Según la Fed de St. Louis, uno de los factores del escaso crecimiento de la productividad, está en el bajo incremento del stock de capital por hora trabajada.

How Capital Deepening Affects Labor Productivity

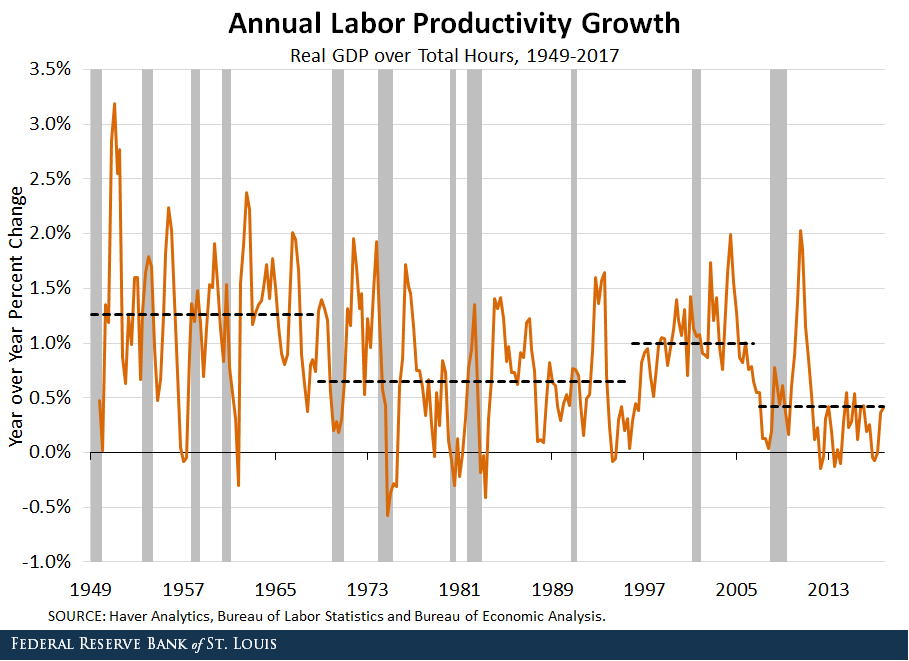

Since the end of World War II, the U.S. economy has experienced periodic shifts in the growth rate of labor productivity, or real output per hour worked. The figure below shows the growth rate of labor productivity since 1948.

The beginning of the post-WWII period saw high levels of labor productivity growth (1.3 percent). Then, during the 1970s and '80s, the U.S. economy experienced a productivity slowdown (0.6 percent) that is sometimes associated with the dramatic rise in oil prices.

The next two decades saw a labor productivity rebound (0.9 percent), typically associated with the rise in information technology. Productivity again slowed leading up to the 2007-09 recession, rising temporarily during and after the Great Recession before settling back to 0.4 percent.

What Caused These Shifts?

Because a number of factors can affect labor productivity, economists have long debated the causes of these shifts. These changes in the growth rate of labor productivity have been attributed to a number of different potential causes, including:

- Fluctuations in factor prices (e.g., energy)

- Changes in workforce demographics (e.g., the low-productivity young baby boomers entering the workforce in the early 1970s and the high-productivity older baby boomers exiting the workforce more recently)

- Shifts in the use of capital

- Changes in technology

Neoclassical growth accounting typically decomposes labor productivity into three components:

- Labor quality (perhaps determined by the age-demographic composition of the workforce)

- Total factor (or multifactor) productivity

- Capital deepening, which we will explain below

Economists have had similar explanations for the most recent slowdown in productivity growth. For example, St. Louis Fed economist Guillaume Vandenbroucke proposed shifting age demographics as a possible cause for the drop in productivity. Age demographics can be important if one believes that older workers have accumulated human capital and have higher productivity than their younger counterparts.

Another explanation for the decline in labor productivity growth is a decline in capital deepening.

What Is Capital Deepening?

Capital deepening refers to an increase in the proportion of the capital stock to the number of labor hours worked. Movements in this ratio are closely tied to movements in labor productivity, all other things held equal. An increase in capital per hour (or capital deepening) leads to an increase in labor productivity.

For example, consider factory workers in a motor vehicle plant. If workers have increased access to machinery and tools to build vehicles, they can produce more vehicles in the same amount of time.

Capital deepening, then, also generally leads to an increase in the growth rate of total output. Capital deepening is also thought to be a major factor—if not a prerequisite—of economic development in emerging markets.

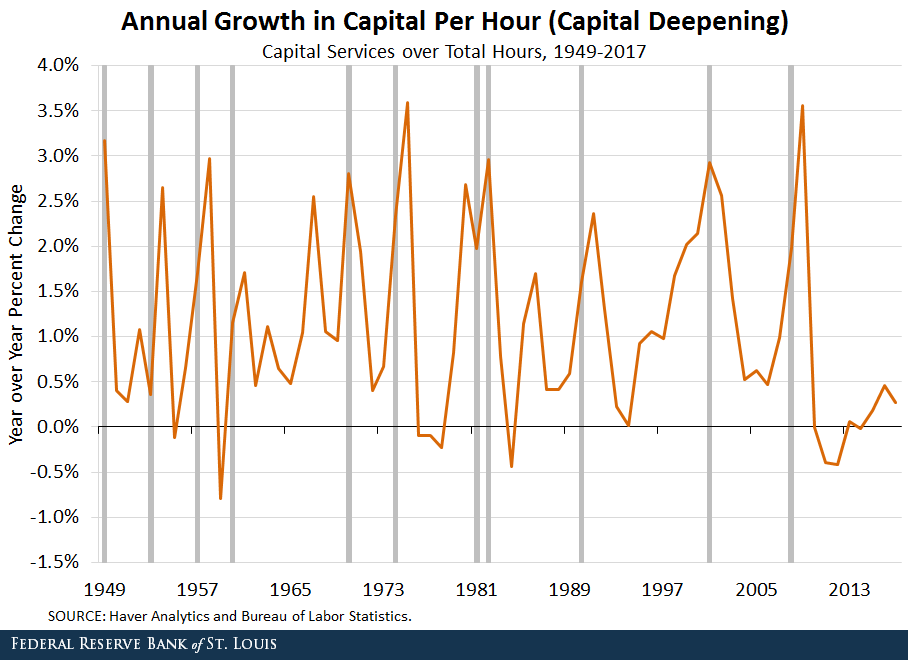

The figure below shows change in capital per labor hour for the U.S. from 1948 to 2017.

During recessions, labor hours fell, but capital remained constant in the short run, increasing capital per hour (or capital deepening). This was true during the Great Recession, when capital per labor hour spiked.

After the recession, hours increased, causing a decline in capital deepening. Typically, capital deepening increases during the recovery phase of the business cycle as business investment picks up. However, during the recovery phase of the recession, investment did not increase sufficiently to boost the capital-to-labor ratio.

The capital-to-labor ratio has risen from the post-recession low but remains at very low levels. The annual growth rate is currently below 0.5 percent and has been since the end of the 2007-09 recession. The end of 2017 marked seven years of growth of less than 0.5 percent, which is the lowest in the series’ history.

Conclusion

Currently, the economy is functioning in a low-productivity state. One explanation could be a decline in labor quality as highly skilled baby boomers retire and are replaced by younger, less-experienced millennials.

However, that explanation does not tell the entire story. Capital deepening is an important component of productivity, and historically low growth of capital per hour is likely contributing to the current low productivity state.

https://www.stlouisfed.org/on-the-economy/2018/april/capital-deepening-affects-labor-productivity

https://articulosclaves.blogspot.com/2023/05/obsesionados-con-la-productividad.html

No hay comentarios:

Publicar un comentario