The roots of the present Greek crisis lie in the political transformation of the country during the 1980s. (Disclaimer: Although this post is about Greek fiscal behaviour, I amnot taking Germany’s side. Lenders to the profligate are just as culpable as the borrowers.)

http://pseudoerasmus.com/2015/02/23/greece-orthodoxy-peronism/

In a paper which passes for a reasonable parody of the Washington Consensus fad of the 1990s, DeLong & Eichengreen argued that the main effect of the Marshall Plan was enticing postwar Europe away from economic dirigisme and toward market mechanisms. Given their wariness of markets in the wake of depression and world war, Europeans lacking such inducements might have stressed the controls aspect of the mixed economy more than the market part of it. IMF-like “conditionalities” saved them from the self-destructive impulses to which the unconstrained Argentina surrendered in its postwar stagnation and decline. Thus, in this argument, the Marshall Plan was “history’s most successful structural adjustment programme”.

I don’t really buy that argument (that’s for another day), but it might be the best way to think about the Greek economy in the long run. Not simply the Marshall Plan, but external institutional incentives in general have played a major role in the evolution of the Greek economy since 1949. In short, external factors have interacted positively or negatively with Greek cultural traits and population characteristics. When Greece was constrained, the Greek economy performed well. When constraints were relaxed or gave way to outright perverse incentives, the Greeks let their worst impulses rip and behaved like a Third World country.

(1)

The proximate causes of the present Greek crisis are straightforward. Although the Greek government had engaged in ‘fiscal consolidation’ during the 1990s in order to qualify for the Eurozone, upon accession it began running larger budget and current account deficits. These were financed with cheap foreign credit thanks to the lower cost of borrowing in euros. The fiscal monitoring functions of the EU’s Stability & Growth Pact were laxly enforced, but Greece also had some foreign help in cooking its books. When the global financial crisis hit, investors suddenly lost confidence in Greece as a sovereign debtor. Soon Greece could no longer roll over its debt, its deficits rose even further on account of the recession, and the government was forced to seek help.

Greek budget deficits represented a combination of rising public sector spending and stagnant tax revenue. “Oligarchs” are often blamed for not paying their fair share of taxes, but tax evasion is widespread in the country, with the professional classes disproportionately responsible. Evasion is enabled in good measure by an unusually high level of self-employment and also by the size of the underground economy, whose estimates place Greece at the lower bound of the ex-communist countries. Moreover, whilst it’s likely the very richest avoid taxes altogether, average taxes in Greece have been quite progressive, and the average Greek has paid little tax. (See Mitsopoulos on the pre-crisis “full employment” tax incidence.) “Oligarchs” are also often blamed for rising state expenditures, but some 75% of the government’s non-interest budget in 2009 went towages and pensions. Greek public sector employment is actually not too big compared with other OECD countries, but (as of 2008) the majority of public employees in Greece had worked for state-owned enterprises, which is very much outside the EU norm.

Many have pointed to Greece’s long history of accumulating foreign debts and defaulting on them. Others have argued the recent crisis is the fault of the oligarchs lording over the Greek people, an implicit comparison with Russia or Mexico.

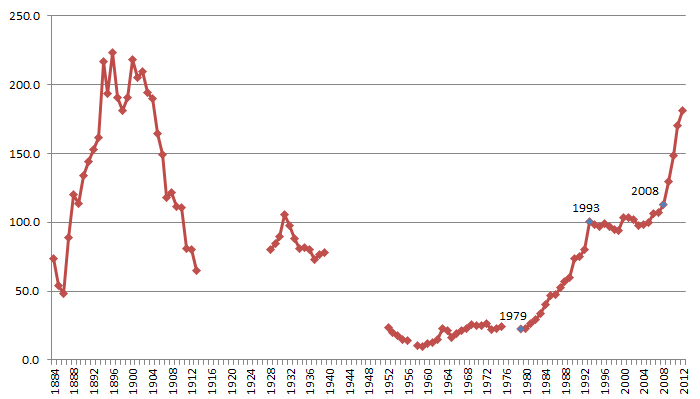

What’s less noted is that as of 2008, Greek sovereign debt as a share of GDP had been approximately constant since 1993. That doesn’t mean Greece hadn’t been borrowing new sums in the 2000s, just that the debt had been growing in proportion to GDP. Most of the leap in the debt-GDP ratio, in fact, took place in the 1980s. Greek debt as % of GDP in the very long run:

[Chart from here]

The debt accumulation in the 1980s is not per se important, because it could have been reduced by later stringency and growth. But the events of the 1980s, which cast a long shadow on the present, speak to a fundamental break with the earlier policy regime in Greece. In the decades before the 1980s, Greece had been a model of sterling economic performance !

Between the end of the civil war in 1949 and the first oil crisis of 1973-74, the Greek economy was characterised by rapid growth, low inflation, high rates of investment, government budgets in balance or moderate deficit, and a relatively small public sector. Its persistent external deficits were always offset by private capital inflows, with remittances from Greek workers in northern Europe helping out. After an initial devaluation, Greece in this period never experienced a balance of payments crisis and never required assistance from the IMF. In other words, postwar Greece was a growing economy with a healthy macro environment whose external imbalances reflected investment, not consumption.

So what changed ?

(2)

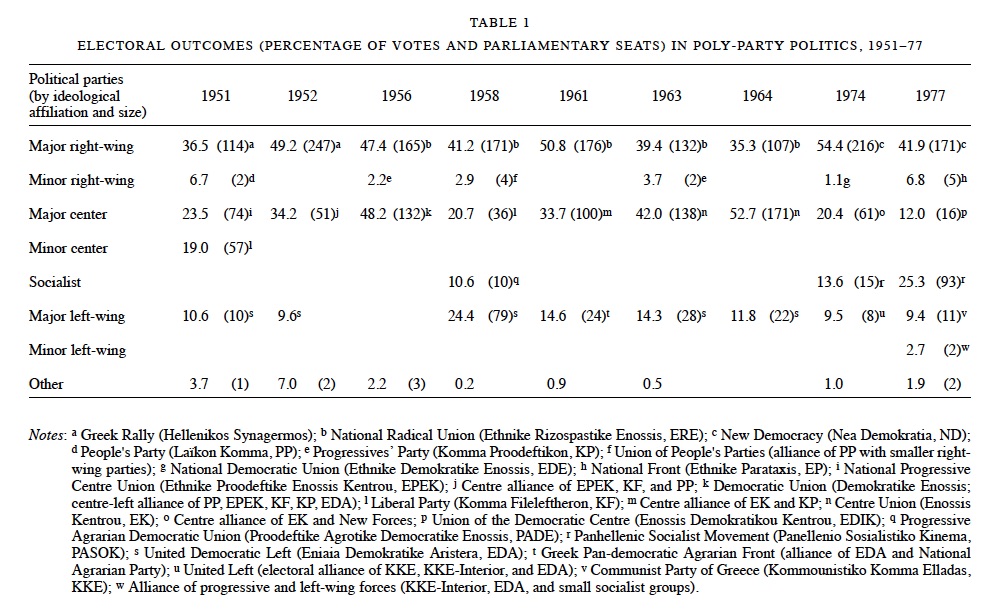

Greece had been part of the Bretton Woods system of fixed exchange rates; and it had also been a recipient of the Marshall Plan, which made certain policy stipulations. (See Pagoulatos.) But politics was also essential. After the Greek Civil War, which was fought against a communist insurgency, the reins of government alternated only between right and centre. The left, frequently divided, did compete in elections, but were de facto excluded from political power by the adoption of a majority voting system in 1952 and, subsequently, a complex mix of electoral rules. (Miller documents the involvement of the United States in 1951-52 in pressurising the Greeks into abandoning proportional representation in favour of majority voting.) Electoral data on Greek elections before the 1980s :

[Source: Pappas 2003]

Except in 1958, the combined left-wing parties could scarcely muster 20% of the vote and 30 seats in parliament (out of 300). A military coup in 1967 installed an even more rightist regime that lasted until its collapse in 1974.

Greek trade unions were either repressed or monitored by the state. In some other countries, strong trade unions made wage demands in excess of labour productivity growth, and concessions would be followed by devaluations to maintain competitiveness, which a few years later would prompt further wage demands and devaluations. Greece avoided this wage-price spiral in the postwar period.

The result of both the external constraints and the marginalisation of the left was relatively orthodox fiscal and monetary policies, albeit in combination with a modestimport substitution policy which allocated tightly controlled credit to “favoured” industrial sectors. But the latter was not considered terribly heterodox in the 1950s and 1960s, especially for developing countries.

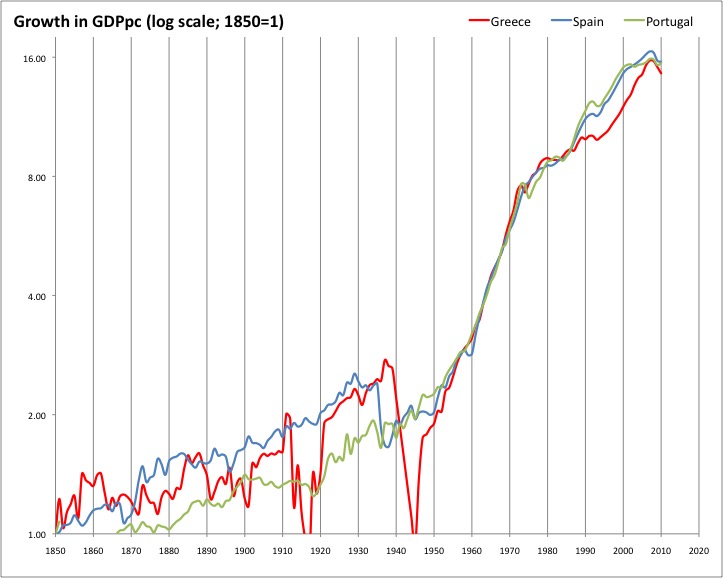

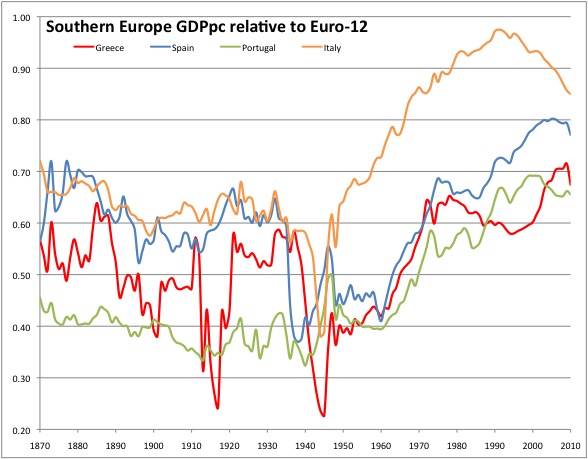

[Chart based on Maddison Project data]

Greece’s constrained policy regime facilitated, or rather did not interfere with, the rapid postwar economic development of the country. I do not say it was caused by those policies because the high growth rates represented convergence with the rich countries, which itself was enabled by the postwar diffusion of technologies developed in 1930-45 and the resumption of global trade. Most developing countries (including Sub-Saharan Africa) also participated in the global boom and grew rapidly in 1945-73/80, at least relative to the subsequent period. The point is that Greece under the monarchy and the junta did not fuck things up, which they might easily have done.

(3)

There was a shift with the first oil shock of 1973-74 which coincided with full democratisation under the Third Republic and the liberation of the trade unions. These had been preceded by the end of the Bretton Woods system in 1971. Like Ireland, Portugal, and other small open economies, Greece had some difficulty adjusting to a stagflationary environment with volatile exchange rates. But the real sea-change happened with the second oil shock of 1979-80 and Paul Volcker’s decision to disinflate the US economy. The deep global recession which ensued helped produce, in Greece, the historic landslide victory of the firebrand-populist Pan-Hellenic Socialist Movement in the election of 1981. The PASOK victory, reflecting a broad nation-wide swing, probably rode the same wave of electoral discontent in the late 1970s and early 1980s which also brought to power Thatcher, Reagan, Mittérand, etc. [Edit: Please see note at the end of this post.]

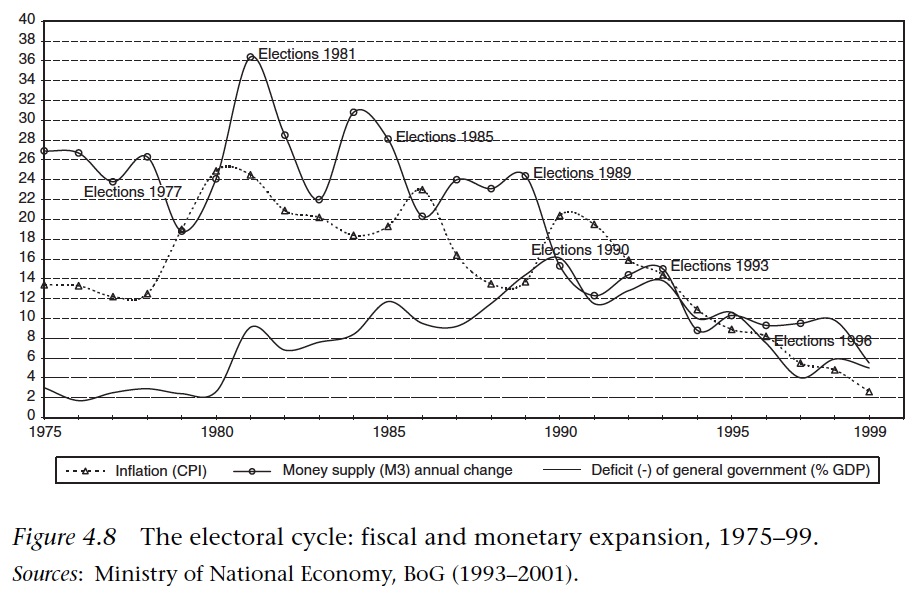

PASOK quickly embarked on populism on an extravagant scale, inviting comparisons with some famous cases in Latin America, except Greece was an EEC member by 1981 and a recipient of European regional development funds. Some charts summarising what happened to various macro aggregates after 1980 (click to enlarge):

|  |  |

|  |  |

[Source: Alogoskoufis 2013, Alogoskoufis 2012]

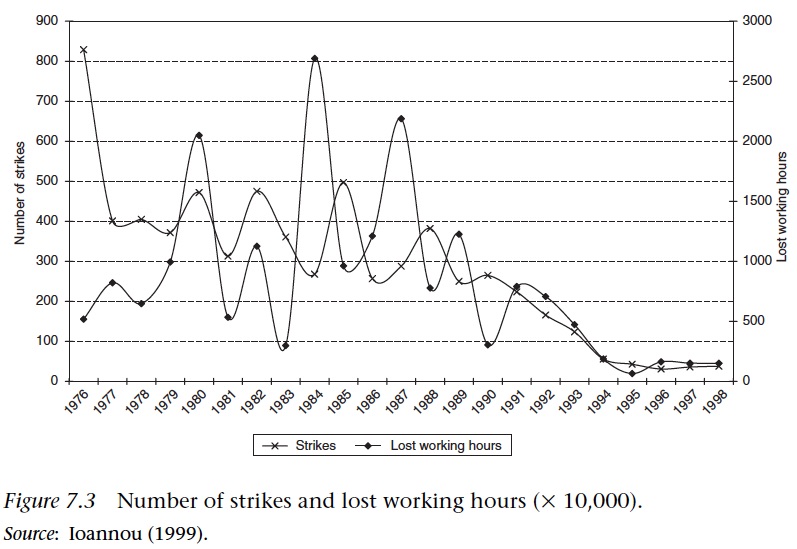

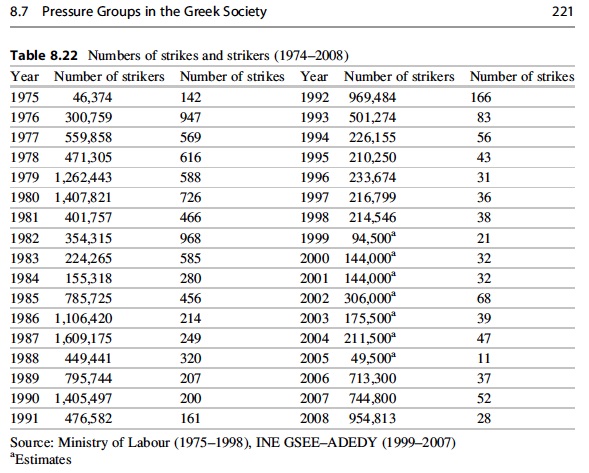

The outcomes — a serious deterioration in fiscal balances, inflationary finance, consumption-driven current account deficits, higher external and internal debt, crashing investment rates, balance of payments crises, high volatility of growth, a rise in the number of strikes, wage-price spirals of wage concessions to unions followed by currency devaluations, deferred stabilisation, etc. — would all be eerily familiar to any student of the macroeconomic history of the Third World. In fact, readers of Boom, Crisis, and Adjustment: The Macroeconomic Experiences of Developing Countries or The Macroeconomics of Populism in Latin America might feel justified in wishing there had been a chapter on Greece in those books !

The details of course differ, but the underlying parallel is that both Greece and many developing countries responded to the sundry shocks, slower growth, and stagflation of the 1970s via “accommodation” and expansion, i.e., spending and printing more money, incrementally adjusting exchange rate pegs, indexing wages, and/or imposing price controls, in order to simultaneously raise wages, fight unemployment, and control inflation. Of course the rich countries also played around with an ‘incomes policy’ in the 1970s, but not nearly to the same extent, and much of it was reversed and the reasons for them mostly eliminated by the mid-1980s. (In the 1980s Ireland went precisely in the opposite direction, pursuing austerity and disinflation with Germanic determination, at the cost of very high unemployment. It makes for an illuminating contrast with Greece.) In Greece and many developing countries, there were also nationalisations, new state-owned enterprises, and state assumption or guarantee of debt in the private sector — which in Greece amounted to 32% of GDP by 1989.

After 1980, Greece also transformed into the most strike-prone country in Western Europe in the overall period 1980-2008:

[Source]

[Source]

Economic growth in Greece, like elsewhere, slowed down in the 1970s, which was inevitable as the country converged with northern Europe. (In econ-growth pidgin: in the postwar period the European countries including Greece were in rapid transition from a lower steady-state to a higher steady-state growth path.) But the Greek economy surely grew less in the 1980s than potential, especially given the mini-divergence from Spain and Portugal after 1980 :

[Chart based on Maddison Project data]

The three countries had shared a parallel growth path and faced similar adjustment issues in the 1970s. But maybe the incentives were different: Greece was already a member of the EEC by 1981, whereas Spain and Portugal were aspirants who only acceded in 1986. Nevertheless, it appears, unlike Spain and Portugal which also became democracies in the mid-1970s, political liberalisation made matters considerably worse in Greece.

(4)

But far more important for the long run than PASOK’s macroeconomic populism, which by itself could have been a fleeting phenomenon, was the radical transformation of Greek party politics amounting to a reorganisation of the state. The political-institutional changes of the 1980s, in combination with the perverse Eurozone incentives of the 2000s, are the cause of Greece’s fiscal pathology.

Greek analysts endlessly navel-gaze about their country’s political culture of clientelism, and it’s pretty clear that Greece ever since becoming independent of the Ottomans has always had a politics of patronage. And the “Currency Committee” that rigidly set postwar lending policies did have cronies (e.g., army officers, agricultural cooperatives, shipping magnates, etc). But clientelism had been mostly an intimate sort of cronyism based on person-to-person contacts, with individual patrons doling out spoils from the public coffer to local clients in backrooms. This traditional clientelism was revolutionised by PASOK into a highly organised, partisan machine politics which infiltrated nearly every institution of society. Schools, universities, trade unions, business associations, private companies, state-owned businesses, the civil service, local governments, these did not so much become ideologically polarised, as simply turned into vehicles of party politics.

Don’t political parties everywhere have special interest groups and other socioeconomic constituents ? Yes, but what happened in Greece in the 1980s seems something special, a degree of politicisation of society that one normally finds only in one-party states and under “corporatism” — except Greece has had since 1974 a genuine and highly competitive two-party system. Here’s a trenchant summary from Mavrogordatos :

And the spoils distributed through these organisational networks were not merely cash transfers and pay increases, but also public sector jobs, lax enforcement of tax and other laws, special exemptions from regulations, etc. (Besides the article mentioned above, I also recommend Populism & Crisis in Greece.)

PASOK’s centre-right opponent New Democracy mostly joined the clientelistic fray when it was returned to power, rather than counteract the system, despite several attempted reforms. So the state became “competitive bipartite clientelist”. This Greek peculiarity is well illustrated by what happened with the trade unions, after PASOK required them to adopt the proportional representation system of voting. Again from Mavrogordatos:

Therefore the trade unions did not become special interests of one party, which might be thought more normal, but literally turned into microcosms of the party system. So it’s not surprising that Afonso et al. find the degree of clientelism in Greece to be well beyond the norm in Western Europe, whether measured in terms of the percentage of political party members in the electorate, or in terms of the European rankings in the “pervasiveness of party patronage”. I don’t think those metrics really capture the degree of clientelism in Greece, but its “democratic Peronist” system does appear to build in an unusually large upward bias for fiscal profligacy.

Alogoskoufis 2012 finds that in Greece between 1975 and 2009,

- the primary (non-interest) deficit as % of GDP trended upward, averaging 0.3-0.4% per year, and the trend was driven by primary expenditure, not falling revenue;

- the “primary deficit is higher by between 1.5 and 3 percentage points of GDP in an election year”, and was driven by expenditure, not tax cuts;

- in non-election years, both parties show modest debt stabilisation behaviour, mostly through tax increases rather than spending cuts;

- the Maastricht Treaty (stipulating the criteria for Eurozone accession) had a restraining effect on Greek fiscal behaviour in the 1990s by both parties, with slightly more than half of the deficit reduction coming from revenue increases and the rest from spending cuts;

- there were “no partisan effects on the primary deficit”, meaning the long-term trend for fiscal deficits is independent of which of the two major parties (PASOK and ND) held power;

- (however, another paper, taking into consideration tax evasion as a determinant of deficits, notes that there were modest partisan effects, with the centre-right party as the bigger offender!)

How does that compare with other countries ? Comparisons with developed countries aren’t really straightforward, because they can typically “afford” bigger national debts (cf. Japan !!!) thanks to capital markets’ confidence in their taxing capacity. So rich countries may face a bigger incentive to borrow. Nonetheless the electoral effects on budget balances are clearly bigger in Greece than in other OECD countries, even taking into account the impact of European growth on the Greek economy.

Unless otherwise noted, I draw on Shi & Svensson, “Political Budget Cycles: A Review of Recent Developments“, for the following results. For OECD countries in 1960s-80s, budgets deficits in election years were higher by approx. 0.6% of GDP. But these effects are very sensitive to time periods sampled. For example, Andrikopoulos et al. could find no electoral effect within the EU as a whole in 1970-98. Also, Alesina et al. found partisan effects on the electoral budget cycles of OECD countries, which were strongest in countries with multiparty coalitional governments — which Greece has not had until 2014.

As for developing countries, per Shi & Svensson, 0.6% of GDP is reported for a smallish sample. Pretty hefty effects (around 6%) are found for years just prior to elections in Latin America, but these are followed by even bigger retrenchments in the subsequent year, for a small net negative effect. Another study for Latin America removing pseudo- or quasi-democracies that held elections (e.g., Mexico under the PRI) show positive 1% or so. For 44 sub-Saharan African countries the electoral effect was approx. 1.2% of GDP. It’s possible, however, these electoral effects are driven by new democracies, and the political budget cycles diminish with the age and “quality” of democracy.

But it’s difficult to say whether the maturation theory holds for Greece :

[Source]

There was a dip in primary deficits in the 1990s, as there was a national consensus to qualify for Eurozone membership, but the electoral cycles are still pronounced even then.In the 2000s the upward movement in primary deficits resumed, and deficits ticked up near each election (2004= rose by 3.2% of GDP, 2007=1.5%).

How ever one looks at it, the electoral effects on budget deficits in Greece are unusually large for an OECD country, overwhelming the less profligate off-years and creating an upward trend. So it’s only a question of whether Greece might have “matured” into behaving more like other OECD countries in the absence of moral hazards from Europe in the 1980s and 2000s.

In part 2 coming later, I will speculate on that question, and also why Greece settled on “democratic Peronism” as a political equilibrium. (Hint: it’s probably not because of actualincome inequality.)

Note (7 July 2015): I probably understated the importance of the changes in Greece in 1974-81. Under New Democracy governments the Greek state ‘socialised’ or nationalised important sectors of the Greek economy, paving the way for the explosion in rent-seeking and clientelism in the 1980s. ND governments in the 1970s were not as fiscally reckless as PASOK in the 1980s, but they still caused important structural changes in the Greek economy. But the point of this post is that Greece, as a state and a nation, reacted to the external shocks of the 1970s much more like the Third World than like members of the OECD. I am not trying to blame the Greek left or the Greek right. I am blaming the Greek nation. So whether the origins of “Democratic Peronism” lie in 1974-81 or 1981-90 does not really matter for my purpose.

No hay comentarios:

Publicar un comentario