Ban the Phillips Curve

The stakes are too high to use the Phillips Curve with its unreliable tradeoff between unemployment and inflation. We don't need millions of Americans out of work. We need investments in our future.

Prohibir la curva de Phillips

Hay demasiado en juego para utilizar la curva de Phillips con su poco fiable equilibrio entre desempleo e inflación. No necesitamos millones de estadounidenses sin trabajo. Necesitamos inversiones en nuestro futuro.

Yesterday we learned that U.S. inflation, albeit too high, stepped down again in November, even as unemployment remains low and consumer spending, adjusted for inflation, is rising solidly. The pandemic and war in Ukraine have been incredibly difficult for everyone and tragic for many. We are not at the finish line but on the right path. Keep going. We must do more!

We must learn our lessons. Start by banning the Phillips Curve.

Before we dive into its problems. What is the Phillips Curve?

The model created in 1958 says that to get inflation down, unemployment must rise.

Low unemployment, as we have now, is a sign of a strong labor market, which fuels strong demand. Strong demand leads to high inflation. The Fed raising interest rates is the primary policy tool its believers call for to fight inflation.The Phillips Curve is wrong.

The pandemic caused hardship among families, the unemployed, communities, and businesses. Thankfully, it was met with massive economic relief—trillions of dollars from Congress and rock-bottom interest rates from the Fed.

Not everyone agreed with that relief, especially the $2 trillion American Rescue Plan in March 2021. Though not alone in his concern, Larry Summers is the loudest of its critics. Soon after it passed, he made a dire prediction:

Close to two years later, in December 2022, here’s the reality:

Real consumer spending rose 2% during the past year, the pre-Covid average—no stagflation (low growth and high inflation).

Inflation did surge, with a peak of 10.7% in March 2022, but it has moved down to 3.7% in November 2022. (Both figures are three-month moving averages.)

The unemployment rate is 3.7%, near the 50-year low. No recession.

Larry was wrong.

That said, by early 2022, it was clear that Larry was correct about a surge in inflation (largely for the wrong reasons).

On his 'victory' tour, he kept going with claims that we "need" a severe recession and massive rate hikes to get inflation down:Wrong again.

Unemployment remains low, and inflation has come down notably. We are not yet at the Fed’s 2% target, but the progress is undeniable and without a recession.

Why do inflation hawks like Larry keep getting it wrong? The Phillips Curve.

La Curva de Phillips es mala.La Curva de Phillips, desarrollada en 1958, sostiene que existe un equilibrio entre desempleo e inflación. En los 64 años transcurridos desde entonces, los macroeconomistas han aprendido mucho sobre cuándo se cumple (rara vez) y cuándo no (a menudo).

Here are highly-regarded macroeconomists Larry Ball and Greg Mankiw in 2002:

The instability of this relationship [the Phillips Curve] is hardly a surprise. Even Samuelson [Larry Summers’ uncle] and Solow’s (1960) classic discussion of the Phillips curve suggested that the short-run menu of inflation-unemployment combinations would likely shift over time. Skeptics are sometimes temptedto use the shifting Phillips curve as evidence to deny the existence of a short-run tradeoff. This is pure sophistry. It would be like observing that the United States has more consumption and investment than does India to deny that society faces a tradeoff between consumption and investment. The situation is not hard to understand and, in fact, arises frequently in economics. At any point in time, society faces a tradeoff, but the tradeoff changes over time. The next question is what factors cause the tradeoff to shift.

Changes in supply, in many possible forms, are a leading reason:

Few economists would deny that shifts in aggregate demand, such as those driven by monetary policy, push inflation and unemployment in opposite directions, at least in the short run … The practical application of this concept, however, is less straightforward … The economy experiences many kinds of shocks that influence inflation and unemployment. In light of this fact, it would be remarkable if the level of unemployment consistent with stable inflation were easy to measure.

Demography and government [fiscal] policy both play some role. In addition, changes in productivity growth appear to shift the inflation-unemployment tradeoff. In the past, most macroeconomists studying the Phillips curve have concentrated their attention on the dynamic relationship between inflation and unemployment. In the future, they should expand their scope to build and test models of inflation, unemployment and productivity.

Amen. Covid and Putin have caused massive, slow-to-heal supply disruptions, including reductions in our labor force and access to goods. The Phillips Curve is bad.

La curva de Phillips es peligrosa.Y eso no es lo peor. Aferrarse a la Curva de Phillips amenaza la economía estadounidense. No necesitamos una recesión; no necesitamos tipos de interés por las nubes. Necesitamos más trabajadores e inversión. Esto no es un debate académico; nuestro futuro está en juego.

¿Quieres bajar la inflación? ¿Quiere resolver la escasez de mano de obra? Empiecen a pensar en la oferta.

Den a todos los estadounidenses asistencia sanitaria y baja por enfermedad remunerada. Incluso antes de la pandemia, nuestro país estaba fallando a la gente. Además de ser clave para el florecimiento humano, la buena salud conduce a trabajadores más productivos. Covid ha causado un daño inmenso a la salud física y mental. Véase también Barry Ritholtz sobre este y otros factores que mantienen a los trabajadores sin trabajo en la actualidad. El hundimiento de la economía empeorará la situación.

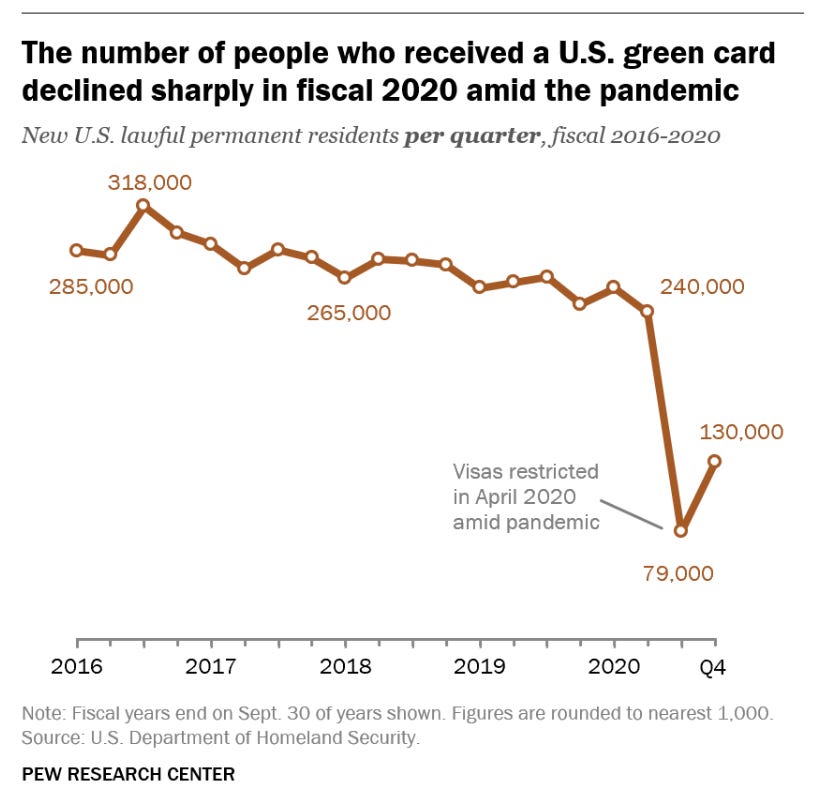

Fix our deeply broken immigration system. The number of immigrants has steadily fallen for years, and it plunged in 2020 when the pandemic began. The backlog of green card applications is in the millions, including hundreds of thousands of workers. Only Congress, not the Fed, can act.

Invest in our future. The Fed jacking up interest rates to destroy demand is undermining policies from Congress and the White House to make our country more resilient and productive. As Stephanie Kelton explains, the Infrastructure Act, Inflation Reduction Act, and the CHIPS Act largely use tax incentives to encourage investment. Taxes are not the only, or even the primary reason, that companies invest. Expected profits are extremely important. High interest rates cut into profits and make debt financing riskier. Sending the economy into a severe recession is bad for business. Duh. Business fixed investment is already falling. That will hurt us for decades. The Phillips Curve is costing us dearly.

And that’s only the tip of the iceberg. Invest in our children by restarting the Child Tax Credit, which had no work requirements. Invest in education with free pre-K. Invest in our working parents with affordable child care. Invest in basic needs with more housing. High interest rates make it more costly to make all these investments.

In closing.

Ban the Phillps Curve.

In addition to writing on Substack, I am an independent consultant and give investor talks or other speaking events. Email me at claudia.sahm@gmail.com.

Here is a good summary. Fancier versions of the Phillips Curve exist, such as the one embedded in the workhorse New Keynesian models. They introduce (unmeasurable) concepts of inflation expectation (pi-star), potential output (y-star), the natural rate of unemployment (u-star), and the natural rate of interest (r-star). The logic remains the same.

Most macroeconomists—not Larry Summers and other inflation hawks—expected a temporary burst of inflation from the pent-up demand and the one-time fiscal stimulus as the economy reopened with the vaccine rollout. What we all, including the hawks, got wrong is that the vaccines, masking, and social distancing would be politicized and Covid denial rampant. We were also wrong about how hard it would be to contain the pandemic. Inflation had started to cool in the summer of 2021, but then delta and Omicron came, causing more deaths, millions out sick from work, and even more disruptions to global supply chains. It’s also taken far longer than expected for workers to return to work and consumers to shift back toward service spending. And finally, we were wrong tragically that Putin would invade Ukraine, leading to humanitarian crises and soaring energy and food prices worldwide. The problems go well beyond the American Rescue Plan, though it did contribute to the inflation (and the first job-full recovery in several decades).

https://twitter.com/Claudia_Sahm

https://brujulaeconomica.blogspot.com/2020/12/lss-teorias-economicas-que-parte-de-las.html

https://github.com/dubilava/theguessproject/blob/main/98-phillips/phillips.r

https://twitter.com/DavidUbilava/status/1651779823235379204

No hay comentarios:

Publicar un comentario