Annual Economic Report 2022

At its Annual General Meeting on Sunday 26 June 2022, the BIS released its Annual Economic Report and its Annual Report.

https://www.bis.org/publ/arpdf/ar2022e.htm

I. Old challenges, new shocks

https://www.bis.org/publ/arpdf/ar2022e1.htm

II. Inflation: a look under the hood

https://www.bis.org/publ/arpdf/ar2022e2.htm

III. The future monetary system

A burst of creative innovation is under way in money and payments, opening up vistas of a future digital monetary system that adapts continuously to serve the public interest

https://www.bis.org/publ/arpdf/ar2022e3.htm

III. The future monetary system

Key takeaways

- Se está produciendo un estallido de innovación creativa en el ámbito del dinero y los pagos, que abre las puertas a un futuro sistema monetario digital que se adapte continuamente para servir al interés público.

- Los defectos estructurales hacen que el universo criptográfico sea

inadecuado como base de un sistema monetario: carece de un ancla nominal

estable, mientras que los límites de su escalabilidad dan lugar a la

fragmentación. En contra de la narrativa de la descentralización, el

cripto depende a menudo de intermediarios no regulados que plantean

riesgos financiero

- Un sistema basado en el dinero del banco central ofrece una base más

sólida para la innovación, garantizando que los servicios sean estables e

interoperables, tanto a nivel nacional como transfronterizo. Este

sistema puede mantener un círculo virtuoso de confianza y adaptabilidad a

través de los efectos de la re

- Las nuevas capacidades, como la programabilidad, la componibilidad y la tokenización, no son exclusivas de las criptomonedas, sino que pueden construirse sobre las monedas digitales de los bancos centrales (CBDC), los sistemas de pago rápido y las arquitecturas de datos asociadas

Introduction

Cada día, personas de todo el mundo realizan más de 2.000 millones de pagos digitales1 . Cada vez que lo hacen, dependen del sistema monetario, es decir, del conjunto de instituciones y mecanismos que rodean y apoyan el intercambio monetario.El sistema monetario con el banco central en el centro ha servido bien a la sociedad. Sin embargo, la innovación digital está ampliando la frontera de las posibilidades tecnológicas, planteando nuevas exigencias al sistema.

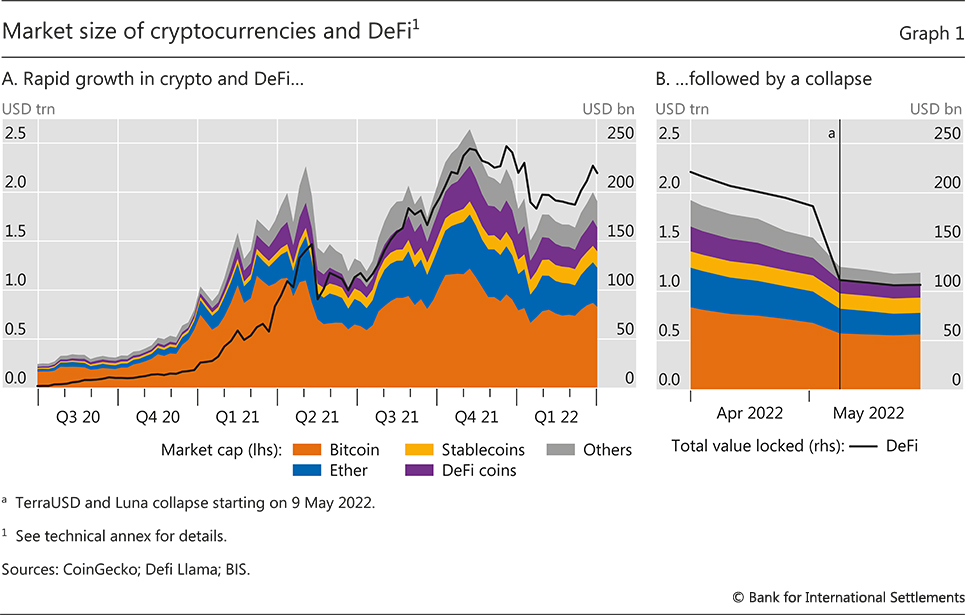

Sin embargo, los últimos acontecimientos han revelado un gran abismo entre la visión de las criptomonedas y su realidad. La implosión de la stablecoin TerraUSD y el colapso de su moneda gemela Luna han puesto de manifiesto la debilidad de un sistema que se sustenta en la venta de monedas para la especulación. Además, ahora está quedando claro que el cripto y el DeFi tienen limitaciones estructurales más profundas que les impiden alcanzar los niveles de eficiencia, estabilidad o integridad necesarios para un sistema monetario adecuado. En particular, el universo de las criptomonedas carece de un ancla nominal, que intenta importar, de forma imperfecta, a través de las stablecoins. También es propenso a la fragmentación, y sus aplicaciones no pueden escalar sin comprometer la seguridad, como demuestran su congestión y sus exorbitantes tarifas. La actividad de este sistema paralelo se sostiene, en cambio, gracias a la afluencia de los poseedores de monedas especulativas. Por último, existe una gran preocupación por el papel de los intermediarios no regulados en el sistema. Al estar profundamente arraigadas, es poco probable que estas deficiencias estructurales puedan solucionarse únicamente con soluciones técnicas. Esto se debe a que reflejan las limitaciones inherentes a un sistema descentralizado construido sobre cadenas de bloques sin permisos.

Este capítulo establece una visión alternativa para el futuro, que se basa en los bienes públicos de los bancos centrales. Esto garantizará que los servicios innovadores del sector privado estén firmemente arraigados en la confianza que proporciona el dinero del banco central.

Este capítulo está organizado de la siguiente manera. Para preparar el terreno, se describe en primer lugar el sistema monetario actual y los objetivos de alto nivel que debe alcanzar, y hasta qué punto los cambios en la tecnología y el entorno económico han abierto un margen de mejora. En la siguiente sección se analizan las promesas y los escollos de las innovaciones en materia de criptomonedas y DeFi. A continuación, el capítulo analiza una visión del futuro sistema monetario, construida sobre los bienes públicos de los bancos centrales. La última sección concluye.

What do we want from a monetary system?

Para garantizar la seguridad y la estabilidad del sistema, el dinero debe cumplir tres funciones: como depósito de valor, como unidad de cuenta y como medio de cambio. Cuando el sistema monetario se apoya en nodos o entidades clave (ya sean públicas o privadas), éstas deben rendir cuentas, mediante mandatos específicos para las autoridades públicas y mediante una regulación y supervisión adecuadas para las entidades privadas. El sistema monetario debe ser eficiente, permitiendo pagos fiables y rápidos para apoyar las transacciones económicas tanto a escala como a bajo coste. El acceso a los servicios de pago básicos a precios asequibles, en particular a las cuentas de transacciones, debe ser universal para difundir los beneficios de la actividad económica, promoviendo la inclusión financiera. No menos importante es que el sistema debe proteger la privacidad como un derecho fundamental, y proporcionar al usuario el control de los datos financieros. Hay que proteger la integridad del sistema, protegiéndolo de actividades ilícitas como el blanqueo de dinero, la financiación del terrorismo y el fraude.

El sistema monetario actual se ha acercado a estos objetivos de alto nivel, pero aún queda camino por recorrer. La evolución de las necesidades de los usuarios y los cambios tecnológicos concomitantes han puesto de manifiesto las áreas de mejora (cuadro 1, segunda columna). Los servicios de pago actuales pueden ser a veces engorrosos y costosos de utilizar, lo que refleja en parte la falta de competencia. Los pagos transfronterizos son especialmente caros, opacos y lentos: suelen implicar a uno o más bancos corresponsales para liquidar una transacción, utilizando libros de contabilidad construidos con tecnologías diferentes3 . Pero un mundo globalizado que presenta una economía digital en constante crecimiento requiere un sistema monetario que permita a todos realizar transacciones financieras a nivel nacional y mundial de forma segura, sólida y eficiente. Responder a estos cambios en las exigencias que la sociedad plantea al sistema monetario exige avances en la tecnología y en los acuerdos institucionales.

The promise and pitfalls of crypto

Por muy dramáticos que hayan sido estos recientes colapsos de precios, centrarse únicamente en la acción de los precios desvía la atención de los defectos estructurales más profundos de las criptomonedas que las hacen inadecuadas como base de un sistema monetario que sirva a la sociedad (Tabla 1, tercera columna).

La prevalencia de las stablecoins, que intentan fijar su valor al dólar estadounidense o a otras monedas convencionales, indica la necesidad generalizada en el sector de las criptomonedas de apoyarse en la credibilidad que proporciona la unidad de cuenta emitida por el banco central. En este sentido, las stablecoins son la manifestación de la búsqueda de un ancla nominal por parte de las criptomonedas. Las stablecoins se asemejan a la forma en que un vínculo monetario es un ancla nominal para el valor de una moneda nacional frente al de una moneda internacional, pero sin los acuerdos institucionales, los instrumentos, los compromisos y la credibilidad del banco central que opera el vínculo. Proporcionar la unidad de cuenta para la economía es el papel principal del banco central. El hecho de que las stablecoins deban importar la credibilidad del dinero del banco central es muy revelador de las deficiencias estructurales de las criptomonedas. El hecho de que las stablecoins sean a menudo menos estables de lo que afirman sus emisores demuestra que, en el mejor de los casos, son un sustituto imperfecto de una moneda soberana sólida.

Las stablecoins también desempeñan un papel fundamental a la hora de facilitar las transacciones entre la plétora de criptodivisas que han proliferado en los últimos años. En el último recuento había más de 10.000 monedas en muchas cadenas de bloques diferentes que competían por la atención de los compradores especuladores.

La proliferación de monedas revela otro importante defecto estructural de las criptomonedas: la fragmentación del universo de las criptomonedas, con muchas capas de liquidación incompatibles que compiten por un lugar en el centro de atención.

No obstante, el cripto ofrece un atisbo de características potencialmente útiles que podrían mejorar las capacidades del sistema monetario actual. Éstas se derivan de la capacidad de combinar transacciones y de ejecutar la liquidación automática de las transacciones agrupadas de forma condicional, permitiendo una mayor funcionalidad y velocidad. Así pues, una cuestión a tener en cuenta es cómo pueden incorporarse las útiles funcionalidades de las criptomonedas en un futuro sistema monetario que se base en el dinero de los bancos centrales.

Para profundizar en los defectos y posibilidades del cripto, es instructivo explicar primero algunos elementos básicos del mundo del cripto.

The building blocks of crypto

Las criptomonedas tienen su origen en el Bitcoin, que introdujo una idea radical: un medio descentralizado de transferencia de valor en una cadena de bloques sin permisos. Cualquier participante puede actuar como nodo de validación (véase el glosario) y participar en la validación de las transacciones en un libro de contabilidad público (es decir, la cadena de bloques sin permisos). En lugar de depender de intermediarios de confianza (como los bancos), el mantenimiento de registros en la cadena de bloques es realizado por una multitud de validadores anónimos e interesados.

Transactions with cryptocurrencies are verified by decentralised validators and recorded on the public ledger. If a seller wants to transfer cryptocurrencies to a buyer, the buyer (whose identity is hidden behind their cryptographic digital signature) broadcasts the transaction details, eg transacting parties, amount or fees. Validators (in some networks called "miners") compete to verify the transaction, and whoever is selected to verify then appends the transaction to the blockchain. The updated blockchain is then shared among all miners and users. The history of all transactions is hence publicly observable and tied to specific wallets, while the true identities of the parties behind transactions (ie the owners of the wallets) remain undisclosed. By broadcasting all information publicly, the system verifies that the transaction is consistent with the history of transfers on the blockchain, ie that the cryptocurrency actually belongs to the seller and has not been double-spent.

However, for a decentralised governance system, economic incentives are key. The limits of the system are set by the laws of economics rather than the laws of physics. In other words, not only the technology but also the incentives need to work. Miners (or validators) are compensated with monetary rewards for performing their tasks according to the rules so that the system becomes self-sustaining. Rewards, paid in crypto, can come in the form of transaction fees but can also stem from rents that accrue to "staking" one's coins in a proof-of-stake blockchain. The larger the stake, the more often a node will serve as validator, and the larger the rents.

Since the advent of Bitcoin in 2009, many other blockchains and associated crypto coins have entered the scene, most notably Ethereum, which provides for the use of "smart contracts" and "programmability" (see glossary). Smart contracts, or self-executing code that triggers an action if some pre-specified conditions are met, can automate market functions and obviate the intermediaries that were traditionally required to make decisions. As the underlying code is publicly available, it can be scrutinised, making smart contracts transparent and reducing the risk of manipulation. An important feature of smart contracts is their composability, or the capacity to combine different components in a system. Users can perform complex transactions on the same blockchain by combining multiple instructions within one single smart contract – "money legos". They can create a digital representation of assets through "tokenisation" (see glossary). As smart contracts cannot directly access information that resides "off-chain", ie outside the specific blockchain, they require mediators to provide such data (so-called oracles).4

Newer blockchains, with Terra (before its collapse) being a prominent example, have been touted as "Ethereum killers" in that they boast higher capacity and larger throughput (see glossary). However, these changes bring new problems. Capacity is often increased through greater centralisation in the validation mechanisms, weakening security and concentrating the benefits for insiders, as explained below.5

Stablecoins in search of a nominal anchor

A key development in the crypto universe is the rise of decentralised finance, or "DeFi". DeFi offers financial service and products, but with the declared objective of refashioning the financial system by cutting out the middlemen and thereby lowering costs.6 To this end, DeFi applications publicly record pseudo-anonymous transactions in cryptocurrencies on permissionless blockchains. "Decentralised applications" (dApps) featuring smart contracts allow transactions to be automated. To reach consensus, validators are incentivised through rewards.

While the DeFi ecosystem is evolving rapidly, the main types of financial activity continue to be those already available in traditional finance, such as lending, trading and insurance.7 Lending platforms let users lend out their stablecoins with interest to borrowers that post other cryptocurrencies as collateral. Decentralised exchanges (DEXs) represent marketplaces where transactions occur directly between cryptocurrency or stablecoin traders, with prices determined via algorithms. On DeFi insurance platforms, users can insure themselves against eg the mishandling of private keys, exchange hacks or smart contract failures. As activities almost exclusively involve exchanging one stablecoin or cryptocurrency for another, and do not finance productive investments in the real economy, the system is mostly self-referential.

Stablecoins play a key role in the DeFi ecosystem. These are so-called because they are usually pegged to a numeraire, such as the US dollar, but can also target the price of other currencies or assets (eg gold). In this sense, they often import the credibility provided by the unit of account issued by the central bank. Their main use case is to overcome the high price volatility and low liquidity of unbacked cryptocurrencies, like Bitcoin. Their use also avoids frequent conversion between cryptocurrencies and bank deposits in sovereign currency, which is usually associated with significant fees. Because stablecoins are used to support a wide range of DeFi activities, turnover in stablecoins generally dwarfs that of other cryptocurrencies.

The two main types of stablecoin are asset-backed and algorithmic. Asset-backed stablecoins, such as Tether, USD Coin and Binance USD, are typically managed by a centralised intermediary who invests the underlying collateral and coordinates the coins' redemption and creation. Assets can be held in government bonds, short-term corporate debt or bank deposits, or in other cryptocurrencies. In contrast, algorithmic stablecoins, such as TerraUSD before its implosion, rely on complex algorithms that automatically rebalance supply to maintain their value relative to the target currency or asset. To avoid reliance on fiat currency, they often do so by providing users with an arbitrage opportunity relative to another cryptocurrency.

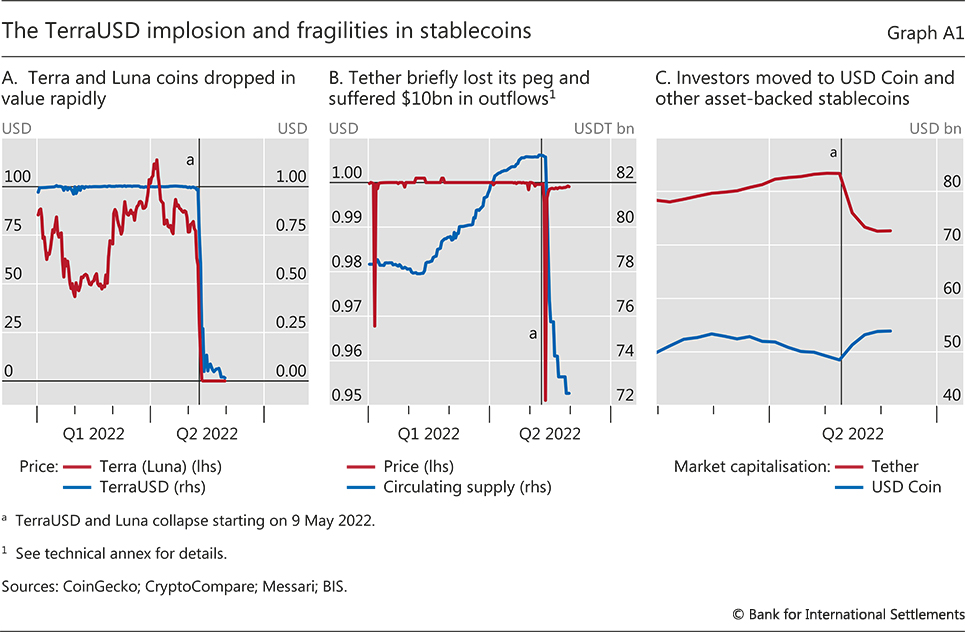

Despite their name, stablecoins – in particular, algorithmic ones – are less stable than their issuers claim. In May 2022, TerraUSD entered a death spiral, as its value dropped from $1 to just a few cents over the course of a few days (see Box A). In the aftermath, other algorithmic stablecoins came under pressure. But so did some asset-backed stablecoins, which have seen large-scale redemptions, temporarily losing their peg in the wake of the shock. Redemptions were more pronounced among stablecoins whose issuers did not disclose the composition of reserve assets in detail, presumably reflecting investors' worries that such issuers might not be able to guarantee conversion at par.

Indeed, commentators have warned for some time that there is an inherent conflict of interest in stablecoins, with an incentive for issuers to invest in riskier assets. Economic history is littered with attempts at private money that failed, leading to losses for investors and the real economy. The robustness of stablecoin stabilisation mechanisms depends crucially on the quality and transparency of their reserve assets, which are often woefully lacking.8

Yet even if stablecoins were to remain stable to some extent, they lack the qualities necessary to underpin the future monetary system. They must import their credibility from sovereign fiat currencies, but they benefit neither from the regulatory requirements and protections of bank deposits and e-money, nor from the central bank as a lender of last resort. In addition, they tie up liquidity and can fragment the monetary system, thus undermining the singleness of the currency.9 As stablecoins are barely used to pay for real-world goods and services, but underpin the largely self-referential DeFi ecosystem, some have questioned whether stablecoins should be banned.10 As will be discussed below, there is more promise in sounder representations of central bank money and liabilities of regulated issuers.

Box A

The collapse of the TerraUSD stablecoin

The implosion of TerraUSD (UST) highlights inherent fragilities in some versions of stablecoins. The use of UST grew rapidly over 2021–22 so that, prior to its collapse, it was the third largest stablecoin, with a peak market capitalisation of $18.7 billion. An algorithmic stablecoin, it maintained value by adjusting supply in an automated arbitrage trading strategy with another cryptocurrency, Luna, on the Terra blockchain. UST aimed to keep a one-for-one peg to the US dollar by being convertible into one dollar's worth of Luna, and vice versa. For example, should Terra fall to 99 cents, a user could purchase UST on an exchange for 99 cents and then exchange their UST for $1 worth of new units of Luna on the Terra platform. A crucial aspect of this arrangement was that users would only be willing to exchange UST into Luna if Luna's market capitalisation exceeded that of UST. As Luna had no intrinsic value, its valuation stemmed primarily from the influx of speculative users into the Terra ecosystem. To attract new users, the associated lending protocol Anchor offered a deposit rate of around 20% on UST. As long as users had confidence in the stable value of UST and sustained market capitalisation of Luna, the system could be sustained. The Terra/Luna pairing was regarded as being especially significant as it promised to offer a "self-levitating" version of money that did not piggyback on real-world collateral assets.

However, this hope proved unfounded. Once investors lost confidence in the sustainability of the system, the arrangement unravelled. In May 2022, the value of UST plummeted to almost zero (Graph A1.A). As UST dropped below its peg, a classic run dynamic took hold as investors sought to redeem their funds. Users burned their UST on a large scale to mint $1 worth of new Luna, in the hope of selling Luna as long as it still had some value. However, given the size and speed of the shock, confidence evaporated, meaning that there were not enough parties willing to buy all the newly minted Luna coins – and so the price of Luna collapsed.

The UST/Luna implosion spilled over to the largest stablecoin, Tether, which dropped to a value of $0.95 before recovering. It saw outflows of over $10 billion in the subsequent weeks (Graph A1.B). The de-pegging has been linked to Tether's unwillingness to provide details about its reserve portfolio: investors worried about whether Tether had enough high-quality assets that could be liquidated to support the peg. This argument is supported by the inflows experienced by the regulated stablecoin USDC (with better documented reserves), with funds probably coming from Tether (Graph A1.C).

Structural limitations of crypto

Los validadores interesados son responsables de registrar las transacciones en la cadena de bloques. Sin embargo, en el sistema criptográfico pseudoanónimo, no tienen reputación en juego y no pueden rendir cuentas ante la ley. En cambio, deben ser incentivados mediante recompensas monetarias lo suficientemente altas como para sostener el sistema de consenso descentralizado. La validación honesta debe producir mayores beneficios que las ganancias potenciales de las trampas. Si las recompensas fueran demasiado bajas, los validadores individuales tendrían un incentivo para hacer trampas y robar fondos. El mecanismo de consenso fallaría, poniendo en peligro la seguridad general.

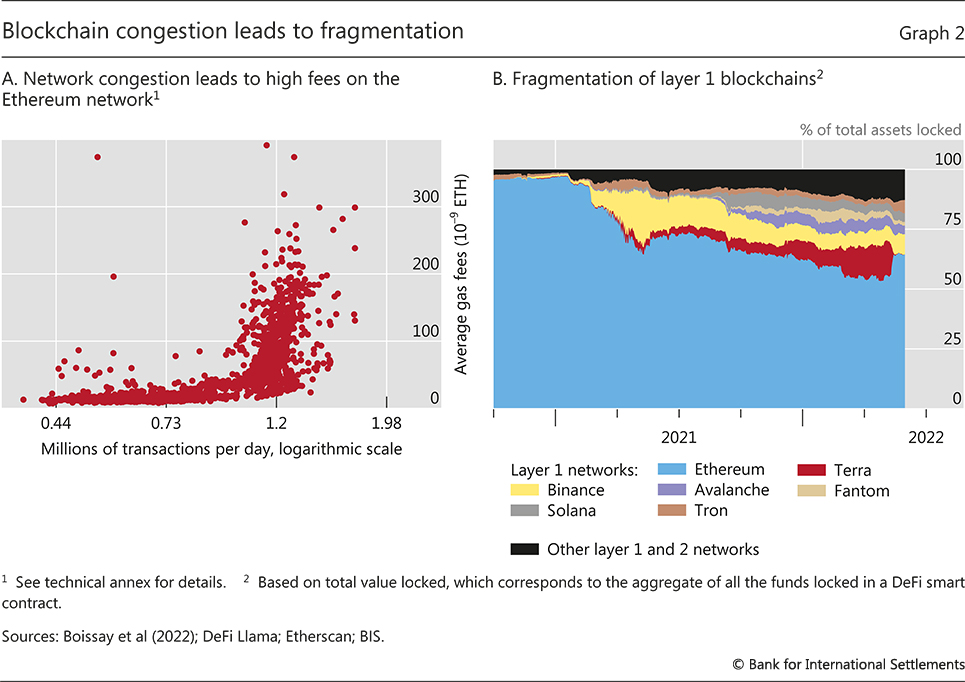

La única forma de canalizar las recompensas a los validadores, manteniendo así los incentivos, es limitar la capacidad de la blockchain, manteniendo así las tasas altas, sostenidas por la congestión. Como los validadores pueden elegir qué transacciones se validan y procesan, en los periodos de congestión los usuarios ofrecen tarifas más altas para que sus transacciones se procesen más rápido (Gráfico 2 A).12

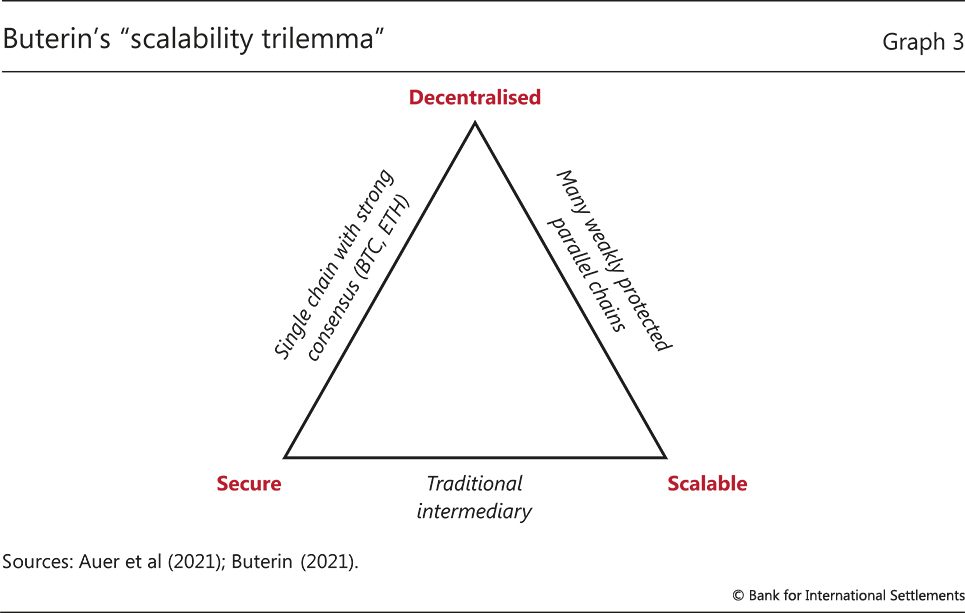

The limited scale of blockchains is a manifestation of the so-called scalability trilemma. By their nature, permissionless blockchains can achieve only two of three properties, namely scalability, security or decentralisation (Graph 3). Security is enhanced through incentives and decentralisation, but sustaining incentives via fees entails congestion, which limits scalability. Thus, there is a mutual incompatibility between these three key attributes, preventing blockchains from adequately serving the public interest.

The limited scalability of blockchains has fragmented the crypto universe, as newer blockchains that cut corners on security have entered the fray. The Terra blockchain is just the most prominent of a horde of new entrants (Graph 2.B). Even as recently as the beginning of 2021, Ethereum accounted for almost all of the total assets locked. By early May 2022, this share had already dropped to 50%. The widening wedge (in red) accounted for by the failed Terra blockchain is particularly striking. Terra's collapse highlights the tendency of the crypto universe to fragment through its vulnerability to new entrants that prioritise market share and capacity at the expense of decentralisation and security.

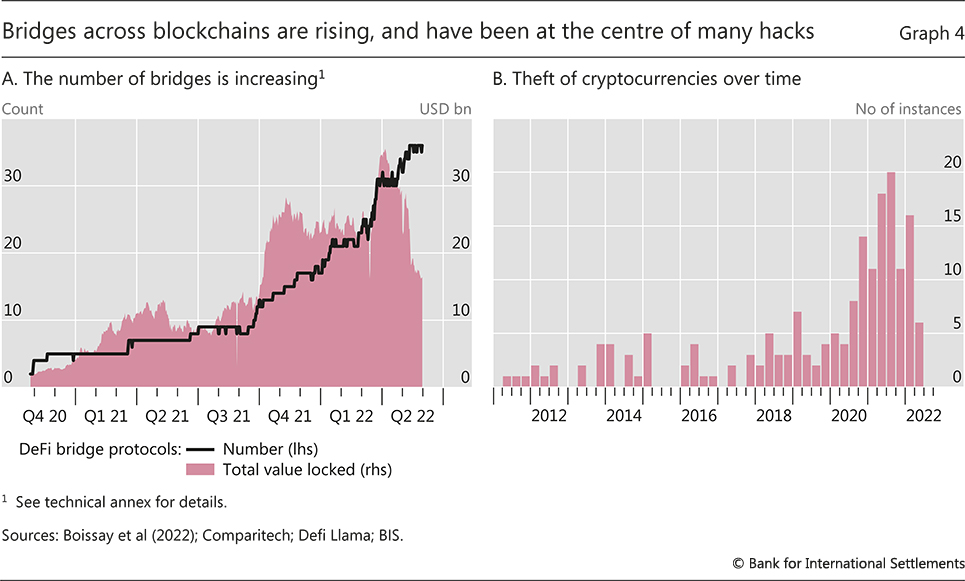

A system of competing blockchains that are not interoperable but sustained by speculation introduces new risks of hacking and theft. Interoperability refers here to the ability of protocols and validators to access and share information, as well as validate transactions, across different blockchains. Interoperability of the underlying settlement layers is not achievable in practice, as each blockchain is a separate record of settlements. Nevertheless, "cross-chain bridges" have emerged to permit users to transfer coins across blockchains.13 Yet most bridges rely on only a small number of validators, whom – in the absence of regulation and legal accountability – users need to trust to not engage in illicit behaviour. But, as the number of bridges has risen (Graph 4.A), bridges have featured prominently in several high-profile hacks (Graph 4.B). These attacks highlight the vulnerabilities to security breaches that stem from weakness in governance.

The striking fragmentation of the crypto universe stands in stark contrast to the network effects that take root in traditional payment networks. Traditional payment networks are characterised by a "winner takes all" property, whereby more users flocking to a particular platform beget even more users. Such network effects stand at the heart of the virtuous circle of lower costs and enhanced trust in traditional platforms. In contrast, crypto's tendency toward fragmentation and high fees is a fundamental structural flaw that disqualifies it as the foundation for the future monetary system.14

Despite fragmentation, speculation can induce high price correlations across different cryptocurrencies and blockchains. Attracted by high returns and the expectation of further price increases (Box B), the influx of new users can push up prices even more. As many cryptocurrencies share a similar user base and are tied to similar protocols, there is strong price co-movement. There are important concerns about what happens to a system that relies on selling new coins when the new inflow of users suddenly slows.

The DeFi decentralisation illusion and the role of exchanges

Despite its name, the DeFi ecosystem shows a tendency towards centralisation. Many key decisions are taken by vote among the holders of "governance tokens", which are often issued to developer teams and early investors and are thus heavily concentrated. Smart contracts tied to real-world events involve oracles that operate outside the blockchain. "Algorithm incompleteness", ie the impossibility of writing contracts to spell out what actions to take in all contingencies, requires some central entities to resolve disputes. Moreover, newer blockchains usually aim for faster transactions and higher throughput by relying on concentrated validation mechanisms. For example, proof-of-stake mechanisms build on a limited number of validators who stake their coins.

Centralisation in DeFi is not without risks. Increasing centralisation of validators gives rise to incentive conflicts and the risk of hacks, also because these centralised nodes are often unregulated.15 Further, those in charge of an oracle can corrupt the system by misreporting data (the so-called oracle problem). Currently, there are no clear rules on how to vet or incentivise oracle providers.

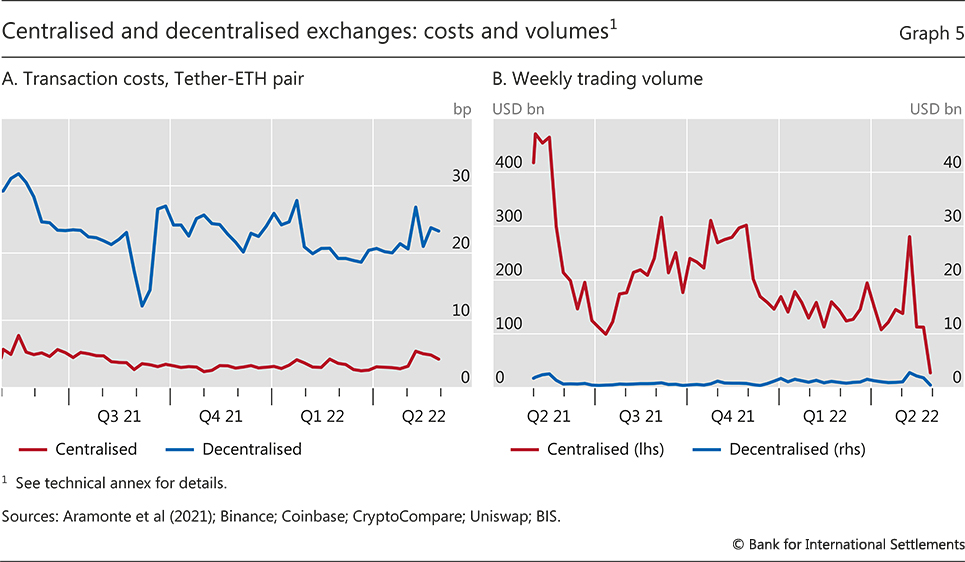

Centralisation is also present in crypto trading activities, where investors rely mainly on centralised exchanges (CEXs) rather than decentralised ones (DEXs). While the latter work by matching the counterparties in a transaction through so-called automated market-maker protocols, CEXs maintain off-chain records of outstanding orders posted by traders – known as limit order books – which are familiar from traditional finance. CEXs attract more trading activity than DEXs, as they feature lower costs (Graph 5.A).16 In terms of business model and the way they operate, crypto CEXs are not fundamentally different from traditional exchanges, even though they are not subject to the same regulation and supervision.

Box B

Crypto trading and Bitcoin prices

Speculation is a key driver of cryptocurrency holdings, but retail investors may not be fully aware of the risks associated

with investments in cryptocurrency. A recent BIS study assembles a novel

cross-country database on retail use of crypto exchange apps at a daily

frequency over 2015–22, focusing on the relationship between the use of

crypto trading apps and Bitcoin prices.

but retail investors may not be fully aware of the risks associated

with investments in cryptocurrency. A recent BIS study assembles a novel

cross-country database on retail use of crypto exchange apps at a daily

frequency over 2015–22, focusing on the relationship between the use of

crypto trading apps and Bitcoin prices. The

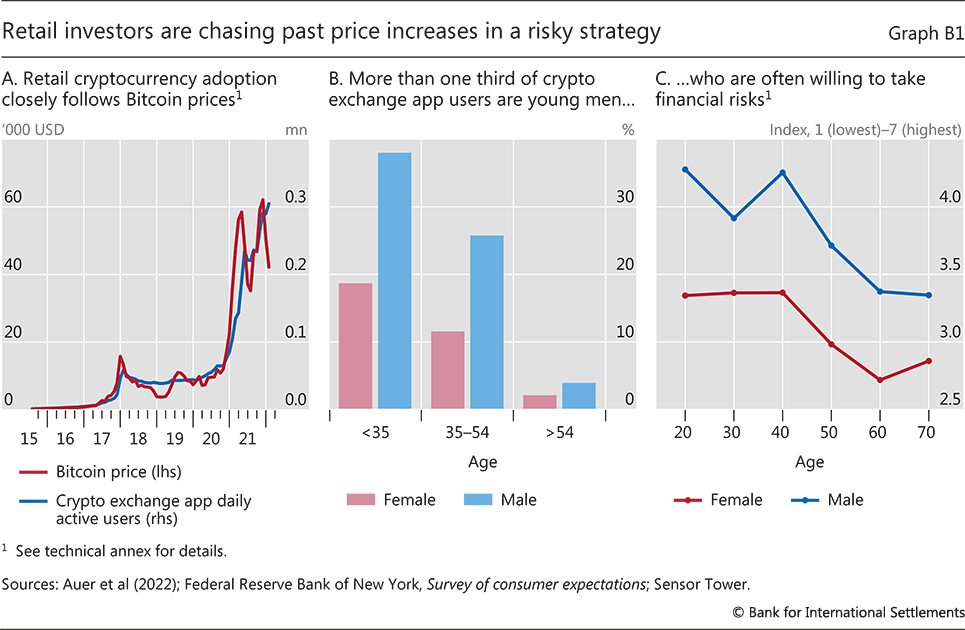

analysis shows that a rise in the price of Bitcoin is associated with a

significant increase in new users, ie the entry of new investors, with a

correlation coefficient of more than 0.9 (Graph B1.A).

A one standard deviation increase in the daily Bitcoin price is

associated with an increase of around 90,000 crypto exchange app users.

Crypto app users are primarily younger users and men (Graph B1.B),

commonly identified as the most "risk-seeking" segment of the

population, and potentially motivated by a "fear of missing out". These

patterns are consistent with survey evidence on individuals' risk

tolerance: younger men are more willing than either women or older male

respondents to take financial risks (Graph B1.C).

The

analysis shows that a rise in the price of Bitcoin is associated with a

significant increase in new users, ie the entry of new investors, with a

correlation coefficient of more than 0.9 (Graph B1.A).

A one standard deviation increase in the daily Bitcoin price is

associated with an increase of around 90,000 crypto exchange app users.

Crypto app users are primarily younger users and men (Graph B1.B),

commonly identified as the most "risk-seeking" segment of the

population, and potentially motivated by a "fear of missing out". These

patterns are consistent with survey evidence on individuals' risk

tolerance: younger men are more willing than either women or older male

respondents to take financial risks (Graph B1.C).

Quantifying the effect of Bitcoin prices on entry into crypto is difficult because of the possibility of reverse causality. Prices might also increase because of the entry of new crypto exchange app users. To address such concerns, it is possible to focus on specific exogenous shocks when Bitcoin price changes were due to specific factors, such as the crackdown of Chinese authorities on crypto mining activities and the social unrest in Kazakhstan. During each of these episodes, structural changes affected the global price of Bitcoin, independently of the entry of new users in crypto exchange apps. In these cases, the exogenous drop in the Bitcoin price was associated with an average reduction in the number of new app users of 5–10% in the two-weeks following the shocks. Results are further corroborated from a panel vector autoregression model, where a 10% increase in the Bitcoin price leads to a 3% increase in the number of app users.

People invest in cryptocurrencies for different reasons, for example

because they distrust domestic financial institutions, for cross-border

money transfers or for the potential for pseudo-anonymity – for either

legitimate or nefarious reasons. However, one of the main reasons is

that cryptocurrencies are seen as investment assets. See Auer and

Tercero-Lucas (2021), Foley et al (2019), Hileman (2015), Knittel et al

(2019) and Swartz (2020).

People invest in cryptocurrencies for different reasons, for example

because they distrust domestic financial institutions, for cross-border

money transfers or for the potential for pseudo-anonymity – for either

legitimate or nefarious reasons. However, one of the main reasons is

that cryptocurrencies are seen as investment assets. See Auer and

Tercero-Lucas (2021), Foley et al (2019), Hileman (2015), Knittel et al

(2019) and Swartz (2020).  Auer, Cornelli, Doerr, Frost and Gambacorta (2022)

Auer, Cornelli, Doerr, Frost and Gambacorta (2022)

CEXs have seen substantial growth since 2020 and have reached volumes that make them relevant from a financial stability viewpoint (Graph 5.B). Moreover, trading in CEXs shows a strong tendency towards market concentration: trading volumes in three large CEXs represented around half of the total in the first months of 2022. However, it is generally difficult to gauge the actual size of crypto exchanges, because CEXs hold a significant share of their custodial cryptocurrencies off-balance sheet. For example, the platform Coinbase reported publicly that it had $256 billion of assets on platform (as of end-March 2022) but a balance sheet of only $21 billion as of end-2021. Securities and Exchange Commission staff recently argued that the platform should report both liabilities (obligations to customers) and assets on its balance sheet.17 In addition, crypto service providers often perform a multitude of services, raising the question whether activities are appropriately ring-fenced and risks adequately managed. For example, together with third-party trading, they undertake proprietary trading, margin lending or token issuance, and supply custody services. Often, transactions involve interactions between on-chain smart contracts and off-chain centralised trading platforms, with the distributed nature of on-chain settlement giving rise to distinct risks as compared with those arising from traditional infrastructure operators.

A balanced assessment of the similarities and differences between the crypto market and traditional finance is a prerequisite for considering appropriate regulatory policies. Some activities of crypto service providers are common features in banks too, although their combination in one entity is not currently common in traditional finance. Moreover, differences in underlying technologies mean that risk features and drivers could differ between traditional finance and the crypto ecosystem.

Regulatory approaches to crypto risks

Sobre todo, las autoridades deben abordar con rigor los casos de arbitraje regulatorio. Partiendo del principio de "misma actividad, mismo riesgo, mismas reglas", deben garantizar que las actividades de cripto y DeFi cumplan con los requisitos legales para actividades tradicionales comparables. Los emisores de stablecoin, por ejemplo, se asemejan a las entidades de depósito o a los fondos del mercado monetario (FMM). Por ello, es necesario legislar para calificar estas actividades y garantizar que estén sujetas a una sólida regulación prudencial y a la divulgación de información. En el caso de los emisores de stablecoins de importancia sistémica, debe existir una sólida supervisión. En los casos en que las stablecoins sean emitidas por grandes entidades con amplias redes y datos de usuarios, se necesitarán requisitos basados en la entidad.18 El reciente colapso de la stablecoin Terra UST ha puesto de manifiesto la urgencia del asunto.

En segundo lugar, se necesitan políticas que respalden la seguridad e integridad de los sistemas monetarios y financieros. Los intercambios de criptomonedas que ocultan la identidad de las partes que realizan las transacciones y no cumplen con los requisitos básicos de conocimiento del cliente (KYC) y otros requisitos del Grupo de Acción Financiera Internacional (GAFI) deben ser multados o cerrados. De lo contrario, pueden utilizarse para blanquear dinero, evadir impuestos o financiar el terrorismo, así como para eludir sanciones económicas. Del mismo modo, los bancos, las empresas de tarjetas de crédito y otras instituciones financieras que proporcionan puntos de entrada y salida entre la DeFi y el sistema tradicional deben exigir la identificación de los usuarios y realizar el cumplimiento de las normas de CSC.

Third are policies to protect consumers. While investors should be allowed to invest in risky assets, including cryptocurrencies, there should be adequate disclosure. This implies sound regulation of digital asset advertising by crypto platforms, which can often be misleading and downplay risks. Practices akin to front-running may require the deployment of new legal approaches.19 In addition, decentralised platforms cannot, by design, take responsibility in case of fraud or theft connected to the platform, eg as a result of hacks. This stands in the way of providing incentives for the basic disclosure of risks and, as such, new approaches may be needed.20 This logic also extents to the oracle problem. Sound regulatory rules need to ensure that outside information is not manipulated.

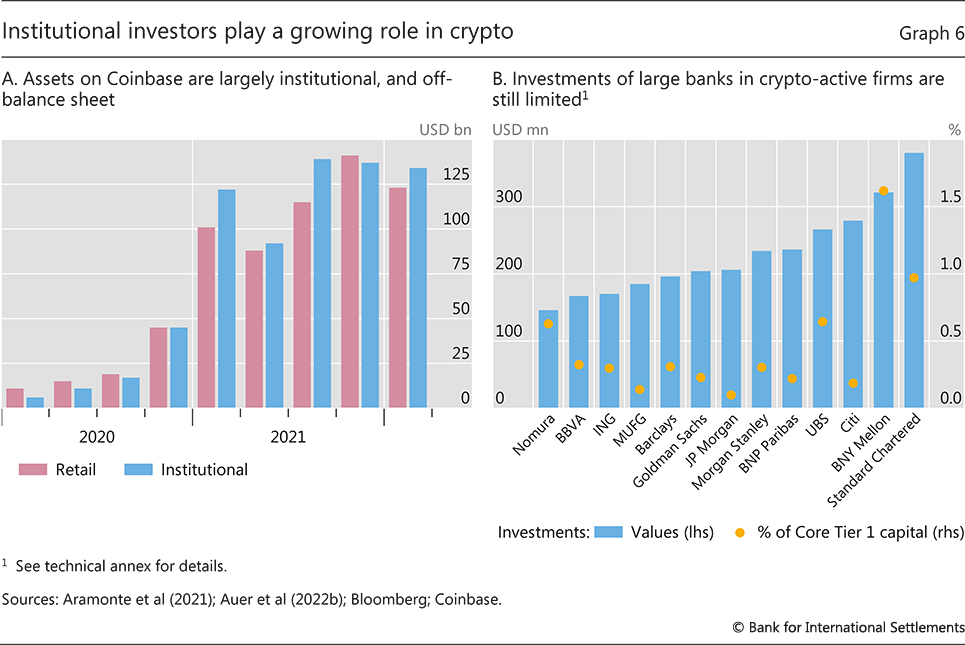

Finally, central banks and regulators need to mitigate risks to financial stability that arise from the exposure of banks and non-bank financial intermediaries to the crypto space. Fast-growing investments in cryptocurrencies by traditional financial institutions mean that shocks to the crypto system could have spillovers. Non-bank investors, family offices and hedge funds have reportedly been the most active institutional investors in cryptocurrencies (Graph 6.A). So far, the exposures of large traditional banks have been limited and direct investments in firms active in crypto markets are still small relative to bank capital (Graph 6.B).21 That said, bank funding from stablecoin issuers has increased, as bank liabilities such as certificates of deposit form a key part of stablecoins' asset backing.22 Addressing these risks implies a sound implementation of standards for bank exposures to cryptocurrencies, which should seek to ensure adequate resilience to large and sudden changes in prices or large losses through direct and indirect channels.23 This may also require prudential regulation of crypto exchanges, stablecoin issuers and other key entities in the crypto system. This does not preclude an innovative approach; for example, supervision could be embedded in these markets, so that it is conducted "on-chain".

It is essential to fill data gaps and identify entry points for regulation. The growth of the crypto market has led to the proliferation of new centralised intermediaries. Additional entities, such as reserve managers and network administrators, have developed directly as a response to the growth of stablecoins. These centralised entities and traditional financial institutions provide a natural gateway for regulatory responses. These entities could also support the collection of better and more detailed data on DeFi activities, as well as the investor base.

Across all areas of regulation, the global nature of crypto and DeFi will require international cooperation. Authorities may need to actively exchange information and take joint enforcement actions against non-compliant actors and platforms. In some cases, new bodies such as colleges of supervisors may be necessary to coordinate policy toward the same regulated entities operating in different jurisdictions.

The BIS is contributing to this international cooperation through discussions in BIS committees such as the BIS Committee on Payments and Market Infrastructures (BIS CPMI) and the Basel Committee on Banking Supervision (BCBS). The BIS is actively engaged in the G20 discussion on the regulation of cryptocurrencies, as coordinated by the Financial Stability Board (FSB). The BIS is also developing applied technological capabilities in this area to inform the international policy dialogue. The Eurosystem Centre of the BIS Innovation Hub is developing a cryptocurrency and DeFi analysis platform that combines on-chain and off-chain data to produce vetted information on market capitalisations, economic activity and international flows.

Crypto's lessons for the monetary system

Overall, the crypto sector provides a glimpse of promising technological possibilities, but it cannot fulfil all the high-level goals of a digital monetary system. It suffers from inherent shortcomings in stability, efficiency, accountability and integrity that can only be partially addressed by regulation. Fundamentally, crypto and stablecoins lead to a fragmented and fragile monetary system. Importantly, these flaws derive from the underlying economics of incentives, not from technological constraints. And, no less significantly, these flaws would persist even if regulation and oversight were to address the financial instability problems and risk of loss implicit in crypto.

The task is not only to enable useful functions such as programmability, composability and tokenisation, but to ground them on more secure foundations so as to harness the virtuous circle of network effects. Central banks can provide such foundations, and they are working actively to shape the future of the monetary system. To serve the public interest, central banks are drawing on the best elements of new technology, together with their efforts to regulate the crypto universe and address its most immediate drawbacks.

Vision for the future monetary system

The future monetary system should meld new technological capabilities with a superior representation of central bank money at its core. Rooted in trust in the currency, the advantages of new digital technologies can thus be reaped through interoperability and network effects. This allows new payment systems to scale and serve the real economy. The system can thus adapt to new demands as they arise – while ensuring the singleness of money across new and innovative activities.

Central banks are uniquely positioned to provide the core of the future monetary system, as one of their fundamental roles is to issue central bank money (M0), which serves as the unit of account in the economy. From the basic promise embodied in the unit of account, all other promises in the economy follow.

The second fundamental role of the central bank, building on the first, is to provide the means for the ultimate finality of payments by using its balance sheet. The central bank is the trusted intermediary that debits the account of the ultimate payer and credits the account of the ultimate payee. Once the accounts are debited and credited in this way, the payment is final and irrevocable.

The third role of the central bank is to support the smooth functioning of the payment system by providing sufficient liquidity for settlement. Such liquidity provision ensures that no logjams will impede the workings of the payment system when a payment is delayed because the sender is waiting for incoming funds.

The fourth role of the central bank is to safeguard the integrity of the payment system through regulation, supervision and oversight. Many central banks also have a role in supervising and regulating commercial banks and other core participants of the payment system. These intertwined functions of the central bank leave it well placed to provide the foundation for innovative private sector services.24

The future monetary system builds on these roles of the central bank to give full scope for new capabilities of central bank money and innovative services built on top of them. New private applications will be able to run not on stablecoins, but on superior technological representations of M0 – such as wholesale and retail CBDCs, and through retail FPS that settle on the central bank balance sheet. Central bank innovations can thereby support a wide range of new activities. Because central banks are mandated to serve the public interest, they can design public infrastructures to support the monetary system's high-level policy goals (Table 1, final column) from the ground up.

This vision entails a number of components that require both formal definitions and examples. The section first introduces and explains these components. It next gives a metaphor for what the future system will look like, both domestically and across borders. Finally, it dives into the specifics of reforms to central bank money at the wholesale, retail and cross-border level, before reviewing where central banks stand in achieving this vision.

Components of the future monetary system

The future monetary system builds on the tried and trusted division of roles between the central bank – which provides the foundations of the system – and private sector entities that conduct the customer-facing activities. On top of this traditional division of labour come new standards such as application programming interfaces (APIs, see glossary) that greatly enhance the interoperability of services and associated network effects. Not least are new technical capabilities encompassing programmability, composability and tokenisation, which have so far been associated with the crypto universe.

This vision contains components at both the wholesale and retail level, which enable a number of new features (in bold).

At the wholesale level, central bank digital currencies (CBDCs) can offer new capabilities and enable transactions between financial intermediaries that go beyond the traditional medium of central bank reserves. Wholesale CBDCs that are transacted using permissioned distributed ledger technology (DLT) offer programmability and atomic settlement, so that transactions are executed automatically when set conditions are met. They allow a number of different functions to be combined and executed together, thus facilitating the composability of transactions. These new capabilities not only permit the expansion of the types of transactions, but also enable transactions between a much wider range of financial intermediaries – not just commercial banks. Wholesale CBDCs also work together across borders, through multi-CBDC arrangements involving multiple central banks and currencies.

Within the new functions unlocked by wholesale CBDCs, one set of applications deserves special mention – namely, those stemming from the tokenisation of deposits (M1), and other forms of money that are represented on permissioned DLT networks.25 The role of intermediaries in settling transactions was one of the major advances in the history of money, tracing back to the role of public deposit banks in Europe in the early history of central banking.26 Bank deposits serve as the payment medium, as the intermediary debits the account of the payer and credits the account of the receiver. The tokenisation of deposits takes this principle and translates the operation to DLT by creating a digital representation of deposits on the DLT platform, and settling them in a decentralised manner. This could facilitate new forms of exchange, including fractional ownership of securities and real assets, allowing for innovative financial services that extend well beyond payments.

At the customer-facing, or "retail" level, the enhanced capabilities of the financial intermediaries benefit users in the form of improved interoperability between customer-facing platforms provided by intermediaries. Core to this interoperability are APIs, through which users of one platform can easily communicate and send instructions to other, interlinked platforms. This way, innovations at the retail level promote greater competition, lower costs and expanded financial inclusion.

Concretely, retail FPS and retail CBDCs constitute another core feature of the future monetary system. Retail FPS are systems in which the transmission of a payment message and the availability of final funds to the payee occur in (near) real time, on or as near to 24/7 as possible. Many are operated by the central bank. Retail CBDCs are a type of CBDC that is directly accessible by households and businesses. Both retail CBDCs and FPS allow for instant payments between end users, through a range of interfaces and competing private PSPs. They hence build on the two-tiered system of the central bank and private PSPs. Retail CBDCs and FPS share a number of further key features and can thus be seen as lying on a continuum. Both are supported by a data architecture with digital identification and APIs that enable secure data exchange, thus supporting greater user control over financial data. By providing an open platform, they promote efficiency and greater competition between private sector PSPs, thus facilitating lower costs in payment services. Through inclusive design features, both can support financial inclusion for users that currently do not have access to digital payments.

Details of the wholesale and retail components are expanded upon below. For each of these, an advanced representation of central bank money supports private sector services that serve the real economy. The central bank supports the singleness of the currency, and interoperability – the ability of participants to transact in different systems without having to participate in each.27 This allows network effects to take hold, whereby the use of a service by one party makes it more attractive for others.

A metaphor for the future monetary system

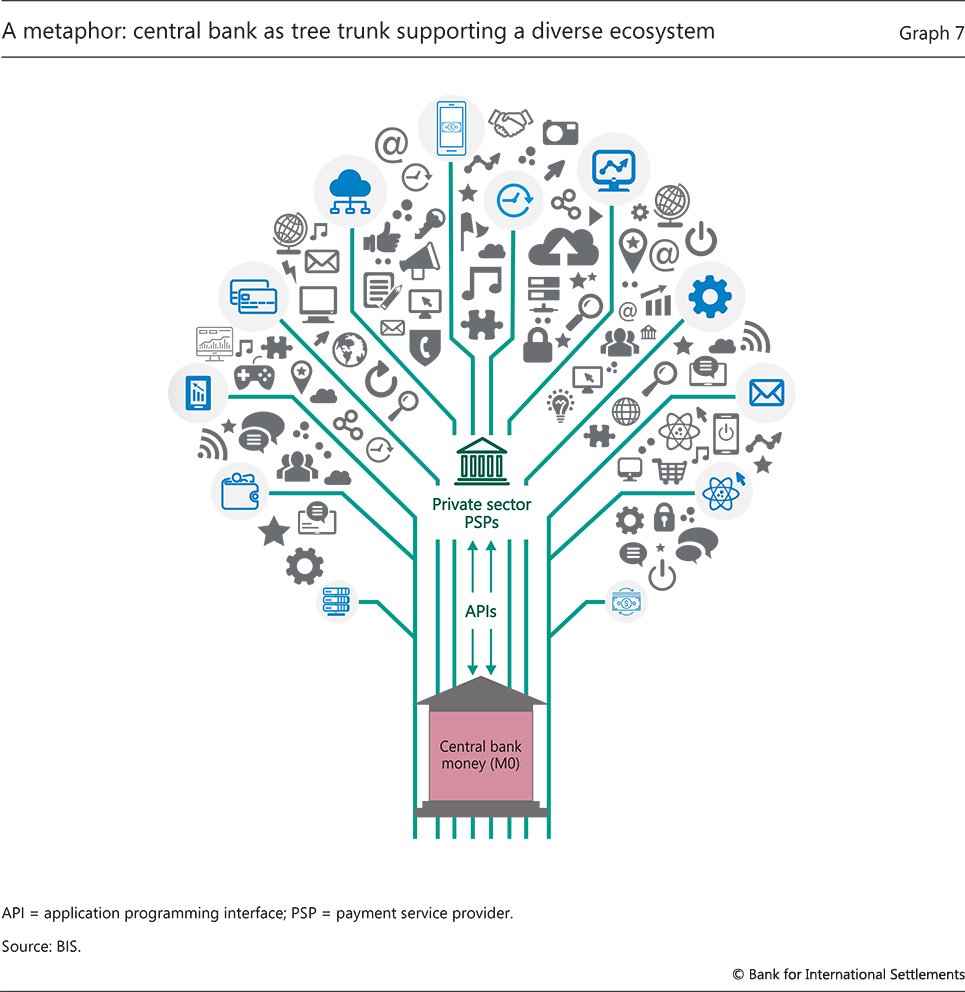

The metaphor for the future monetary system is a tree whose solid trunk is the central bank (Graph 7). As well as exemplifying the solid support provided by central bank money, the tree metaphor expresses the principle of the monetary system being rooted (figuratively speaking) in payment finality through ultimate settlement on the central bank's balance sheet.

The monetary system based on central bank money supports a diverse and multi-layered vibrant ecosystem of participants and functions in which competing private sector PSPs can give full play to their creativity and ingenuity to serve users better. Underlying these benefits is the virtuous circle set off by network effects arising from the data architecture, consisting of digital identity and APIs, that enables interoperability both domestically and across borders.

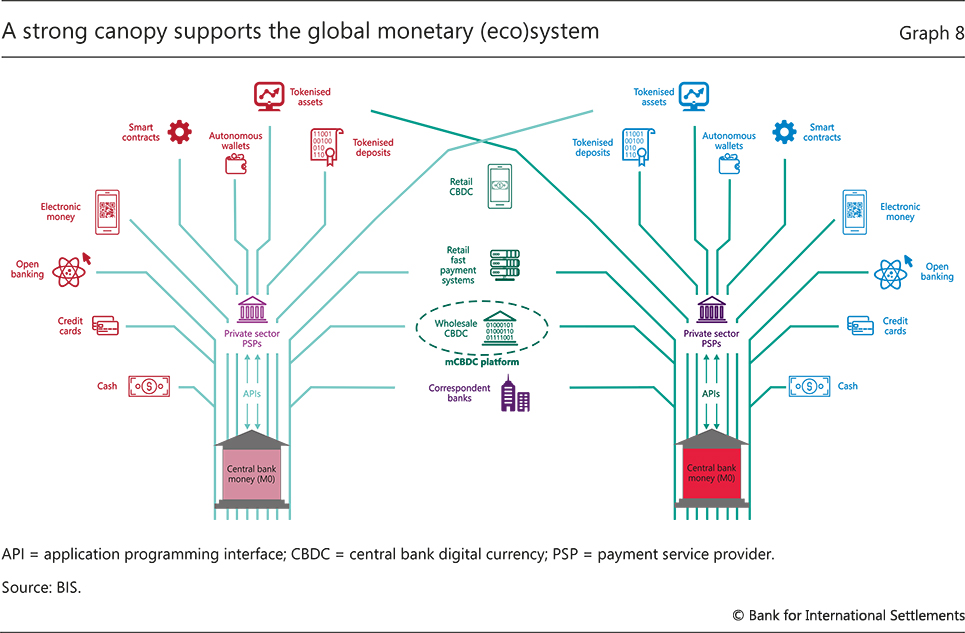

Zooming out, the global monetary system can then be compared with a forest, whose canopy facilitates cross-border and cross-currency activity (Graph 8). In the canopy, infrastructures such as multi-CBDC platforms serve as important new elements of the system, as discussed in detail below. The functionality of new platforms in the canopy is ultimately rooted in the domestic settlement layers underneath.

Innovation is not only about the latest fashion or buzzword. Just as a tree cannot sustain a vibrant ecosystem without a solid trunk, getting the basics right is a prerequisite for private innovation that serves the public interest. Ongoing work at central banks is showcasing how public infrastructures can improve the payment system, taking advantage of many of the supposed benefits of crypto without the drawbacks. Wholesale and retail CBDCs, FPS and further reforms in open banking show how central banks can support interoperability and data governance. In fulfilling their public interest mandates, central banks are not working alone but collaborating closely with other public authorities and innovators in the private sector. The following subsections fill in the details of how the system functions, together with concrete examples of the functionalities.

Wholesale CBDCs and tokenised money

A CBDC is a digital payment instrument, denominated in the national unit of account, which is a direct liability of the central bank.28 Much attention has recently focused on retail CBDCs that are accessible by households and businesses (discussed below). Yet wholesale CBDCs also offer new functions for payment and settlement, and to a much wider range of intermediaries than domestic commercial banks. They could unlock significant private sector innovation across a range of financial services.

Wholesale CBDCs can allow intermediaries to access new capabilities that are not provided by the reserves held by commercial banks with the central bank. These are particularly relevant in permissioned DLT networks, where a decentralised network of trusted participants accesses a shared ledger. As discussed below, decentralised governance is a useful feature of multi-CBDC systems involving multiple central banks and currencies. Yet the functions could in principle be offered in more centralised payment systems. Key are self-executing smart contracts that let participants make their transactions programmable. Transactions thus settle only when certain pre-specified conditions are met. In security trading, such automation can allow payment vs payment (PvP) and delivery vs payment (DvP) mechanisms, meaning that payments and delivery of a security are made only all together or not at all. Such atomic settlement can significantly speed up settlement and mitigate counterparty risk.29

One benefit of wholesale CBDCs is that they could be available to a much wider range of intermediaries than just domestic commercial banks. Allowing non-bank PSPs to transact in CBDC could make for much greater competition and vibrancy. New protocols built on wholesale CBDCs could be open source, making the source code freely available for a community of developers to develop and scrutinise. This feature would allow for libraries of protocols that can be used to combine functions, thus facilitating the composability of different functions and enabling new services to be built on top of the programmability function of CBDCs.

By construction, wholesale CBDCs would allow for finality in payments. The mechanics of how finality is attained in permissioned DLT platforms are described in more detail in Box C, but their essence can be explained through the simple analogy with a physical banknote. The recipient of a physical banknote wants to be assured that the note is genuine, not counterfeit. Ensuring that payment is in genuine money in a digital system is accomplished by proving the origin or "provenance" of the money transferred. Crypto proves its provenance by publicly posting the full history of all transactions by everyone. When real names are used, such public posting would violate privacy and would be unsuitable as a payment system. This is where cryptographic techniques such as zero-knowledge proofs (ZKPs) provide a solution. As the name signifies, "proof" denotes that a statement is true, and "zero-knowledge" means that no additional information is exposed beyond the validity of the assertion. Cryptographic techniques allow the payer to prove that the money was obtained from valid past transactions without having to post the full history of all transactions. Depending on the detailed implementation, a "notary" may be needed to prevent the same digital token being spent twice; in many cases, the central bank can play this role. The common theme is that decentralisation can be achieved without the structural flaws of crypto.

As issuers of the settlement currency, central banks can support the tokenisation of regulated financial instruments such as retail deposits.30 Tokenised deposits are a digital representation of commercial bank deposits on a DLT platform. They would represent a claim on the depositor's commercial bank, just as a regular deposit does, and be convertible into central bank money (either cash or retail CBDC) at par value. Depositors would be able to convert their deposits into and out of tokens, and to exchange them for goods, services or other assets. Tokenised deposits would also be protected by deposit insurance but, unlike traditional deposits, they would also be programmable and "always on" (24/7), thus lending themselves to broader uses in retail payments – eg in autonomous ecosystems. This way, they could facilitate tokenisation of other financial assets, such as stocks or bonds. This functionality could allow for fractional ownership of assets and for the ability to exchange these on a 24/7 basis. Crucially, this could be done in a regulated system, with settlements in wholesale CBDC.

Box C

Making use of DLT with central bank money

In a permissionless blockchain used for crypto applications, all

transactions are public. Privacy is maintained by hiding the user's real

identity behind a private key. In this sense, there is pseudo-anonymity. By contrast, a monetary system based on users' real names raises the

question of how to safeguard their privacy. Privacy has the attributes

of a fundamental human right. Nobody else needs to know from which

supermarket an individual buys their groceries. Therefore, a basic task

of a decentralised monetary system based on real names is to find a way

to ensure both that the ledger is secure without the need for a central

authority, while at the same time preserving the privacy of the

individual transactions.

By contrast, a monetary system based on users' real names raises the

question of how to safeguard their privacy. Privacy has the attributes

of a fundamental human right. Nobody else needs to know from which

supermarket an individual buys their groceries. Therefore, a basic task

of a decentralised monetary system based on real names is to find a way

to ensure both that the ledger is secure without the need for a central

authority, while at the same time preserving the privacy of the

individual transactions.

One possible route is through permissioned DLT systems. In these systems, only select users that meet eligibility requirements can obtain access. Interactions between system participants are thus invisible to people outside the system. One example is the permissioned DLT system Corda, which is used by private financial institutions (eg for trade finance platforms) and in a number of central bank wholesale CBDC projects, including Projects Helvetia, Jura and Dunbar at the BIS Innovation Hub.

In Corda, updates to the ledger are performed through a validation function and a uniqueness function. Validation, which involves checking that the details of the transaction are correct and that the sender has the available funds, is done by the system participants. In fact, only the participants that are involved in a transaction are responsible for validating it. Checking that the sender has a valid claim to funds does not, however, ensure that they will not attempt to spend those same funds twice. Transaction uniqueness (ie the prevention of double-spending) is ensured by a centralised authority called a "notary". Notaries have access to the entire ledger and hence can ensure that funds being used in a particular transaction are not being used elsewhere. In the case of wholesale CBDCs, a natural candidate for the notary is the central bank, as this institution already plays a similar role in maintaining the integrity of the overall transaction record in centralised systems.

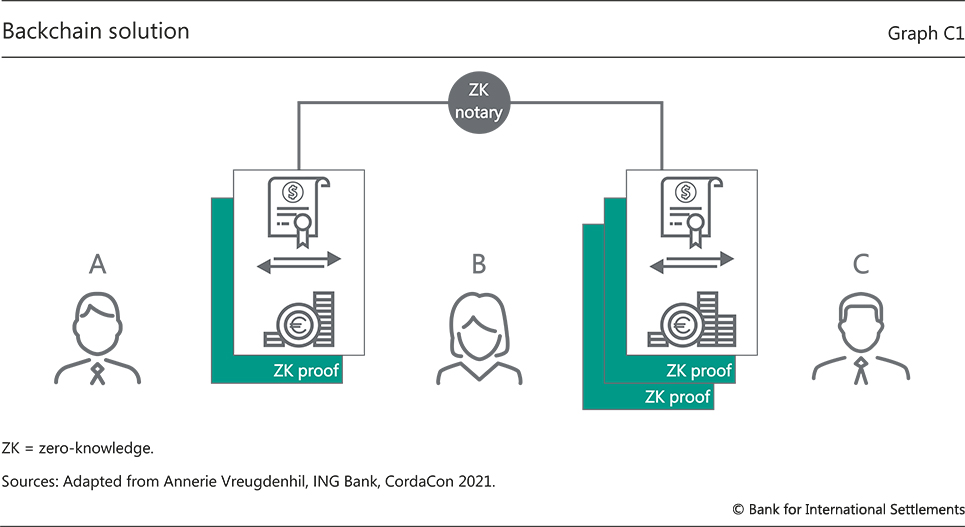

In such permissioned systems, a tension can arise between payment integrity and transactional privacy. Transactional privacy in a peer-to-peer exchange means that only the two participants involved in a transaction can see that it occurs – very much like when one person hands over a one-dollar bill to a friend. In the case of a digital banknote, the validation process performed by the participants requires that the recipient can trace the banknote back to its origin, which in turn entails seeing every one of the banknote's previous holders. In the context of Corda, this is called the "backchain problem". While the system does not allow everyone to see everything, it does allow participants to have a view beyond their own transactions. Solving the backchain problem is an important design problem in central bank CBDC projects. The challenge is to arrange matters so that they can truly emulate paper banknotes and preserve people's transactional privacy.

Recently, system architects have been exploring the use of zero-knowledge proofs (ZKPs) to generate a cryptographic record that a transaction has occurred, without revealing either the identity of a participant or the content of the transaction. ZKPs let one party prove to another that a statement is true without revealing any information beyond that fact. In a payment system, the goal is to prove that the sender of funds obtained those funds through a legitimate chain of transactions, going all the way back to and including the origination of the funds, without sharing any details of these transactions. The goal is achieved by replacing each individual transaction with a ZKP and transferring these proofs, in place of the individual transaction details, during each successive transaction. This technique allows recipients of a digital banknote to know that it can be traced back to its origin, without knowing the details of this banknote's history. Instead of seeing the history of all previous transactions, the verifier, and, if desired, the notary, can observe only a series of ZKPs (see Graph C1).

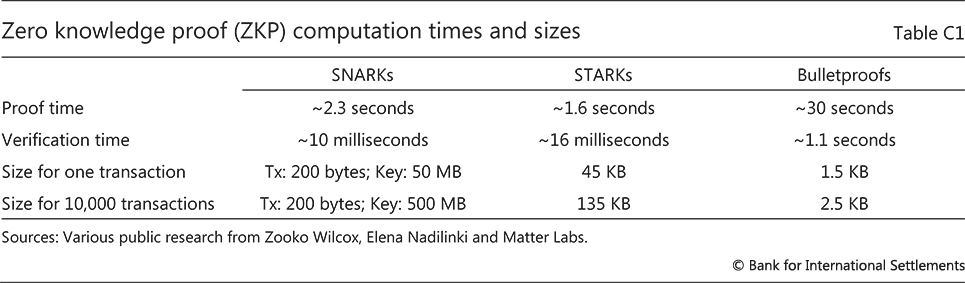

The ZKP technique is generally understood to be an effective means of generating transactional privacy, but using cryptographic proofs erodes system performance by reducing its speed. Currently, the most popular ZKP systems are the so-called succinct non-interactive arguments of knowledge (SNARKs), succinct transparent arguments of knowledge (STARKs) and Bulletproofs. Each solution has different costs in terms of verification and overall proof time and overall proof size; these are shown in Table C1. Long verification and proof times may reduce transaction throughput to levels that are insufficient to settle typical payment system volumes without adding an unacceptable amount of delay. Researchers are looking for ways to reduce these times.

Además de la ZKP, la privacidad de las transacciones puede lograrse por otros medios, como el cifrado homomórfico, el cálculo seguro multipartito, la privacidad diferencial, las firmas ciegas, las firmas en anillo, los compromisos de Pedersen, la abstracción de cuentas y las direcciones ocultas. Cada una de estas metodologías emplea diferentes combinaciones de configuración de confianza y/o sobrecarga computacional adicional. Actualmente, el Centro de Innovación del BIS está experimentando con las direcciones ocultas, que son direcciones de uso único generadas por un protocolo, con el objetivo de ocultar las identidades de los participantes en una transacción.

Transactions are not fully anonymous to the extent that, once personal

information is linked to a wallet address, all transactions using that

address can be traced on the blockchain.

Transactions are not fully anonymous to the extent that, once personal

information is linked to a wallet address, all transactions using that

address can be traced on the blockchain.

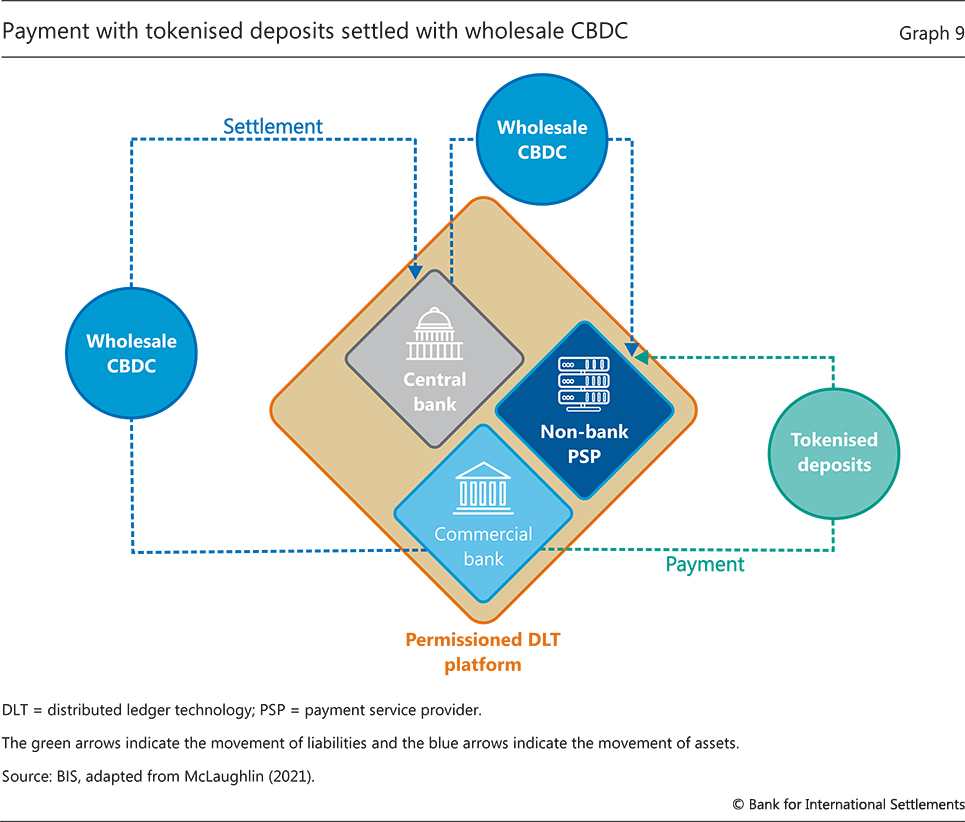

Un posible sistema con depósitos tokenizados podría contar con una plataforma DLT autorizada. Esta plataforma registra todas las transacciones en tokens emitidos por las instituciones participantes, por ejemplo, los bancos comerciales (que representan los depósitos), los PSP no bancarios (que representan el dinero electrónico) y el banco central (que representa el dinero del banco central). Los inversores minoristas (depositantes) mantendrían los tokens en carteras digitales y harían los pagos transfiriendo tokens entre carteras. La liquidación de las transacciones entre instituciones financieras en la plataforma DLT se basaría en el uso de CBDC mayoristas como moneda de liquidación. Para hacerse una idea de cómo funcionaría esto, consideremos un depositante que posee tokens de un banco y desea hacer un pago al titular de tokens PSP no bancarios, que representan dinero electrónico, por ejemplo para pagar una casa (Gráfico 9). Ambas partes pueden acordar que el pago (flecha verde) se produzca al mismo tiempo que se transfiere la escritura de la casa. En segundo plano, para liquidar la transacción, el banco transferiría el CBDC mayorista en la plataforma DLT al PSP no bancario (flechas azules). El PSP no bancario transferiría una cantidad correspondiente de nuevos tokens a la cartera de su cliente. Todos estos pasos podrían ocurrir simultáneamente, como parte de una única transacción atómica, ejecutada a través de contratos inteligentes. En este sistema, los CBDC mayoristas ayudan a liquidar las transacciones y a garantizar la convertibilidad y uniformidad de las distintas representaciones del dinero. El mismo sistema podría permitir también representaciones digitales de acciones y bonos. Esto permitiría a los usuarios finales acceder fácilmente a (fracciones de) estos activos en pequeñas denominaciones, 24 horas al día y 7 días a la semana, de proveedores regulados - y liquidar las transacciones instantáneamente.

Programmable CBDCs could also support machine-to-machine payments in autonomous ecosystems.31 Autonomous machines and devices increasingly communicate and execute processes without human intervention through the Internet of Things, a network of connected devices. Looking ahead, machines may directly purchase goods and services from each other, and manage their own budget. Their interconnection will increase the need for smart contracts and programmable money. For example, they may be equipped with wallets, charged with a certain budget of digital money. Smart contracts may automatically trigger payments as soon as certain conditions are met, eg the arrival of the goods. This could lead to significant efficiency gains, for example in the goods logistics sector, where transactions often take several days and are still predominantly paper-based. The full potential of these technological developments can be realised only if machine-to-machine transactions are settled instantly, so that any settlement risk is removed. Existing private sector cryptocurrency projects for the Internet of Things are still exploratory and suffer from limits to scalability.32 They also raise concerns about the stability and convertibility of cryptocurrencies used for payments and would require on- and off-ramp bridges to connect with traditional payment rails. In this respect, the industry could benefit from CBDCs, which could underpin a decentralised system, eg by enabling regulated financial institutions to issue programmable money.33

In short, programmability, composability and tokenisation are not the preserve of crypto. The benefits of atomic settlement and open-source protocols are fully compatible with central banks being at the core of the validation process. Yet by relying on central bank money, wholesale CBDCs would benefit from the stability and singleness of the currency that central banks provide. They would also draw on the accountability of the central bank and of regulated intermediaries to society. By supporting innovative private sector services, they would facilitate adaptability so that the system can meet new needs as they arise.

Retail CBDCs and fast payment systems

Retail CBDCs and retail FPS share many similarities. Retail CBDCs make central bank money available in digital form to households and businesses. Bank and non-bank PSPs provide retail-facing payment services. The key difference from retail FPS is that, for CBDCs, the instrument is a legal claim on the central bank. Retail CBDCs are thus sometimes seen as "digital cash" – another form of central bank money available to the public.34 In retail FPS, many of which are operated by the central bank, the instrument being exchanged is a claim on private intermediaries (eg bank deposits or e-money). Nonetheless, both retail CBDCs and retail FPS build on public data architecture with APIs that ensure secure data exchange and interoperability between different bank and non-bank PSPs. Both feature high speeds and availability, as transfers occur in real time or near real time on a (near) 24/7 basis.

These retail payment infrastructures have already shown their mettle in enhancing efficiency and inclusion in the monetary system. Unlike crypto, which requires high rents and suffers from congestion and limited scalability, CBDCs and retail FPS allow for network effects to lead to a virtuous circle of greater use, lower costs and better services. Because of their explicit mandates, central banks can design systems to meet these goals from the ground up. An open payment system resting on the interoperability of services offered by competing private PSPs can challenge rents in concentrated banking sectors and reduce the payments costs for end users.

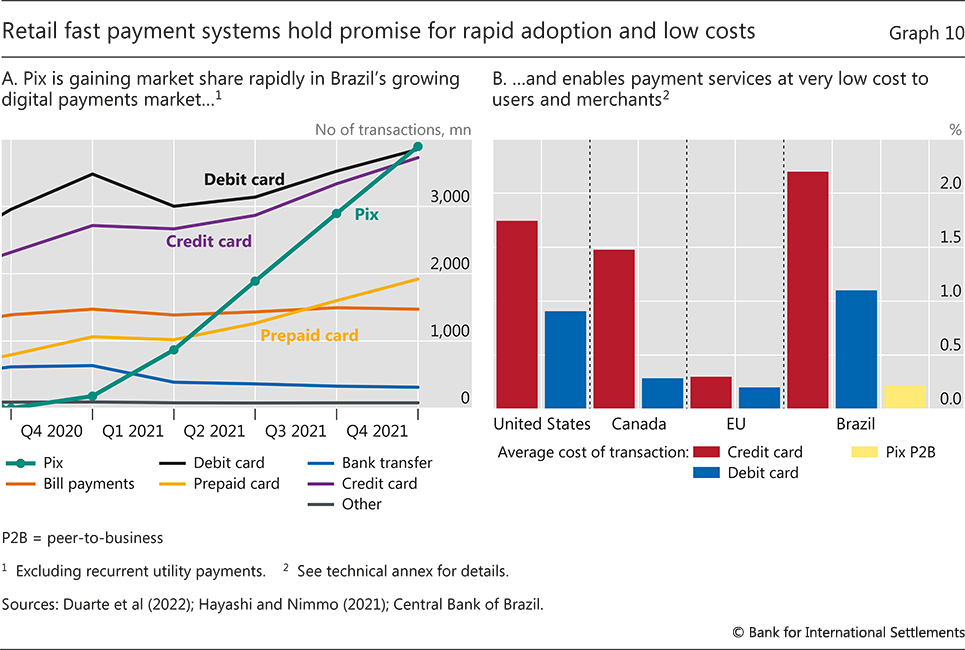

Retail FPS have already made impressive progress in lowering costs and supporting financial inclusion for the unbanked. For example, in just over a year after its launch, the Brazilian retail FPS Pix is used by two thirds of the adult population – with 50 million users making a digital payment for the first time. Powered by innovative products and services offered by over 770 private PSPs, Pix payments have now surpassed credit and debit card transactions (Graph 10.A). The costs to merchants of accepting person-to-business (P2B) payments average one tenth of the cost of credit card payments (Graph 10.B). Equally impressive progress in inclusive, low-cost payments has been made in other economies.35

Retail CBDCs could play a similarly beneficial role as retail FPS, while offering additional technological capabilities. For example, Project Hamilton – a joint project by the Federal Reserve Bank of Boston and the Massachusetts Institute of Technology Digital Currency Initiative – has shown the technical feasibility of a CBDC architecture that can process 1.7 million transactions per second – far more than major card networks or blockchains.36 The project uses functions inspired by cryptocurrencies, but it does not use DLT. In its next stage, Project Hamilton aims to create a foundation for more complex functionalities, such as cryptographic designs for privacy and auditability, programmability and self-custody. The code for the project is open-source and can be scrutinised by any developer, to maximise knowledge-sharing and expand the pool of experts contributing to the code base, including central banks, academia and the private sector.

Like retail FPS, retail CBDCs can be designed to support financial inclusion.37 Many central banks are exploring retail CBDC design features that tackle specific barriers to financial inclusion, for instance through novel interfaces and offline payments (see Box D). For instance, Bank of Canada staff have researched the potential for dedicated universal access devices that individuals could use to securely store and transfer a CBDC. The Bank of Ghana has explored the use of existing mobile money agent networks and wearable devices.38 Through tiered CBDC wallets with simplified due diligence for users transacting in smaller values, central banks can reduce the cost of payment services to the unbanked, thus fostering greater access to digital payments and financial services. By allowing new (non-bank) entities to offer CBDC wallets, they can also overcome the lack of trust in financial institutions that holds back many individuals in today's system.39

Both retail CBDCs and FPS can be designed to protect privacy and grant greater user control over data. In the digital economy, every transaction leaves a trace, raising concerns about privacy, data abuse and personal safety. In addition, the resulting data are of immense economic value – which currently accrues mostly to financial institutions and big techs that collect, store and monetise users' personal data.

The power over data of individual PSPs stems from the fact that, in conventional payment systems, there is no single, complete record of all transactions. Instead, every PSP keeps a record of its own transactions only. While payments across PSPs are made through a centralised system and require instructions to be sent to a central operator, these instructions may involve batched payments or incomplete information about the purpose of the payment. Hence, even the central operator has no complete picture of all payments. Privacy in payments is thus maintained through a fragile combination of isolated record-keeping and the promise of confidentiality by the central operator – but it is not guaranteed. In some cases, data privacy laws give consumers the opportunity to grant or deny third parties consent to use their data. But this option is often difficult to exercise effectively. Such a setup implies that consumers may not always know whether their data are being collected and for what purpose.

Box D

Designing retail CBDCs to support financial inclusion

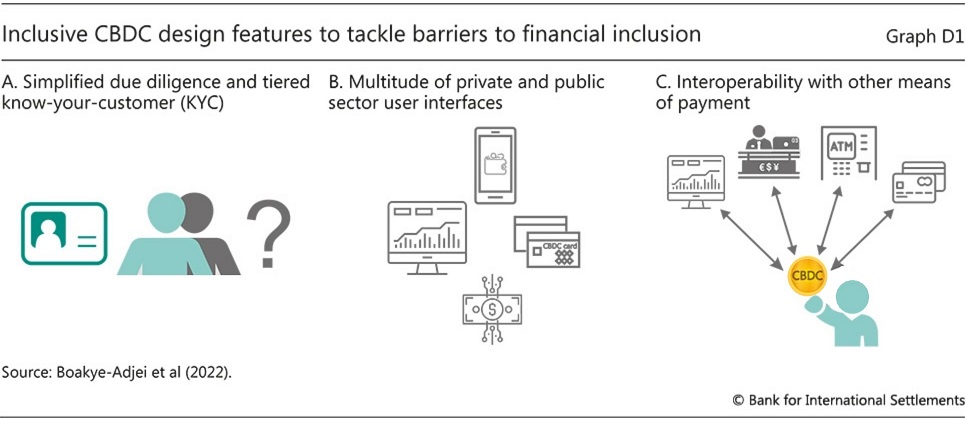

Many central banks around the world see financial inclusion as a key motivation for their work on retail CBDCs. This is particularly true in emerging market and developing economies (EMDEs), where access to digital payment and other financial services is constrained by several key barriers. These include (i) geographic factors, eg vast territories or islands; (ii) institutional and regulatory factors, such as a lack of identity credentials and informality; (iii) economic and market structure issues, including limited competition and high costs in the financial sector; (iv) characteristics of vulnerability, eg barriers by age, gender, income or disability status; (v) a lack of educational opportunities and financial literacy; and (vi) distrust of existing financial institutions. In many EMDEs, a majority of adults lack access to digital payment options.

A new study draws on the experience of nine central banks around the world in tackling financial inclusion challenges. It finds that some central banks consider CBDCs as key to their mandate

as a catalyst for innovation and economic development. Others see CBDCs

as a potential complement to existing policies to support financial

inclusion. The study argues that, if CBDCs are to be issued, they could

be designed with several key design features that directly address

barriers to financial inclusion. For instance, they might facilitate

low-cost customer enrolment processes, for instance with simplified due

diligence, electronic KYC arrangements and tiered wallets, as

demonstrated in several live retail CBDC systems (Graph D1.A).

Features such as the use of third-party agents help to reach isolated

communities and to work around a lack of trust in financial

institutions. Central banks can offer a robust, low-cost public

infrastructure with a multitude of user interfaces (Graph D1.B).

This includes offline functionality, and interfaces that specifically

tailor to underserved users. And finally, CBDCs foster interoperability

both domestically and across borders, thus contributing to greater

competition and lower costs for end users (Graph D1.C).

It finds that some central banks consider CBDCs as key to their mandate

as a catalyst for innovation and economic development. Others see CBDCs

as a potential complement to existing policies to support financial

inclusion. The study argues that, if CBDCs are to be issued, they could

be designed with several key design features that directly address

barriers to financial inclusion. For instance, they might facilitate

low-cost customer enrolment processes, for instance with simplified due

diligence, electronic KYC arrangements and tiered wallets, as

demonstrated in several live retail CBDC systems (Graph D1.A).

Features such as the use of third-party agents help to reach isolated

communities and to work around a lack of trust in financial

institutions. Central banks can offer a robust, low-cost public

infrastructure with a multitude of user interfaces (Graph D1.B).

This includes offline functionality, and interfaces that specifically

tailor to underserved users. And finally, CBDCs foster interoperability

both domestically and across borders, thus contributing to greater

competition and lower costs for end users (Graph D1.C).

Proponents of crypto argue that permissionless blockchains return the control over personal data to users, but a system based on pseudo-anonymity and a public ledger introduces severe risks to privacy and integrity. It is also incompatible with a system based on real names, which is required to ensure integrity and accountability.

The data architecture underlying both retail FPSs and CBDCs can give much greater user control over personal data, while preserving privacy and consumer welfare. Indeed, central banks have no commercial interest in personal data, and can thus credibly design systems in the public interest. Data governance systems can ensure user consent, use limitation and retention restrictions.40 Similar to open banking, these data architectures can also allow users to port data in ways that bring economic benefits to users, for instance when they apply for a loan, want to use financial planning services or in a range of other contexts. Importantly, such a system is based on identification – and this identity information may often be held only by the PSP and not by the central bank. The use of identification also allows financial intermediaries to screen borrowers to assess their creditworthiness, thereby ensuring that scarce capital is allocated to its best use.

In the process, central banks can make use of modern cryptography, which offers solutions to preserve the privacy of users and ensure the security of transactions. This can be achieved for instance through ZKPs, which verify the authenticity of the transaction without revealing its content (Box C). Nonetheless, the system would be based on users' true, verified identities, ie they would transact under their real names. Several central banks also see "electronic cash" in the form of retail CBDC as one potential solution for preserving people's transactional privacy.41

Identity-based designs are compatible with integrity in the financial system. With clear mandates and public accountability, systems can be designed to grant law enforcement authorities access to information with the requisite legal safeguards. These approaches are already commonplace in the form of bank secrecy laws and are being considered for retail CBDCs.42 Importantly, transactions would not be recorded on a public blockchain visible to all. In the corporate space, new corporate digital identity solutions could improve oversight of beneficial ownership, thus reducing fraud, tax avoidance and sanctions evasion.43 Together with new regtech tools and capabilities inspired by blockchain analytics, there is potential for better tracking illicit activity while making compliance with regulatory frameworks less resource-intensive.

Finally, retail CBDCs and FPS offer opportunities to improve on accountability relative to today's system, and certainly relative to the crypto universe. Indeed, the design of new public infrastructures is not a task for the central bank alone. New systems require public dialogue on the role of the central bank in retail payments. Their operation will require legal mandates to be updated, as well as proper checks and balances and appropriate forms of central bank accountability to society. It is for this reason that many central banks have issued consultations on these initiatives and are promoting dialogue on legal tender and central bank laws.44 A system built on public infrastructure would also ensure that private service providers are embedded in a sound regulatory and supervisory framework. Unlike in a parallel crypto financial system, parties can be held to account for their actions. In this new ecosystem, there will likely be new private sector business models that do not yet fit with current regulatory frameworks, but experience to date suggests that frameworks can adapt to allow for new types of innovative activity.45

Achieving cross-border integration