In defense of #Globalization by Harold James in@IMFNews

La historia sugiere que el camino para controlar la inflación pasa por más comercio internacional, no por menos.

El

repunte actual de la inflación es el resultado de la interacción de las

interrupciones de la cadena de suministro con los grandes déficits

fiscales. La pandemia, seguida de la invasión rusa de Ucrania, trastornó

las cadenas de suministro y produjo escasez. Los países

industrializados ricos respondieron a la escasez, las desigualdades y el

estrés social con grandes paquetes fiscales. En la espiral

subsiguiente, el aumento del gasto generó más demanda, lo que provocó

más escasez. Puede seguir otra espiral viciosa. El aumento de los

precios de los alimentos y el combustible podría desencadenar

descontento, protestas, incluso revoluciones y rupturas gubernamentales

en todo el mundo.

La espiral inflacionista puede parecer el

presagio de un mundo muy diferente, dividido en bloques competidores que

aplican costosas estrategias de "friendhoring", consistentes en dirigir

el comercio hacia naciones y regímenes amigos mientras intentan

perjudicar a los rivales. Los grandes Estados se replantean los

beneficios de la globalización e intentan proteger lo que consideran

recursos vitales o estratégicos. Todo ello constituye una receta para

congelar el crecimiento económico mundial.

Patrón histórico

Por

mucho que la globalización haya sido objeto de ataques últimamente, la

historia sugiere que puede ser el objetivo equivocado para renovar la

política y que la globalización ofrece un antídoto contra las espirales

inflacionistas. Las crisis del hambre de mediados del siglo XIX y las

crisis del petróleo de la década de 1970 desencadenaron al principio

rondas explosivas de inflación mundial. En ambos casos, las nuevas

tecnologías alteraron drásticamente los sistemas de abastecimiento

mundial, ampliando la globalización y dando lugar a largos periodos de

desinflación. De este modo, la inflación galopante llevó finalmente al

mundo a una mayor globalización, en lugar de a una menor, con amplios

beneficios.

Es probable que las mismas fuerzas entren en juego

hoy en día. El entorno de precios benignos de principios del siglo XXI

surgió de una mejor política de los bancos centrales, pero también

reflejó la apertura de los mercados mundiales de bienes y de trabajo. Un

mercado laboral mundial presionó a la baja los salarios en los países

ricos, y los países más pobres querían estabilidad monetaria para poder

acceder a los mercados mundiales sin perturbaciones.

Los

responsables políticos y los académicos identificaron la relación entre

la globalización y una transición hacia una inflación baja en todo el

mundo, primero en los países industriales ricos, luego en los mercados

emergentes asiáticos y, finalmente, incluso en América Latina, donde la

inflación había sido una forma de vida. En 2005, el entonces Presidente

de la Reserva Federal, Alan Greenspan, argumentó que la globalización y

la innovación eran "elementos esenciales de cualquier paradigma capaz de

explicar los acontecimientos de los últimos 10 años", o lo que se

denominó la Gran Moderación. Ya en 2021, el actual presidente de la Fed,

Jay Powell, se refirió a "fuerzas desinflacionistas sostenidas,

incluyendo la tecnología, la globalización y quizás factores

demográficos".

History suggests the path to taming inflation is through more international trade—not less

Today’s surge in inflation grows out of the interplay of supply chain disruptions with large fiscal deficits. The pandemic, followed by Russia’s invasion of Ukraine, upended supply chains and produced scarcities. Rich industrial countries responded to the shortages, inequalities, and social stress with large fiscal packages. In the ensuing spiral, increased spending led to more demand, which led to more shortfalls. Another vicious spiral may follow. Rising food and fuel prices could spark discontent, protests, even revolutions and government breakdowns around the world.

The inflationary spiral may appear to herald a quite different world, split into competing blocs that pursue costly “friendshoring” strategies of steering trade to friendly nations and regimes while attempting to hobble rivals. Large states rethink the benefits of globalization and attempt to protect what they see as vital or strategic resources. This adds up to a recipe for freezing global economic growth.

Historical pattern

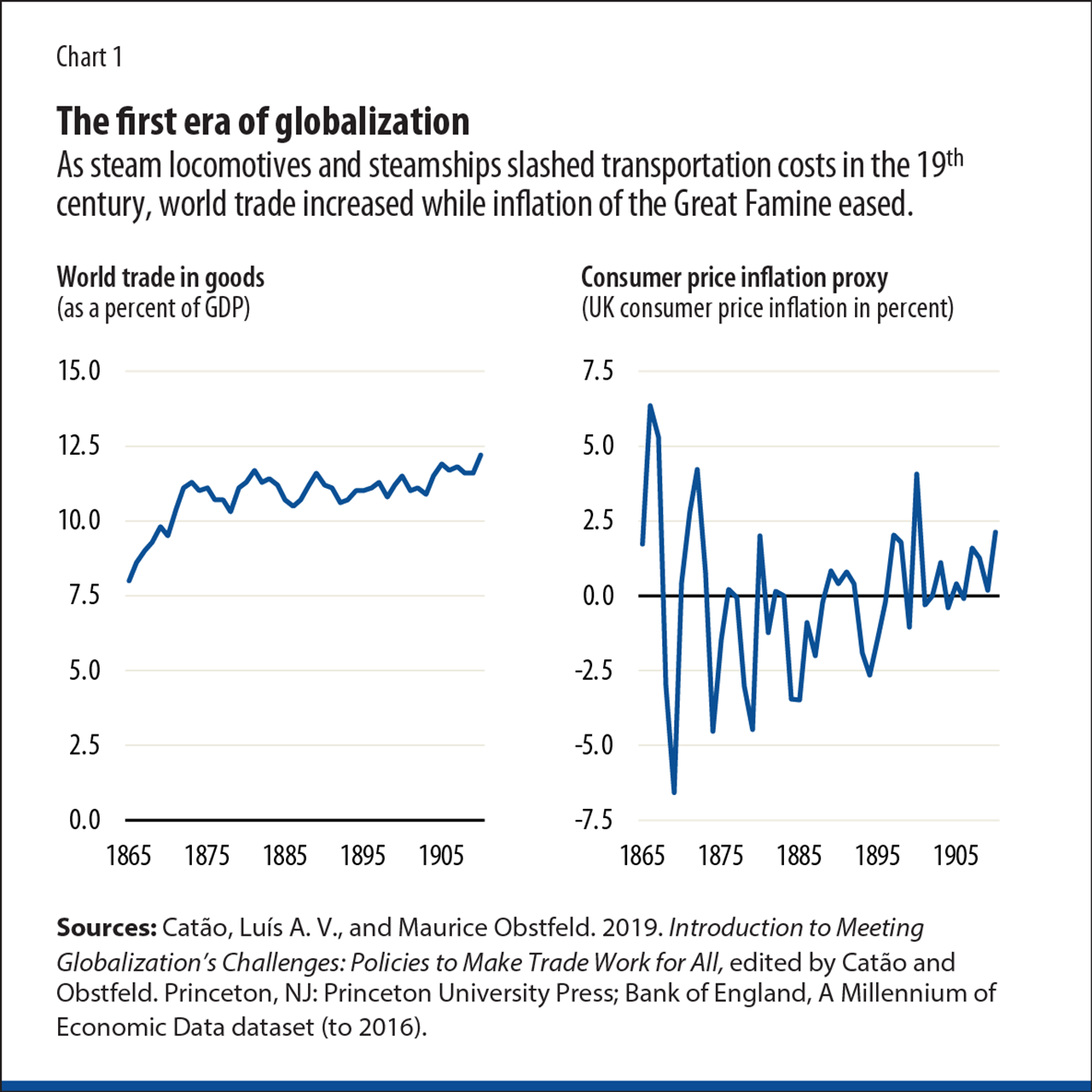

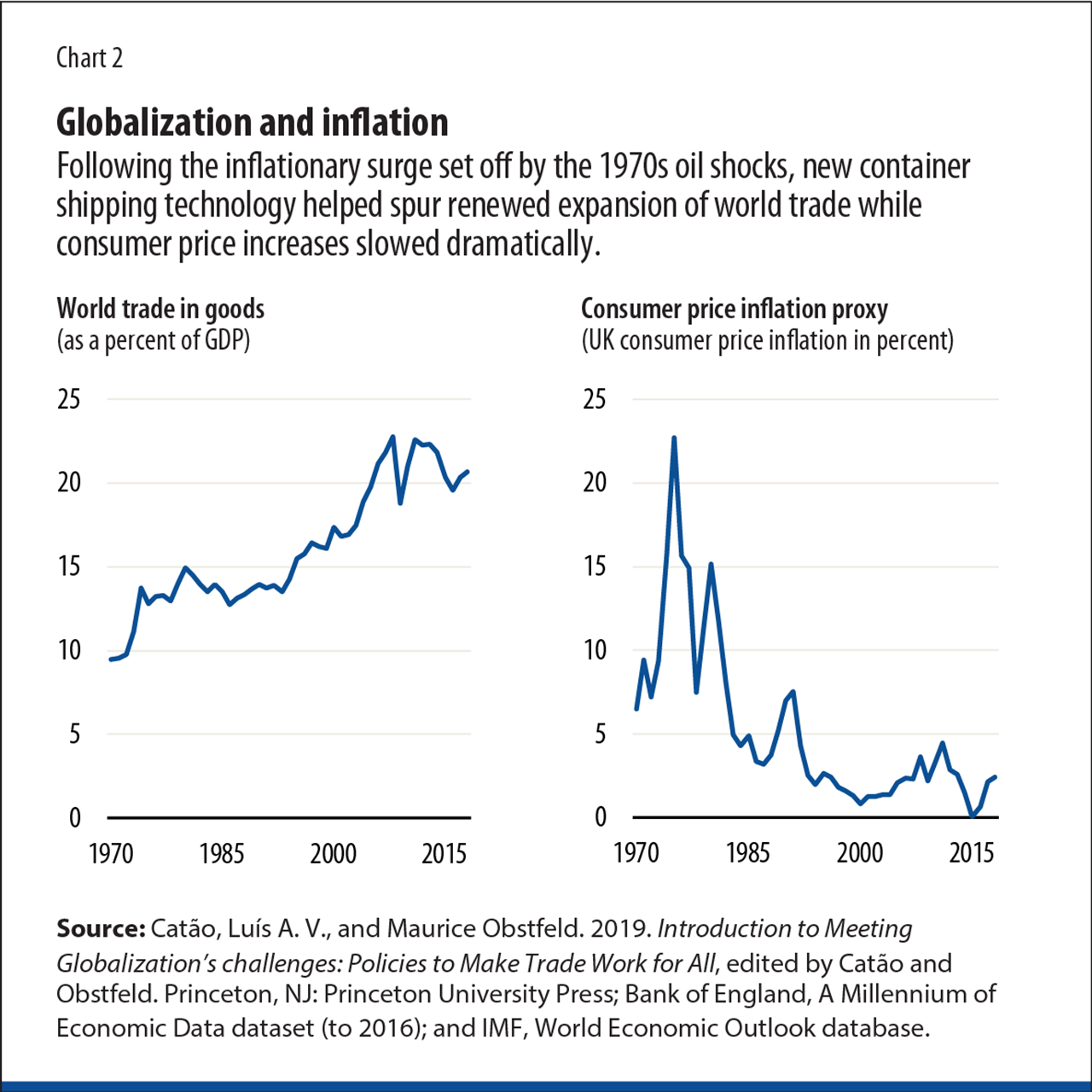

As much as globalization has come under attack lately, history suggests that it may be the wrong target for renewing policy and that globalization offers an antidote to inflationary spirals. The hunger crises of the mid-19th century and the oil shocks of the 1970s at first ignited explosive rounds of worldwide inflation. In both cases, new technologies dramatically altered global supply systems, expanding globalization and leading to lengthy periods of disinflation. Thus, rampant inflation eventually drove the world to more rather than less globalization, with broad benefits.

The same forces are likely to come into play today. The benign price environment of the early 21st century grew out of better central bank policy but also reflected the opening of world goods and labor markets. A global labor market pressed wages down in rich countries, and poorer countries wanted monetary stability so they could access global markets without disruption.

Policymakers and academics identified the relationship between globalization and a transition to low inflation around the world, first in rich industrial countries, then in Asian emerging markets, and ultimately even in Latin America, where inflation had been a way of life. In 2005, then-Federal Reserve Chairman Alan Greenspan argued that globalization and innovation were “essential elements of any paradigm capable of explaining the events of the past 10 years,” or what was termed the Great Moderation. As late as 2021, today’s Fed chairman, Jay Powell, referred to “sustained disinflationary forces, including technology, globalization and perhaps demographic factors.”

There is a historical pattern of globalization driving disinflation. What is usually thought of as the first age of modern globalization began in the middle of the 19th century with the hunger crises. It was interrupted by World War I, followed by the Great Depression. Eventually, a new style of globalization took off in the 1970s. Both turning points—in the 1840s and 1850s and in the 1970s—started with shortages and inflationary surges (see Charts 1 and 2).

Transformational technologies

In both cases, technological breakthroughs in transportation then drove an innovative globalization. It was the steam engine that opened up continents with railroads and oceans with steamships. Following the 1970s, the shipping container sharply reduced the cost of transporting goods. The actual inventions occurred substantially earlier. Matthew Boulton and James Watt were building operational steam engines in the 1770s, and the first container ship was launched in 1931.

It took a dramatic shock in each case to turn intriguing ideas into transformational technologies: the hunger crises of the mid-19th century and then the oil price surges in the 1970s. It was disruption caused by big price increases that created the circumstances to realize the transformative power of the innovations. The big payoff came only through conditions of shortage.

The widespread adoption of innovation depended on policy choices, starting with the removal of impediments to commerce. Revolutions in government meant that public authorities took on many more tasks concerned with managing the economy, including guiding the course of trade liberalization and writing legislation that revolutionized the course of enterprise. In the 19th century, business was reshaped through new corporate forms, including the limited liability joint stock company and universal banks that mobilized capital in innovative ways. The combination of new gold supplies and banking innovation produced monetary and price surges.

Price stability and monetary order returned and brought a consensus around a stable and internationally applicable monetary framework as countries sought a mechanism that would allow them to attract capital inflows or to globalize further. In the 19th century, that was the gold standard. In the late 20th century, it was modern inflation targeting on the part of central banks. The new vision that followed involved monetary stabilization and a refocusing of government on core tasks.

Is it realistic to expect a repeat of the same dynamic today? Historically, the initial response to a threatening volatility is to run in the opposite direction and look for more self-sufficiency. That course, however, is rarely successful. It increases costs and fuels inflation. It makes attractive solutions harder to implement. Especially the questions of institutional design—how to write new corporate legislation, run public procurement, operate new financial systems—have no easy answers. Breakthrough technologies require substantial learning, where the experience of other countries is invaluable.

Political fallout

In the midst of the previous transitions, few people felt comfortable. There was instability. In the mid-19th century, governments were overthrown around the world, and it was not immediately obvious that the successors were better, more competent, or more effective. They needed to learn. In the 1970s, there was widespread, corrosive doubt about the viability of democracy. The world went through the contemplation of similarly complex, multiple crises as today. But there was a way out. Societies, voters, and consequently also political leaders start to make comparisons with adjustments and experiments elsewhere. In the mid-19th century and also in the 1970s, it soon became clear that governments that did not open to the world performed worse.

There are already signs of today’s learning process. The UK, by fluke of its political system, began a process of political, regulatory, and economic disengagement in 2016 with the Brexit vote. By 2022 the costs were much more apparent, and the radical alternative of trying to push independent growth failed abysmally in the short-lived government of Prime Minister Liz Truss. The UK became a poster child for what not to do. Populist anti-globalization movements across Europe that were initially attracted by the allure of an anti-EU stance quickly retreated.

Today there are rising protests against autocracies and democracies alike. A common theme is discontent with existing ways of managing pandemics, wars, and even information technology.

At the same time, we can see the new technologies that will produce better growth and a superior capacity to tackle the wide range of contemporary issues—health, energy policy, climate, and even security. They all require cross-border action and coordination. The equivalents to the steam engine or the container ship are scientific breakthroughs that already exist. The messenger RNA vaccine, for example, had been under slow development since the 1990s, mostly as an answer to rare tropical diseases. Then its use against COVID provided a model, and now applications for the treatment of other diseases, chiefly cancers, follow.

The ‘real’ inflation reduction act

Similarly, the technical possibilities of remote medicine or education were there well before the pandemic. Under pressure of necessity, their application quickly became commonplace and set off a revolution that might make for broader and cheaper access. Remote working—also across political frontiers—is the equivalent of communications revolutions of the past. The application of information technology means we can communicate more while physically moving less.

An initial globalization centered around the Industrial Revolution saw the exchange of manufactured goods from a few countries for commodities from many in the rest of the world. The 1970s created globalization through increasingly complex supply chains. The current crises are generating a different sort of globalization, shaped by information flows. There will be marked contrasts in the competence with which societies respond to the new data revolution. Today’s globalization dynamic has the potential to create a revolution of system optimization, making the result of prior technical change cheaper and more accessible. In that sense, it is globalization that constitutes the real Inflation Reduction Act.

HAROLD JAMES is a professor of history and international affairs at Princeton University and IMF historian.

https://www.imf.org/en/Publications/fandd/issues/2023/03/in-defense-of-globalization-harold-james?utm_medium=email&utm_source=govdelivery

No hay comentarios:

Publicar un comentario