign can generate financial instability or fail to act as an effective backstop of the financial sector. Central banks can provide liquidity, but only the sovereign can back up solvency. Moreover, the sovereign's creditworthiness depends on the health of the financial sector. Indeed, banking crises have typically caused surges in public debt, in teens of GDP – directly, because of the government support, and indirectly, because of the damage to economic activity. Long-term projections of public debt trajectories are worrisome, even under favourable interest rate and growth configurations (see below).

Near- and longer-term policy challenges

The sheer size of the challenges ahead calls for a holistic policy response, involving monetary, fiscal, prudential and, last but not least, structural policies. Consider, in turn, the near-term and longer-term challenges, although the dividing line between the two is quite fuzzy.

The near term

La prioridad de la política monetaria es volver a situar la inflación en su objetivo. Es bien conocido el insidioso daño que un régimen de alta inflación causa al tejido económico y social. Cuanto más tiempo se permita que persista la inflación, mayor será la probabilidad de que se consolide y mayores los costes de apagarla.

Para volver a situar la inflación en el objetivo, los bancos centrales se enfrentan al menos a tres retos. En primer lugar, las relaciones estadísticas históricas ofrecen una orientación limitada cuando amenaza una transición a un régimen de alta inflación. Tanto el juicio como los modelos más formales se ponen a dura prueba. En segundo lugar, el mecanismo de transmisión de la política monetaria se ve enturbiado por las excepcionales condiciones pospandémicas, que se suman a los conocidos desfases. De ahí la pausa que muchos bancos centrales se han tomado para evaluar mejor el impacto del endurecimiento hasta ahora. Por último, podrían surgir nuevas tensiones en el sistema financiero. En ese caso, si la tensión es lo suficientemente aguda, abordarla sin comprometer la lucha contra la inflación requerirá el apoyo activo de otras políticas, sobre todo prudenciales y fiscales, para complementar el despliegue por parte de los bancos centrales de la gama de herramientas a su disposición. Esto contendría el daño al tiempo que permitiría a la política monetaria mantener una postura restrictiva durante el tiempo que fuera necesario.

The priority for fiscal policy is to consolidate. To be sure, deficits have narrowed somewhat, especially in cyclically adjusted terms. But some of the improvement reflects the temporary impact of the inflation burst, and cyclical adjustments have proved quite misleading in the past, especially before slowdowns. Moreover, from a long-term perspective, deficits remain too high. Consolidation would provide critical support in the inflation fight. It would also reduce the need for monetary policy to keep interest rates higher for longer, thereby reducing the risk of financial instability.

By bolstering the financial system's resilience, prudential policy can also support the inflation fight, as it would increase monetary policy headroom. Macroprudential measures need to be kept tight for as long as possible, or even tightened further where appropriate. Similarly, (microprudential) supervision needs to be stiffened to remedy some of the deficiencies that came to light in recent bank failures. While changes in regulatory standards take longer, a reflection on the recent experience should start without delay; and indeed it has. Examples of issues to be examined are the treatment of interest rate risk, the appropriateness of historical cost accounting, not least for assets used for liquidity management purposes (eg government securities) and assumptions about the stickiness of various deposit categories. But beyond banking, we should not lose sight of the urgent need to strengthen the regulation of NBFIs from a systemic perspective.

The longer term

For monetary policy, two aspects stand out. As regards operational frameworks, it is essential to combine price stability objectives with the appropriate degree of flexibility. As explored in depth in last year's Annual Economic Report, low-inflation regimes, in contrast to high-inflation ones, have self-stabilising properties. No doubt this reflects, in part, the fact that, when inflation is mild, it ceases to be a significant factor influencing people's behaviour. This suggests that, under those conditions, there is room for greater tolerance for moderate, even if persistent, shortfalls of inflation from narrowly defined targets. The approach would also reduce the side effects of keeping interest rates very low for extended periods, such as the build-up of financial vulnerabilities and possible misallocation of resources. As regards institutional frameworks, to buttress the credibility of policy, safeguards for central bank independence, underpinned by appropriate mandates, remain essential. They should become especially valuable in the future, should fiscal positions continue to follow their deteriorating trend.

For fiscal policy, the priority is to ensure fiscal sustainability. Fiscal sustainability is the cornerstone of economic stability and is critical for monetary policy to do its job. Unfortunately, the long-term outlook is grim. Even under favourable assumptions, without sustained and firm consolidation efforts, debt-to-GDP ratios are set to rise relentlessly, threatening safety margins. The looming additional burdens linked to ageing populations, the green transition and geopolitical tensions complicate the picture further. And so does the apparent change in public attitudes following the generous support granted in the wake of the GFC and Covid crises, which has raised expectations regarding government transfers. From an operational perspective, the prominence of financial factors in economic fluctuations merits greater attention when assessing cyclical fiscal positions and fiscal space more generally. From an institutional perspective, there is a need to give more bite to properly designed fiscal rules and fiscal councils, including possibly through constitutional safeguards.

For prudential policy, there is a need for continuous adjustments. The dialectic between financial markets and regulation makes it impossible to stand still. The recent episodes of stress have provided just the latest example. As regards the financial stability risks raised more specifically by fiscal policy, an area that merits particular attention is the favourable treatment of sovereign debt. Adjustments to account effectively for market and credit risk in government securities would also need to give due consideration to the special role that government debt plays in the functioning of the financial system and in central bank operations. Institutionally, just as for monetary policy, it is important to secure the independence of supervisory authorities and to endow them with sufficient resources, both financial and human.

In addition, there is a need to further reflect on crisis management and the financial system's safety net more generally. Policy actions have, de facto, been extending the safety net with each crisis. And now there are proposals to reduce the scope for runs by extending deposit guarantee schemes further. Once confidence is lost, however, deterring runs and preventing institutions from losing market access would require nothing short of insuring 100% of demandable and short-term claims. This would weaken market discipline far too much and, ultimately, increase solvency risks to unacceptable levels. Moreover, while resolution schemes have been improved and should be improved further, when confidence crumbles, the pressure to extend support becomes insurmountable.

This suggests that expectations should be realistic and that a premium should be put on crisis prevention. It indicates that, refinements aside, there is no substitute for a holistic macroeconomic policy framework that promotes financial and macroeconomic stability, bolstered by a regulatory and supervisory apparatus that boosts the financial system's loss-absorption capacity. As described in previous Annual Economic Reports, such a comprehensive macro-financial stability framework, in which all policies play their part, is the way to go. Crises cannot be avoided altogether, but their likelihood and destructive force can be contained.

Accordingly, the ambition needed to build such a framework should be combined with realism about what it can deliver and humility in the way it is run. The challenges the global economy is now facing reflect, in no small measure, a certain "growth illusion", born out of an unrealistic view of what macroeconomic stabilisation policies can achieve. We should avoid falling into the same trap again. Its unintended result has been reliance on a de facto debt-fuelled growth model that has made the economic system more fragile and unable to generate robust and sustainable growth. Overcoming this reliance requires growth-oriented structural reforms (Chapters I and II). Unfortunately, such reforms have been flagging for too long. They should be revived with urgency.

Digitalisation and the financial system: the journey ahead

This takes us to the third and final journey. An important aspect of growth-oriented structural reform is digital innovation in the monetary and financial system. Historically, key innovations in monetary arrangements have enabled new types of economic activity that have led to major advances in the economy. For example, money as ledger entries overseen by trusted intermediaries paved the way for new financial instruments such as bills of exchange that boosted trade by bridging the geographical distance and the timing gap between incurring costs and receiving payment. The gains became even bigger once electronic record-keeping replaced paper ledgers.

Central banks have a duty to lead advances in the monetary system in their role as guardians. The central bank issues the economy's unit of account and ensures the finality of payments through settlement on its balance sheet. Building on the trust in central bank money, the private sector uses its creativity and ingenuity to serve customers. When viewed through this lens, the fight against inflation is just another aspect of the central bank's broader duty to defend the value of money. In the same vein, the central bank's role in innovation serves to defend the value of money by providing it in a form that keeps pace with technology and the needs of society.

Chapter III charts the course for the future of the monetary and financial system. It argues that the system could be on the cusp of a major technological leap. Following the dematerialisation of money from coins to book entries and the digital representation of those ledger entries, the next key development could be tokenisation – the digital representation of money and assets on a programmable platform. Unlike conventional ledgers, which rely on account managers to update records, tokens can incorporate the rules and logic governing transfers. Money and asset claims become executable objects that the user can transfer directly. Tokenisation could enhance the capabilities of the monetary and financial system, not just by improving current processes but also by enabling entirely new economic arrangements that are impossible in today's system. In short, tokenisation could improve the old, and enable the new.

Tokenisation overcomes a key limitation of today's arrangements. Currently, the digital representation of money and other claims resides in siloed proprietary databases, located at the edges of communication networks. These databases must be connected through third-party messaging systems that exchange messages back and forth. As a result, transactions need to be reconciled separately before eventually being settled with finality. Meanwhile, participants have an incomplete picture of actions and circumstances. This incomplete information, and the associated misaligned incentives, preclude some transactions that have a clear economic rationale. While workarounds, such as collateral or escrow, exist, they do have limitations and create their own inefficiencies. Tokenisation addresses the problems more fundamentally. Resolving FX settlement risk and unlocking supply chain finance are two examples discussed in the chapter. Both are thorny problems in the conventional financial system that are amenable to solution in a tokenised environment.

New demands are also emerging from end users themselves, as advances in digital services in everyday life raise their expectations. Users now demand that the monetary and financial system operate just as seamlessly as the apps on their smartphones. These demands are beginning to outgrow the siloed domains that are holding innovation back.

Chapter III presents a blueprint for a future monetary system. The blueprint envisages a new type of financial market infrastructure (FMI) – a "unified ledger". The key elements of the blueprint are central bank digital currencies (CBDCs), private tokenised money in the form of tokenised deposits and tokenised versions of other financial or real assets, depending on the particular use case. The success of this endeavour rests on the foundation of trust provided by central bank money and its capacity to knit together key elements of the financial system. To be sure, in crypto, stablecoins that reside on the same platform as other crypto assets also perform a means of payment role. However, for reasons explored at length in last year's Annual Economic Report, crypto is a flawed system, with only a tenuous connection to the real world. Central bank money is a much firmer foundation. The full potential of tokenisation is best harnessed by having central bank money reside in the same venue as other tokenised claims.

As a new type of FMI, a unified ledger will come with attendant setup costs. While some of the envisaged benefits could also be reaped through more incremental changes to existing systems, history shows that such fixes have their limits, especially as they accumulate on top of legacy systems. Each new layer is constrained by the need to ensure compatibility with the legacy components. These constraints become more binding as more layers are added, holding back innovative developments.

In the near term, a unified ledger could unlock arrangements that have clear economic rationale but which have not been feasible to date due to the limitations of the current system. Over the longer term, the eventual transformation of the financial system will be far more significant. The benefits will be limited only by the imagination and ingenuity of developers, much as the ecosystem of smartphone apps has defied the initial imagination of the platform-builders themselves.

Conclusion

El

camino que tienen por delante la economía mundial y su sistema

financiero es peligroso. Sin embargo, también ofrece grandes

oportunidades. Encauzar el rumbo en la dirección correcta no será nada

fácil. Requiere una rara mezcla de criterio, ambición, realismo y la

voluntad y capacidad políticas para aplicar las políticas necesarias.

Estas políticas suelen implicar costes a corto plazo como precio a pagar

por mayores beneficios a largo plazo. Afortunadamente, el camino no

está predeterminado.

Monetary and fiscal policy: safeguarding stability and trust

Política monetaria y fiscal: salvaguardar la estabilidad y la confianza

Para propiciar un entorno financiero y macroeconómico estable y mantener manejables las tensiones entre ellas, las políticas deben operar dentro de una "región de estabilidad". El riesgo último de salirse de la región es la pérdida de la confianza que la sociedad debe tener en el Estado y en su toma de decisiones.

En las últimas décadas, las políticas monetaria y fiscal se han desplazado gradualmente hacia los límites de la región de estabilidad, ya que a menudo se confiaba en ellas como motores de facto del crecimiento. Esto ha sentado las bases para las actuales tensiones entre ellas, así como para los riesgos macroeconómicos y financieros que se avecinan.

Se necesitan ajustes políticos y salvaguardias institucionales para garantizar que ambas políticas se mantengan firmemente dentro de la región de estabilidad. Estos ajustes dependen de un mayor reconocimiento de las limitaciones de las políticas de estabilización macroeconómica.

Introduction

Por

primera vez en las últimas décadas, estamos asistiendo a la aparición

conjunta de una inflación elevada y de tensiones financieras. Aunque

cada una tiene sus causas específicas (Capítulo I), son, en gran medida,

un síntoma del efecto acumulativo de la política monetaria y fiscal

acomodaticia de las últimas décadas, que culminó con las medidas

extraordinarias de apoyo lanzadas en respuesta a la pandemia. En muchos

países, los tipos de interés oficiales, nominales y reales, fueron

históricamente bajos durante un periodo prolongado y los balances de los

bancos centrales se dispararon hasta niveles nunca vistos en tiempos de

paz (Gráfico 1.A). Al mismo tiempo, los persistentes y abultados

déficits fiscales provocaron un aumento progresivo de la deuda pública

hasta niveles sin precedentes (Gráfico 1.B). Estas trayectorias

políticas dieron un impulso importante y duradero a la inflación y

fomentaron la acumulación de fragilidades en el sistema financiero.

El reciente desafío a las fronteras es el último de un largo camino que se remonta al menos a los años setenta. En cada momento, las opciones políticas parecían razonables, incluso convincentes. Pero acumulativamente, empujaron las políticas hacia los límites. La causa fundamental de esta deriva ha sido la tendencia de los responsables políticos a sucumbir a una especie de "ilusión de crecimiento", es decir, una visión demasiado optimista sobre la capacidad de las políticas de estabilización macroeconómica para mantener el crecimiento económico.

Policy adjustments and institutional safeguards are needed to ensure that monetary and fiscal policy remain firmly within the region of stability. The policies should aim to foster a stable financial and macroeconomic environment in which sustainable growth, which is ultimately driven by supply factors, can take hold. And, to do so, they need to retain sufficient safety margins to deal with unexpected untoward events, as well as inevitable recessions. Ultimately, though, the adjustments call for a shift in mindset, that is, a keener recognition of the limitations of stabilisation policies, which cannot act as engines of growth. Having the region of stability as a conscious and explicit policy consideration would help to guide action.

This chapter lays out the enduring challenge for monetary and fiscal policy to stay within the region of stability and how it might be addressed. The chapter first outlines the role of monetary and fiscal policy as core economic functions of the state and introduces the concept of the region of stability. It then describes the journey of monetary and fiscal policy over the past decades to the boundaries of the region, ushering in high inflation and financial fragility. It next discusses the potential risks ahead for macroeconomic and financial stability. The chapter ends by exploring policy implications.

Policy interactions and the region of stability

As two core economic functions of the state, monetary and fiscal policy play a key role in ensuring economic stability and trust in policymaking. Both policies entail privileged powers to access and reallocate economic resources in society. Fiscal policy hinges on the power to raise taxes and the prerogative to issue debt backed by future tax revenues. Monetary policy wields the power to issue "money", an irredeemable liability of the state used as a means of payment. These powers are mutually reinforcing. The requirement to pay taxes with money sustains money demand, encouraging its use as a payment tool. In turn, a stable monetary system strengthens the tax base. Furthermore, money issuance supports fiscal revenues through seigniorage and can help prevent technical government default as public debt is redeemable against money.

The privileged powers of fiscal and monetary policy ultimately depend on an implicit social contract underpinned by trust in the state. People consent to paying taxes because they trust the government to use the proceeds for the public good. Similarly, people accept the use of money as a means of payment because they trust the central bank to preserve its value.

Box A

The consolidated central bank-government budget constraint

The balance sheets of the central bank and the government are joined at the hip. This, in turn, tightens the link between monetary and fiscal policy and can blur the distinction between them. The balance sheets are intertwined because the central bank is "owned" by the government or is part of it, sending to it remittances based on the institution's financial results. In addition, it is quite common for the two organs of the state to hold claims on each other and issue others that are very close substitutes in private sector portfolios. Examining the link between the two balance sheets sheds further light on the interaction between the two policies.

Consider first the central bank's balance sheet. Its assets typically consist of government securities, claims on the private sector (eg lending to banks) and (often but not always) foreign currency reserves. Its liabilities take the form of own debt (eg own paper or reverse repos) and "monetary liabilities", ie cash in the hands of the public and bank reserves – the "monetary base". Very often, they may also include government deposits. The residual between the value of the assets and liabilities is the central bank's capital. The balance sheet of the fiscal authority includes the central bank's capital as an asset, as well as any other assets held, and liabilities issued, by the fiscal authority.

Consolidating the two balance sheets highlights two important points.

First, large-scale central bank purchases of long-term government

debt amount to a large debt management operation, the nature of which

depends on how the central bank finances them. Since cash is entirely

demand-determined, the central bank can either issue its own short-term

debt – almost indistinguishable from that of the government – or

increase the amount of bank reserves. However, if the central bank wishes to retain control over the interest rate, those reserves must be interest-bearing: the interest rate would fall to zero for as long as those reserves are not reabsorbed. The reserves are, in fact, indexed to the overnight rate.

The reserves are, in fact, indexed to the overnight rate.

Second, central bank profits and losses feed through to the government's financial position. This can strengthen or weaken it in ways that would not be apparent if one considered only the government's financial accounts. For instance, the government may lengthen the maturity of its liabilities. But if the central bank purchased an equivalent amount, the corresponding government debt would be, in effect, overnight or short-term. This would raise, not lower, the sensitivity of the fiscal position to higher interest rates. The higher sensitivity would show up as greater interest costs to the central bank and, through lower remittances to the fiscal authority, lower government revenues.

One example helps to illustrate these two points (Graph A1). Assume that the government issues more long-term (fixed rate) bonds to finance the acquisition of long-term assets, such as public infrastructure (Graph A1.A). Next assume that the central bank buys this debt and finances it by issuing remunerated overnight bank reserves (Graph A1.B). Looking at the balance sheet of the government alone, it would appear that the government has lengthened the maturity of its debt and reduced the sensitivity of its funding costs to higher interest rates. In reality, looking at the consolidated balance sheet, it is clear that the sensitivity is now higher, as higher interest rates immediately reduce central bank remittances (Graph A1.C). In case of large capital losses by the central bank, remittances may even become negative.

Considering the evolution of the consolidated balance sheet in

stylised form sheds further light on how fiscal and monetary policies

interact. The budget constraint can be written as follows:

where Dl,t is the consolidated domestic currency debt (including any central bank debt and interest-bearing bank reserves); Df,tEt is the consolidated foreign currency net debt (ie debt minus FX reserves) expressed in domestic currency (Et is the exchange rate); rl,t and rf,t are the corresponding interest rates; PBt is the primary balance (taxes minus spending excluding interest payments); and ΔMt is the change in (non-interest-bearing) monetary liabilities (reserves and cash). All the variables are expressed in nominal terms. Dividing by nominal

GDP and combining the domestic and foreign currency components of net

debt, highlights the factors determining the evolution of the net

debt-to-GDP ratio:

All the variables are expressed in nominal terms. Dividing by nominal

GDP and combining the domestic and foreign currency components of net

debt, highlights the factors determining the evolution of the net

debt-to-GDP ratio:

where pbt and st = ΔMtYt are the primary balance and so-called seigniorage as a share of GDP, respectively, and gt is the growth rate of nominal GDP. Note that the effective interest rate rt is a weighted average of the interest rate paid on domestic and foreign currency debt (with at indicating the share of domestic currency debt in total net debt) and includes valuation effects through the depreciation et of the exchange rate:

This adds nuance to the ambiguous notion of "monetary financing".

This adds nuance to the ambiguous notion of "monetary financing".

Thus, the consolidated budget constraint highlights that monetary

and fiscal policy are inextricably linked. Higher interest rates as,

say, may be needed to address inflation, weaken the fiscal position and,

if this is precarious enough, can generate strains. By the same token, a

fragile fiscal position reduces the monetary policy room for manoeuvre,

as it makes the control of inflation more costly. Indeed, in the case

of acute concerns about the sovereign's creditworthiness, monetary

policy could even lose control of inflation altogether. The concerns could trigger a run on government debt, capital flight and

a sharp depreciation of the currency, which would generate inflation. A

sharp tightening of monetary policy would simply intensify concerns

about a possible default, especially if part of the debt was denominated

in foreign currency. Even if default was avoided, this would be at the

cost of higher, most likely runaway, inflation. Ultimately, maintaining

low and stable inflation requires fiscal backing.

The concerns could trigger a run on government debt, capital flight and

a sharp depreciation of the currency, which would generate inflation. A

sharp tightening of monetary policy would simply intensify concerns

about a possible default, especially if part of the debt was denominated

in foreign currency. Even if default was avoided, this would be at the

cost of higher, most likely runaway, inflation. Ultimately, maintaining

low and stable inflation requires fiscal backing.

The central bank could also increase a non-interest-bearing reserve requirement, which is a form of tax on the banking system. Here M does not correspond to the monetary base or M0, as the latter also includes interest-bearing reserves.  Specifically, the demand for cash is largely a demand for transactions

balances: it can be thought to depend on nominal income and, with

limited sensitivity, on the nominal interest rate. That for

non-interest-bearing reserves is either minimal or depends on the

factors driving any reserve requirements, typically the deposit base to

which they are related. Deposits, too, can be thought of as a function

of the same variables as cash.

Specifically, the demand for cash is largely a demand for transactions

balances: it can be thought to depend on nominal income and, with

limited sensitivity, on the nominal interest rate. That for

non-interest-bearing reserves is either minimal or depends on the

factors driving any reserve requirements, typically the deposit base to

which they are related. Deposits, too, can be thought of as a function

of the same variables as cash.  In the majority of episodes of high inflation and hyperinflation, the

root cause was often a fiscal imbalance and/or an unrealistic target for

the exchange rate coupled with an accommodative response of the central

bank. See eg Fischer et al (2002).

In the majority of episodes of high inflation and hyperinflation, the

root cause was often a fiscal imbalance and/or an unrealistic target for

the exchange rate coupled with an accommodative response of the central

bank. See eg Fischer et al (2002).  The crucial role of fiscal policy in determining inflationary outcomes

is at the heart of the fiscal theory of the price level (FTPL). Any

increase in government debt that is not backed by the credible

expectation of higher future fiscal surpluses creates inflationary

pressures, with default being ruled out as too costly. The underlying

mechanism that pushes the price level up is a wealth effect. See eg

Cochrane (2023) for a description of the FTPL and additional examples.

The crucial role of fiscal policy in determining inflationary outcomes

is at the heart of the fiscal theory of the price level (FTPL). Any

increase in government debt that is not backed by the credible

expectation of higher future fiscal surpluses creates inflationary

pressures, with default being ruled out as too costly. The underlying

mechanism that pushes the price level up is a wealth effect. See eg

Cochrane (2023) for a description of the FTPL and additional examples.

The need to retain society's trust sets limits on the privileged powers of the two policies. Monetary and fiscal policies can become a major force for prosperity if used effectively to provide public goods and to ensure a stable financial and macroeconomic environment, underpinned by a sound payment system. If instead their powers are wielded unwisely, the policies can seriously damage the economy and, ultimately, trust in the state.

The main channels through which monetary and fiscal policies influence economic activity differ considerably. Fiscal policy does so primarily through the direct impact of spending on goods and services, and the production of some of those services, as well as through transfers to households and firms. Monetary policy works primarily through the central bank's operations in financial markets – notably the policy interest rate – which have a pervasive effect on yields, borrowing costs, asset prices and the exchange rate.

That said, overlaps are also substantial. Fiscal policy influences financial conditions through debt issuance. Not only does public debt underpin the functioning of the financial system and the pricing of assets, it can have a far-reaching effect on the yield curve, other asset prices and the exchange rate, as well as on the soundness of the financial system when fiscal soundness is put in doubt. Monetary policy, in turn, influences the state of public finances. It does so directly, by setting interest rates (borrowing costs) and through its effect on the exchange rate (when debt is denominated in foreign currency); and it does so indirectly, through its impact on economic activity and inflation more generally, which can materially alter government expenditures and taxes.

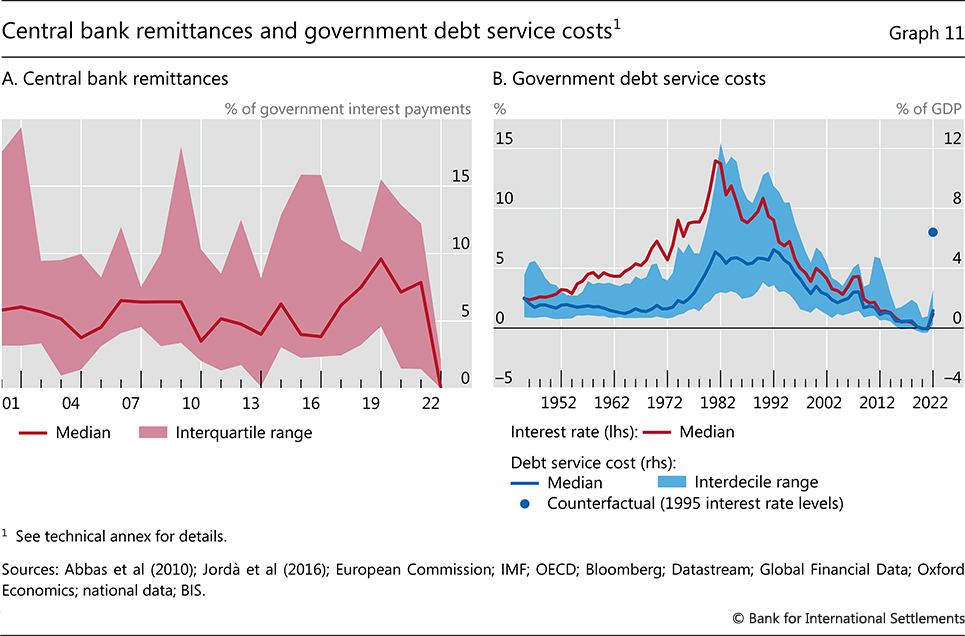

The two policies are further entwined through interlocking balance sheets (Box A). Since the central bank is part of the state, its financial results feed into the financial condition of the government through remittances. The large-scale purchases of government debt, as well as the accumulation of foreign exchange reserves, have made government finances more sensitive to central bank decisions.

The region of stability

The pervasive impact that monetary and fiscal policy have on economic activity, and the overlapping nature of their transmission channels, means that the two policies are joined at the hip. They may work in a coherent fashion to foster a stable financial and macroeconomic environment; but they can, equally, undermine that stability and generate tensions between them that are very difficult to manage.

The concept of the "region of stability" helps identify the appropriate zone of operation of the two policies (Box B).3 This region captures the set of monetary and fiscal policies that are consistent with macroeconomic and financial stability. The boundaries of the region vary across countries and are difficult to pin down with precision ex ante. They cannot be summed up in simple metrics, akin to a constraint on the level of the fiscal deficit or on the policy rate.

Furthermore, the size, shape and locus of the region shift over time. Some changes occur gradually, such as those due to structural developments in the labour market and the structure of production. But the region can also shrink and shift position rapidly, for example due to a sudden loss of confidence in policy or in the economy at large – a risk that has become more acute over time due to the rapid growth and increased fragility of the financial system. This underscores the need for fiscal and monetary policy to operate well within the region and to leave sufficient safety margins at its boundaries.

Box B

The region of stability and its determinants

The region of stability identifies the set of fiscal and monetary

policy combinations which are consistent with macroeconomic and

financial stability. When fiscal and monetary policies operate within this region, tensions

between the two policies may arise frequently but remain manageable.

However, when fiscal and monetary policies approach the boundaries of

the region, they encroach on each other and endanger macro-financial

stability.

When fiscal and monetary policies operate within this region, tensions

between the two policies may arise frequently but remain manageable.

However, when fiscal and monetary policies approach the boundaries of

the region, they encroach on each other and endanger macro-financial

stability.

A key challenge for policymakers is that the region of stability evolves over time in size, shape and position (Graph B1.A). In certain periods, the region can be quite extensive, encompassing a broad set of monetary and fiscal settings. But the region can then rapidly shrink. Monetary and fiscal policy combinations that appear consistent with macro-financial stability at a given point in time, may, all of a sudden, no longer be.

Graph B1

Several factors influence the region of stability by changing the

macro-financial backdrop and the degree of public confidence in the

economic outlook and in the soundness of the policy framework (Graph B1.B).

Some of these factors are relatively slow-moving. For example,

structural forces – including technological and financial innovation –

can gradually alter the foundations of production and finance, in turn

shaping the set of monetary and fiscal policies that are consistent with

macro-financial stability. Demographic factors can also slowly but

profoundly change labour markets. And international trade and financial integration – or forces that work

against it – can heavily influence the global economic landscape and

thus the room for fiscal and monetary policy manoeuvre.

And international trade and financial integration – or forces that work

against it – can heavily influence the global economic landscape and

thus the room for fiscal and monetary policy manoeuvre.

But other factors can evolve much faster, abruptly shifting the

locus and size of the region of stability. One possibility is sudden

exogenous shocks. For example, the commodity price surge triggered by

the Russian invasion of Ukraine provides a vivid illustration of such a

risk. Furthermore, confidence effects greatly heighten the potential for

sudden movements in the region. Market sentiment and public trust in

the ability of macroeconomic policies to preserve stability can shift

rapidly and, in turn, dramatically narrow the fiscal and monetary space.

A sharp depreciation of the exchange rate is often the first sign of a

loss of confidence as well as a key channel that constrains the policy

headroom.

The rapid growth of the financial system in recent decades has made sudden shifts in the region of stability more likely. By becoming more sophisticated and fast-paced, the system has also become increasingly fragile. Leverage and liquidity mismatches have ballooned, in plain sight as well as out of sight. In such a system, confidence can suddenly evaporate, bringing about runs on financial institutions and market breakdowns. This fragility can abruptly shrink the region of stability by limiting the set of fiscal and monetary policy combinations that are consistent with investor confidence.

Besides being affected by structural forces and exogenous shocks,

policies other than monetary and fiscal ones exert a heavy influence on

the region. For example, microprudential and macroprudential regulation

play a critical role in limiting financial excesses and building

precautionary buffers, thus preserving greater space for fiscal and

monetary policy. A targeted and well calibrated use of foreign exchange rate

interventions, in some situations possibly complemented by capital flow

management measures, may also enhance macroeconomic resilience, and

provide fiscal and monetary policy with greater flexibility.

A targeted and well calibrated use of foreign exchange rate

interventions, in some situations possibly complemented by capital flow

management measures, may also enhance macroeconomic resilience, and

provide fiscal and monetary policy with greater flexibility. And structural reforms can considerably expand the region by boosting

potential growth, thereby reducing public pressures for monetary and

fiscal policies to support economic activity.

And structural reforms can considerably expand the region by boosting

potential growth, thereby reducing public pressures for monetary and

fiscal policies to support economic activity.

Yet an even more important – although much less appreciated –

aspect is that the cumulative impact of fiscal and monetary policies

themselves can profoundly alter the region of stability. Policy settings

that may appear stabilising in the near term can, over time,

inadvertently shrink the region. For example, monetary and fiscal

settings with expansionary effects in the short term may come at the

cost of higher instability down the road by encouraging leverage and

risk-taking. Prolonged policy accommodation may also create misperceptions about

economic fundamentals. An extended period of easy monetary conditions

when inflation is held down by favourable tailwinds may provide the

false impression of a permanent and independent decline in real rates

that can lure policymakers towards the region's boundaries.

Prolonged policy accommodation may also create misperceptions about

economic fundamentals. An extended period of easy monetary conditions

when inflation is held down by favourable tailwinds may provide the

false impression of a permanent and independent decline in real rates

that can lure policymakers towards the region's boundaries.

The concept of the region of stability thus underscores the critical intertemporal trade-offs associated with fiscal and monetary policy. In setting policy, policymakers should not only remain firmly within the region of stability but they should also ensure that the cumulative impact of fiscal and monetary settings does not shrink the region over time. Failure to do so can have severe consequences, by dramatically narrowing the space for policy manoeuvre, heightening tensions between monetary and fiscal policies, and ultimately undermining macro-financial stability and trust in the key functions of the state.

See

Borio and Disyatat (2021) for an early discussion on how the region of

stability constrains and is in turn affected by fiscal and monetary

policy.

Structural factors – including rising inequality, an ageing population

and decreases in technological progress – have been proposed as possible

drivers of the decline in real interest rates. See eg the discussion in

Blanchard (2022). Yet the empirical evidence is weak. See Borio et al

(2017).

See

Borio and Disyatat (2021) for an early discussion on how the region of

stability constrains and is in turn affected by fiscal and monetary

policy.

Structural factors – including rising inequality, an ageing population

and decreases in technological progress – have been proposed as possible

drivers of the decline in real interest rates. See eg the discussion in

Blanchard (2022). Yet the empirical evidence is weak. See Borio et al

(2017).  These concepts are at the centre of the literature on currency crises,

eg Krugman (1979), Obstfeld (1996) and Aghion et al (2004).

These concepts are at the centre of the literature on currency crises,

eg Krugman (1979), Obstfeld (1996) and Aghion et al (2004).  See eg Farhi and Werning (2016), Cerutti et al (2017), Korinek and Simsek (2016) and Bergant et al (2023).

See eg Farhi and Werning (2016), Cerutti et al (2017), Korinek and Simsek (2016) and Bergant et al (2023).  See eg Cavallino and Sandri (2023) and Bianchi and Lorenzoni (2022).

See eg Cavallino and Sandri (2023) and Bianchi and Lorenzoni (2022).  High public and private leverage may, for example, constrain monetary

policy and undermine macroeconomic stability via fiscal and financial

dominance concerns, as articulated for example in Sargent and Wallace

(1981) and Brunnermeier (2015). Evidence regarding the link between

credit growth and subsequent financial crises is presented in Borio and

Lowe (2002) and Schularick and Taylor (2012).

High public and private leverage may, for example, constrain monetary

policy and undermine macroeconomic stability via fiscal and financial

dominance concerns, as articulated for example in Sargent and Wallace

(1981) and Brunnermeier (2015). Evidence regarding the link between

credit growth and subsequent financial crises is presented in Borio and

Lowe (2002) and Schularick and Taylor (2012).  For models in which monetary easing may drive a prolonged reduction in

real interest rates, see Rungcharoenkitkul et al (2019), Mian et al

(2021) and Kashyap and Stein (2023). Evidence about the effects of

monetary policy on long-term real rates is provided in Borio et al

(2019), which also includes a review of the literature.

For models in which monetary easing may drive a prolonged reduction in

real interest rates, see Rungcharoenkitkul et al (2019), Mian et al

(2021) and Kashyap and Stein (2023). Evidence about the effects of

monetary policy on long-term real rates is provided in Borio et al

(2019), which also includes a review of the literature.

The cumulative effect of past fiscal and monetary policy decisions crucially shapes the region's boundaries. For example, prolonged periods of monetary and fiscal accommodation may contribute to the build-up of a broad range of vulnerabilities – including greater leverage and risk-taking – that can eventually constrain the policies' room for manoeuvre. Hence the typically intertemporal nature of the trade-offs involved. A policy conduct that may appear stabilising in the near term can, over time, inadvertently shrink the region and take policies towards the boundary. The economic system may appear stable for a long time until, suddenly, it is not.

The boundaries are also approached through the interaction of the two policies. For a given interest rate path, a fiscal policy stance that is cumulatively too loose will risk higher inflation and a sovereign crisis, as debt builds up. For a given fiscal policy path, a monetary policy stance that is cumulatively too easy can generate higher inflation and financial stability risks. Along the corresponding paths, the two policies can reinforce each other's trajectories. Easy monetary policy can induce the government to build up more debt; expansionary fiscal policy can make it harder for monetary policy to be as tight as necessary.

Testing the region's boundaries can trigger vicious cycles. In that case, both policies end up narrowing their respective rooms for manoeuvre, shocks become increasingly damaging and policies increasingly destabilising. The instability, in turn, threatens or reflects loss of trust in the policies themselves. A common feature is loss of trust in money – as a store of value, means of payment or unit of account – and in the sustainability of public debt.

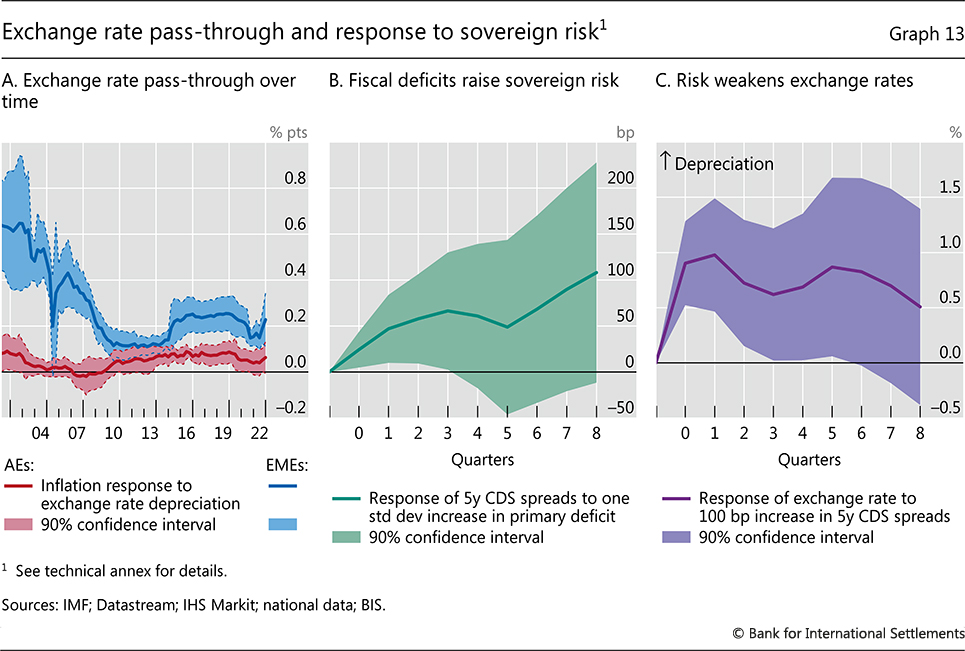

Instability in the wake of overstepping the boundaries of the region of stability can take different forms. Common manifestations include high inflation, economic slumps, sovereign default and financial stress. A sharp depreciation of the exchange rate is a typical symptom and transmission channel. The most acute manifestation of drifting far outside the boundaries is hyperinflations, such as those experienced in some Latin American emerging market economies (EMEs) in the 1980s and 1990s. These show how fiscal pressures and their monetary policy accommodation can destroy the value of money (Graph 2.A).

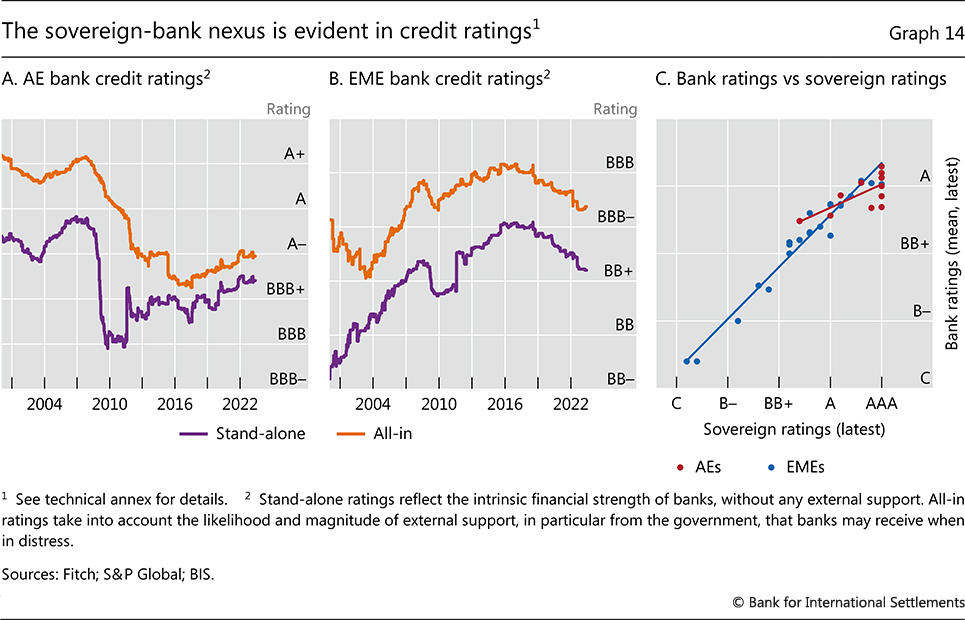

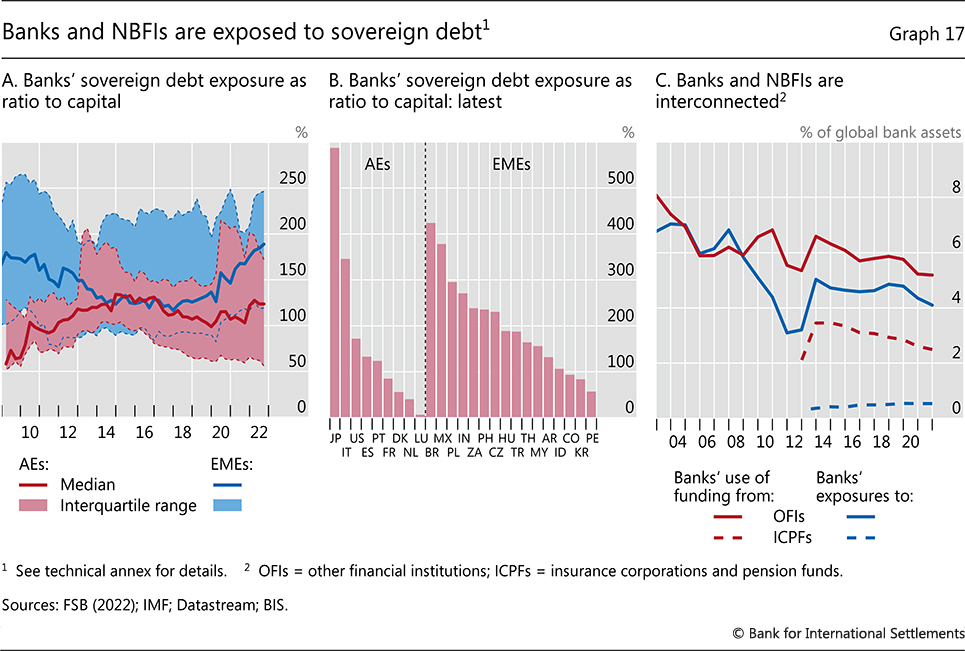

Another manifestation is the coincidence of sovereign debt, systemic banking and currency crises (Graph 2.B). Acute financial crises often feature the so-called doom loop between the sovereign's balance sheet and the financial sector. In such episodes, fiscal and financial instability reinforce each other, as banks suffer losses on government bond holdings while governments need to shore up the failing banking system. In turn, these fiscal and financial crises undermine trust in the currency, and currency depreciation further exacerbates instability.

Testing the boundaries: the long journey so far

The journey: from the 1960s to today

Prior to the pandemic, monetary and fiscal policy were already approaching the boundaries of the region of stability. Interest rates had been historically low for a prolonged period and central bank balance sheets had risen to wartime-like levels following more than a decade of monetary stimulus in the wake of the Great Financial Crisis (GFC). At the same time, public debt had reached historical highs following persistent fiscal deficits. This constellation meant a substantial loss in room for policy manoeuvre and left economies vulnerable to shocks as well as to the inevitable next recession. Then, when the pandemic – a bolt from the blue – struck, the policies tested those boundaries further, ushering in high inflation and financial fragility.

How did monetary and fiscal policies come to approach the boundaries pre-pandemic? It was the result of a long journey. The journey was not linear. The symptoms of an overly expansionary policy stance evolved with the economic landscape that those policies were helping to shape, together with more fundamental structural forces. A consistent underlying factor was the overestimation of how far macroeconomic policies could steer the economy and, by pushing hard enough, ignite the engine of growth – a kind of "growth illusion". This induced a progressive loss of policy space over time.

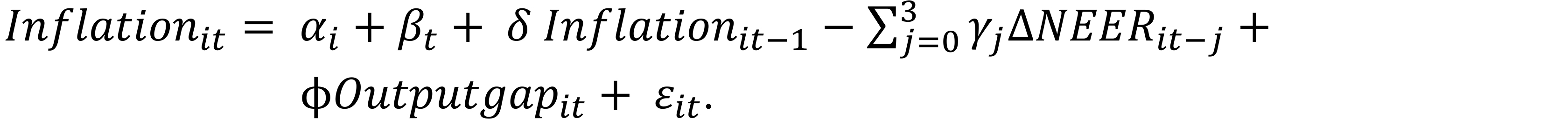

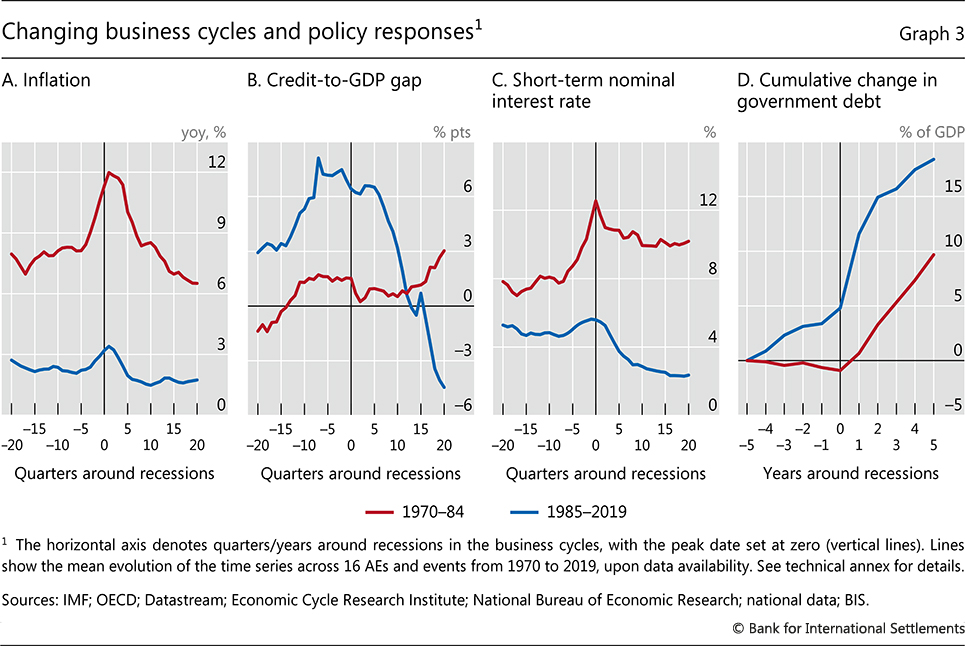

It is useful to divide the journey going back to the 1960s into two phases, with the mid-1980s as a rough watershed. Graph 3 illustrates the break, with reference to advanced economies (AEs) – see below for a discussion of similarities and differences with EMEs.

Until the mid-1980s, the key symptom indicating that the policies were testing the speed limits of the economy, and hence the boundaries of the region of stability, was rising inflation. Recessions were typically induced by a tightening of monetary policy to quell inflation. With the financial system hemmed in by regulation, signs of large build-ups and contractions in credit were missing. During this phase, the drift to the boundaries reflected, in part, the belief that policymakers could fine-tune the economy by a carefully calibrated mix of monetary and fiscal policy. Hence the concept of a stable long-run trade-off between unemployment and inflation. The result was the Great Inflation of the 1970s.

In response to the inflation crisis, policymakers took steps to bring monetary and fiscal policies back within the region of stability. Central banks sought to end inflation by aggressively hiking policy rates. Following the disinflation in the first half of the 1980s, monetary regimes prioritising price stability gradually became the norm. Interest rates declined substantially from their previous peak. However, the rise in interest rates on the back of monetary tightening in the early 1980s had exposed fiscal fragilities in many countries. In combination with persistent fiscal deficits, this led to a surge in public debt. Thus, many governments were forced to embark on fiscal consolidation. For more than a decade from the early 1990s, public debt levels, on average, stabilised.

The beginning of the second phase in the mid-1980s reflected, paradoxically, the confluence of these improvements in policy frameworks with fundamental structural change. The combination altered business cycle dynamics in subtle but far-reaching ways. Financial systems were profoundly liberalised. By the early 1990s, a "government-led" financial system had given way to a "market-led" one, both domestically and internationally.4 And the globalisation of the real economy soon followed. EMEs, most notably China, joined a seamless global labour force and tight production networks spread across the world.

As a result of these changes, inflation ceased to be the main symptom of policies testing the boundaries of the region of stability. Central banks secured price stability as the globalisation of the real economy was eroding the pricing power of workers and firms. This was a powerful structural tailwind, which helped central banks hardwire the low-inflation regime and meant that a given inflation rate would be consistent with lower real and nominal interest rates. It was the era of the Great Moderation.

The symptoms of overstretch now took the form of financial imbalances, ie outsize expansions in credit and asset prices, notably real estate prices, on the back of strong risk-taking. Inflation-induced recessions gave way to financial recessions. Inflation was on average low and stable and barely rose prior to business cycle contractions, while falling mildly but persistently below the pre-recession level in their wake. Instead, business cycles featured sharp pre-recession financial expansions that turned into contractions. The recessions became commonly associated with financial stress or, with prudential regulation failing to adjust to the new environment, even outright crises, most spectacularly the GFC. These recessions had a longer-lasting impact on growth, as the economy laboured under a legacy of higher debt,5 thereby also biasing traditional cyclical adjustment measures.

Over time, the shift from inflationary pressures to financial imbalances contributed to the gradual erosion of policy space. Monetary policy naturally eased during contractions to cushion the economy and fight the headwinds of private sector balance sheet repair. But it had little reason to tighten much during expansions since inflation remained low and stable. Interest rates progressively declined. For fiscal policy, the GFC was a watershed. The outsize financial boom that preceded it greatly flattered government accounts by artificially raising estimates of potential output and boosting tax revenues, thereby disguising the more expansionary stance.6 Financial crises then forced sovereigns to backstop the financial system and support faltering economies, as some countries had already done in the banking crises of the 1990s. Public debt initially increased massively, sustained by low interest rates that kept a lid on debt servicing costs.

The challenges intensified in the aftermath of the GFC. Monetary policy struggled to push inflation back up to target: the globalisation tailwinds that had helped to bring inflation down to target pre-GFC were hindering the central banks' efforts to push it back up. Fiscal policy did seek to regain some of the room for manoeuvre lost in the aftermath of the GFC. But, as a result, monetary policy became the "only game in town". As time wore on, fiscal policy was then asked to support monetary policy in the fight against low inflation by boosting economic activity. It was a topsy-turvy world compared with the one that had preceded it.

The pandemic gave the final push towards the boundaries. All the policy stops were pulled out to shield households and firms from the full force of the lockdowns put in place to deal with the Covid-19 health emergency. Ostensibly, they could stretch the room for manoeuvre further, but the risks were material. At least with the benefit of hindsight, the support proved to be too large and prolonged. Inflation surged on the back of such macroeconomic stimulus when the economy rebounded with surprising vigour as restrictions were lifted and when supply failed to respond in a sufficiently elastic way.7 And this took place against the backdrop of historically high levels of public and private debt, as well as elevated asset prices. For the first time, globally, a surge in inflation coincided with widespread financial vulnerabilities (Chapter I).

The journey: reinforcing effects

Along the journey towards the boundaries of the region of stability, a number of factors reinforced the trajectories of fiscal and monetary policy.

Arguably, one such factor was the waning traction of policies as they approached the boundaries. Changes in policy rates tend to have a smaller effect on aggregate demand when nominal interest rates are very low (Graph 4.A), reflecting, for example, negative income effects on savers and the adverse impacts on bank profitability of persistently low rates.8 This loss of traction implies that larger interest rate cuts are needed to produce the same impact on output and inflation, pushing monetary policy closer to the boundary of the region of stability. Moreover, the side effects of monetary easing through higher risk-taking and private debt build-up tend to become stronger when interest rates are low and stay there for a long time, narrowing the region of stability.9

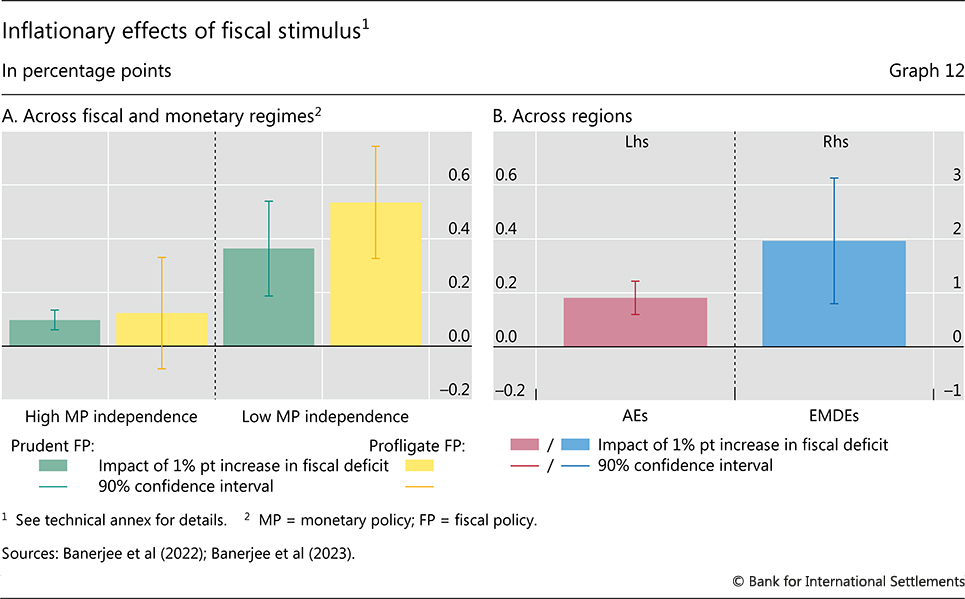

Fiscal stimulus also tends to become less powerful when public debt is higher. This likely reflects adverse confidence effects that kick in when doubts about fiscal sustainability grow. Therefore, larger fiscal measures are required to achieve the same stimulus as debt trends up.10

The self-reinforcing interactions between the two policies constitute a second important factor. Lower interest rates reduced fiscal constraints, diminishing the need and incentive to consolidate in economic expansions. Reductions in the interest rate paid on the debt have indeed been associated with an increase in fiscal deficits, especially during the post-GFC period of ultra-low interest rates (Graph 4.B). Central bank large-scale asset purchases of sovereign debt played a key role in this respect. Across advanced economies, central bank holdings of government debt soared post-GFC (Graph 5.A), driven primarily by large-scale bond purchases of major central banks (Graph 5.B).

High public debt levels, in turn, probably reinforced incentives to maintain an accommodative monetary stance. When debt levels are high, interest rate hikes have a stronger impact on debt servicing costs, raising more acute concerns about adverse macro-financial and fiscal repercussions. By the same token, central bank balance sheet normalisation becomes more difficult when public debt is high because markets must absorb larger amounts of debt. These factors may have made it harder to tighten monetary policy and shrink central bank balance sheets – a kind of "debt trap".

The journey: how different are EMEs?

The journey of EMEs has several similarities to that of AEs. It was shaped by the same global forces that affected business cycles over time. For one, financial liberalisation – sometimes country-specific – elevated the role of financial cycles and increased the incidence of banking crises. Prominent examples include the Southern Cone crisis in Latin America in the early 1980s, the Tequila crisis in Mexico in 1994 and the Asian crisis of 1997–98. In addition, the globalisation of the real economy weighed on inflation from the 1990s on, reinforcing the impact of the adoption of price stability-oriented monetary policy regimes. These basic similarities are reflected also in the broad evolution of key variables such as inflation, interest rates, fiscal deficits and public debt (Graph 6).

At the same time, there are also important differences, including among EMEs, related to structural factors.

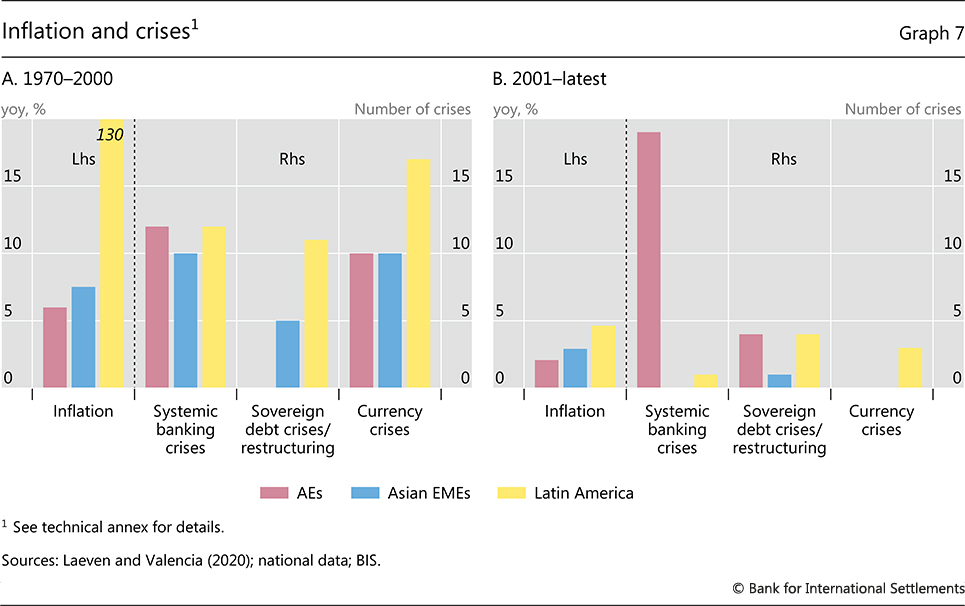

Some of these factors have mainly influenced differences in the journey across EME regions. Political and institutional features can shape attitudes towards fiscal policy, inflation and growth. Partly as a result, inflation has been structurally lower in Asia than in Latin America, which saw hyperinflations in the 1980s and 1990s, often combined with sovereign default and financial stress (Graph 7).11

Other structural factors drive differences, mainly, between EMEs and advanced economies more generally. A key such factor is EMEs' greater sensitivity to global financial conditions and market sentiment. This greater sensitivity reflects, primarily, less developed financial markets, including fewer FX hedging possibilities, and greater reliance on FX funding.12 It has four main implications.

First, the region of stability is smaller and more fluid. The margin of error is commensurately narrower and the risk of sudden and abrupt discontinuities higher. As a result, when policies step outside the region of stability, market discipline is typically felt earlier and more intensely than in AEs, forcing a rapid shift back.13

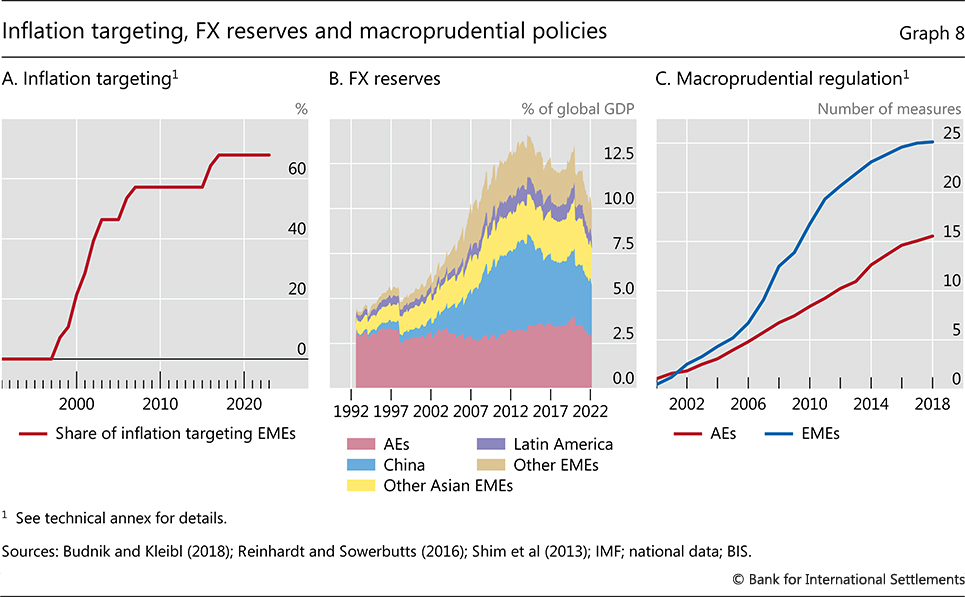

Second, the symptoms of breaches of the boundary of the region more often take the form of capital outflows and large depreciations. The exchange rate plays a bigger role, as a force behind fiscal fragility, inflation and financial instability. And given the greater prevalence of fixed or tightly managed exchange rate regimes until the late 1990s, the incidence of currency crises has been higher. This has prompted a shift over time towards more flexible exchange rate arrangements, accompanied by a widespread adoption of inflation targeting frameworks (Graph 8.A).14

Third, the impact of monetary policy in AEs, notably in the United States, given the dominant role of the US dollar, has been especially prominent. Changes in the US monetary policy stance and swings in the US dollar have been major forces behind the ebbs and flows of global conditions. For example, the Volcker disinflation triggered the Latin American debt crisis, characterised by financial fragilities that had been amplified by strong capital inflows linked to the recycling of petrodollars. The shift to more flexible exchange rate regimes has attenuated, but by no means eliminated, this influence.15

Fourth, the greater exposure to global financial conditions and repeated crises has, over time, fostered EMEs' awareness of the boundaries of the region of stability and their fluidity. From the late 1990s, well before the GFC, they took steps to strengthen their policy frameworks, complementing flexible inflation targeting with a more active use of FX intervention (Graph 8.B), macroprudential tools (Graph 8.C), as well as, to a lesser extent, targeted capital flow management measures – key elements of macro-financial stability frameworks.16 Again, regional differences emerged, with greater concerns about domestic financial imbalances and a lower degree of exchange rate flexibility in Asia than in Latin America.

These enhanced policy frameworks have allowed countries to more successfully weather the GFC and the Covid crises (Graph 7) by increasing shock resilience and enabling countercyclical policies in bad times. They also help explain, for example, why countries in Latin America have tightened monetary policy earlier and more forcefully than many of their AE peers post-Covid. At the same time, these improvements have also somewhat relaxed the policy constraints the countries faced, widening the perceived region of stability. This is, in turn, not without risks going forward and could partly account for the deterioration in fiscal positions and ratings post-GFC (see Graph 6 and below).

Testing the boundaries: risks in the journey ahead

What is the next step in the journey of AEs and EMEs? What are the implications of having tested the boundaries of the region of stability? The ongoing struggle to restore price stability and fend off financial stability risks has triggered tensions between fiscal and monetary policy that raise further challenges down the road.

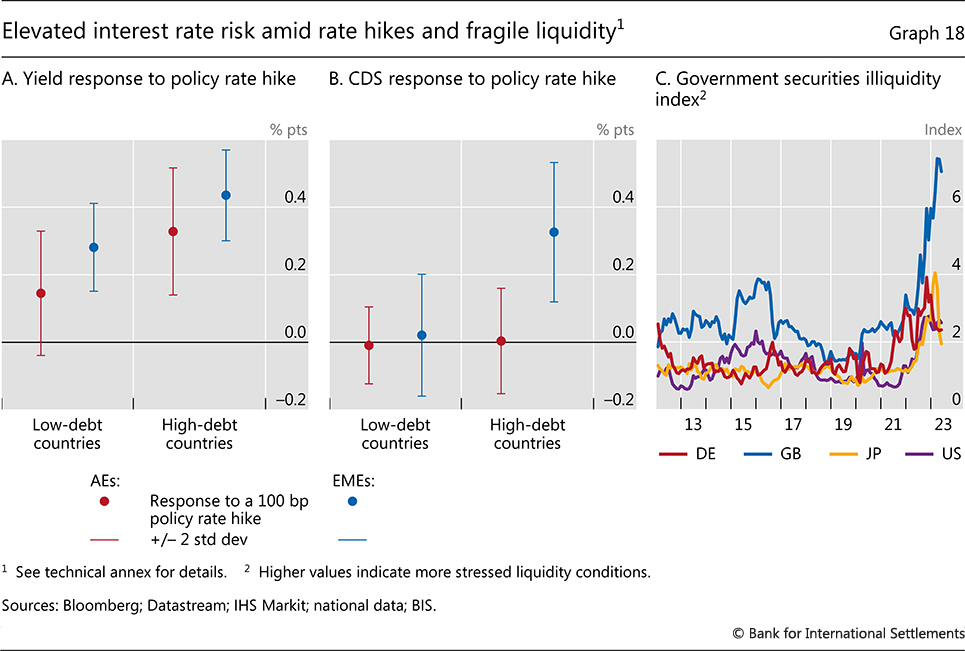

Three main interrelated challenges stand out. First, public finances are facing major strains owing to the combination of record high levels of public debt, strong spending pressures, higher interest rates and weakening growth prospects. Second, large fiscal deficits and high public debt are at risk of working at cross purposes with monetary policy tightening, potentially complicating the fight against inflation. Third, the deterioration in public finances and the sharp repricing of long-term debt in the wake of interest rate hikes may raise financial stability risks.

Consider each issue in turn.

Risks to fiscal positions and the sovereign's creditworthiness

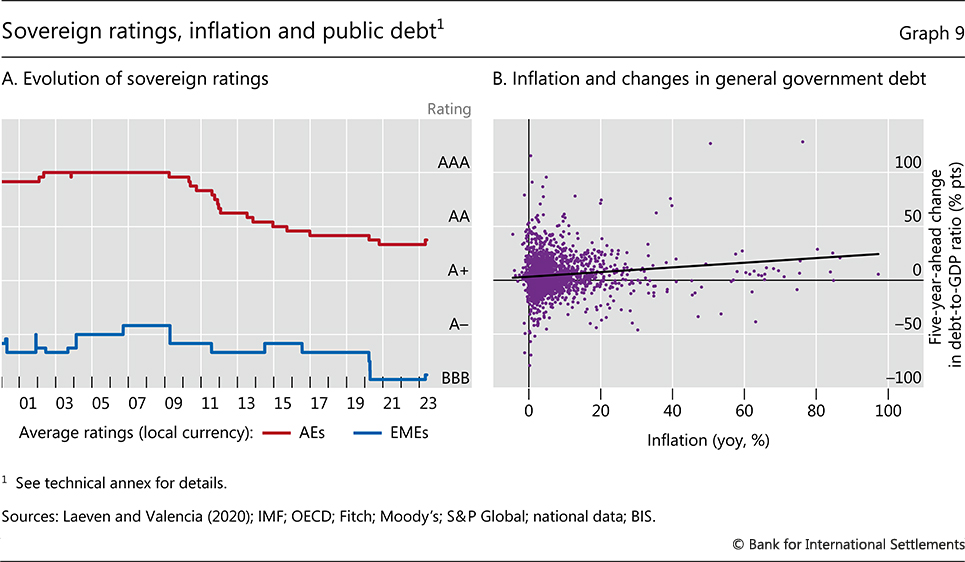

The increase in public debt in AEs and EMEs has led to a deterioration in sovereigns' creditworthiness (Graph 9.A). In AEs, sovereign credit ratings worsened considerably following the surge in debt levels in the wake of the GFC. In EMEs, credit ratings have gradually deteriorated during the past decade in line with the increase in debt levels.

The unexpected inflation surge after the Covid-19 pandemic has temporarily embellished fiscal accounts by boosting nominal GDP and thus mechanically reducing debt-to-GDP ratios. Inflation has also flattered fiscal balances. Since many taxes are levied in proportion to nominal variables – such as wages, sales etc – they tend to increase immediately as prices rise. By contrast, public expenditures are largely fixed in nominal terms from year to year.

Yet improvements in fiscal balances due to inflation are ephemeral. Rising costs will feed into higher public spending and governments will confront pressures to raise public wages and social transfers in line with price increases, if this is not already occurring automatically through indexation mechanisms. Furthermore, the monetary tightening required to bring inflation down will increase borrowing costs and constrain economic growth. Indeed, the historical experience shows that periods of higher inflation tend to be followed, if anything, by rising – not declining – public debt (Graph 9.B).

Looking ahead, fiscal authorities will confront severe challenges due to large new spending pressures, the possibility of higher medium-term interest rates and dimmer growth prospects.

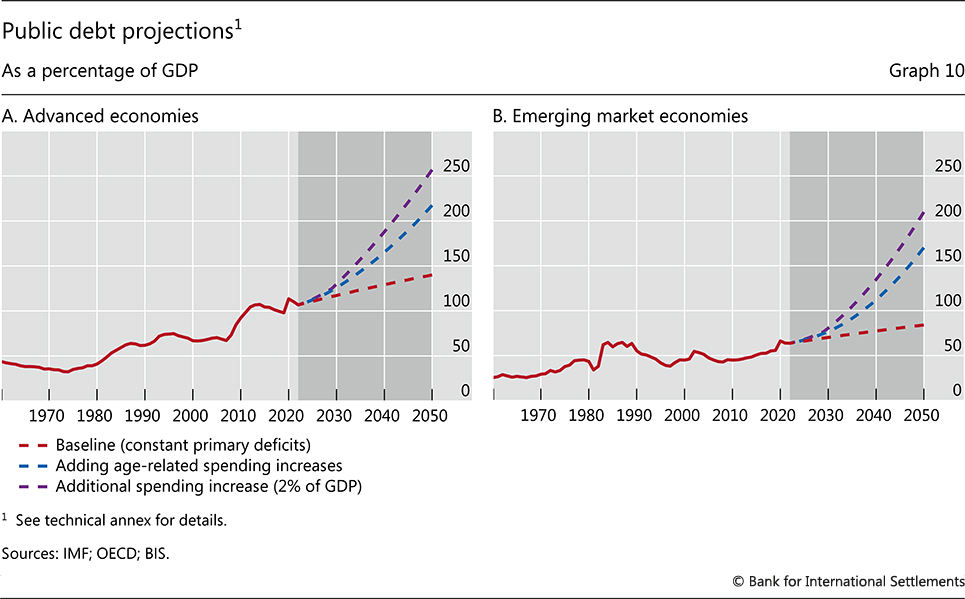

First, consider the implications of new spending pressures for the path of public debt going forward. Estimates for AEs and EMEs suggest that age-related expenditures will grow by approximately 4% and 5% of GDP, respectively, over the next 20 years. Absent fiscal consolidation, this would push debt above 200% and 150% of GDP by 2050 in AEs and EMEs, respectively, even if interest rates remain below growth rates, as was the case in the pre-pandemic years (Graph 10).

Other factors may add to the pressure on public finances. The commitment to supporting a transition towards a sustainable global economy in response to climate change is one. In addition, geopolitical tensions are likely to lead to a material increase in defence spending. An illustrative scenario that includes a rise in public spending by 2% of GDP on top of the increase in age-related spending, would lead to an additional increase in public debt of approximately 50% of GDP by 2050.

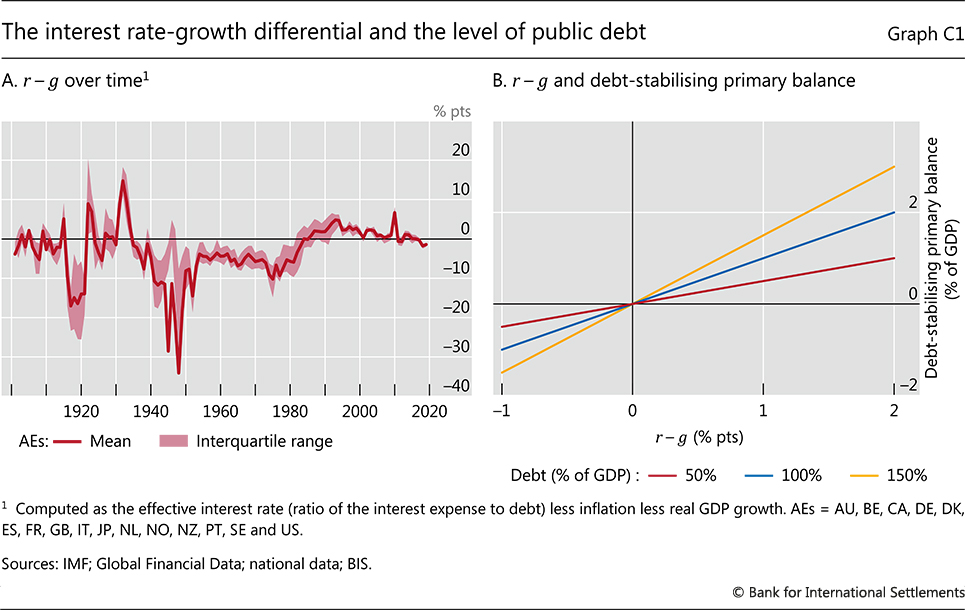

These worrying debt projections are, in fact, rather optimistic: they assume that real interest rates will remain 1 percentage point below growth rates, broadly in line with the experience in recent years. As is well known, this configuration tends to ease debt sustainability pressures (Box C).

Indeed, there are two important reasons why it would be imprudent to count on large and permanent negative differentials between interest rates and growth rates. First, inflation may prove stubborn and require higher interest rates for longer than currently expected. High inflation may also lead to a re-assessment of inflation risk, prompting investors to demand higher risk premia to hold government bonds. And attempts to regain price stability may ultimately result in a substantive economic slowdown.

Second, the link between structural factors and low real rates, which is often relied upon to project persistently low interest rates, is not watertight.17 The economy may thus exit the current period of high inflation by confronting a new reality with higher real rates.

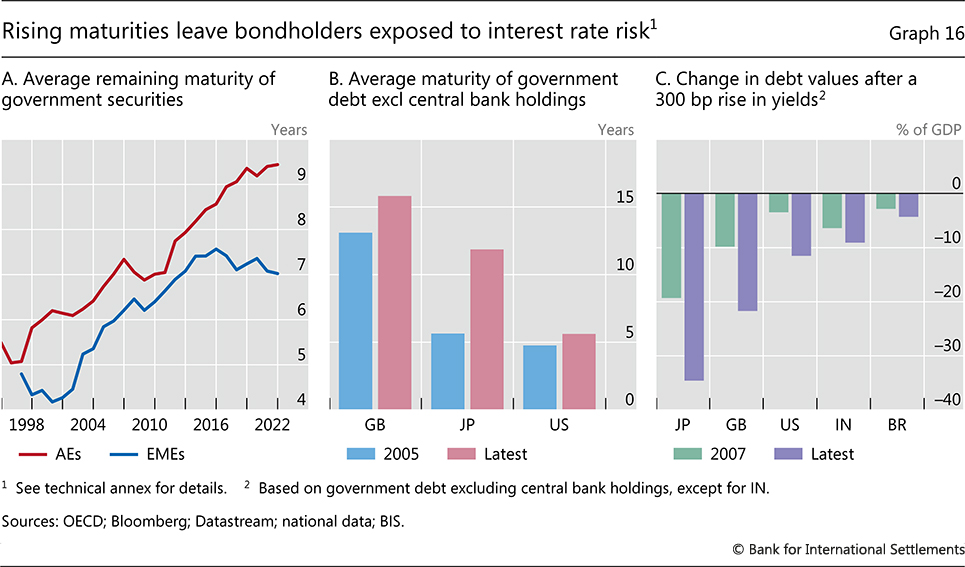

Should real rates increase on a sustained basis, public debt sustainability would come under further considerable pressure. Two factors compound the effect of interest rate hikes on public finances.

Box C

Fiscal limits and the risks to debt dynamics